Time Barring Chart

- Home

- Time Barring Chart

Under the CGST Act, individuals liable for GST registration must obtain it and self-assess their tax liability. After paying the tax, they must file accurate and complete returns as prescribed by the act. The proper officer will examine these returns through scrutiny, audits, surveys, and other proceedings. If any short payment is detected, it will be recovered through adjudication orders. Filing accurate returns is crucial for the proper implementation of the act.

The Department checks the correctness of self-assessment and returns by various means: matching input tax credit and output tax liability, scrutiny of returns, departmental audits, special audits, inspections, surveys, and summary assessments. If returns are found accurate, no further action is taken. However, if discrepancies such as non-payment or short payment of tax are found, the proper officer will determine the liability and issue an adjudication order under sections 73 or 74 of the act to recover any dues.

Section 73:

This section applies when a proper officer issues a notice for non-payment or short payment of tax, erroneous refund, or incorrect availment or utilization of input tax credit due to reasons other than fraud, willful misstatement, or suppression of facts.

Section 74:

This section applies when a proper officer issues a notice for non-payment or short payment of tax, erroneous refund, or incorrect availment or utilization of input tax credit due to fraud, willful misstatement, or suppression of facts.

To streamline operations, the department has set specific due dates each year for issuing Show Cause Notices and Orders. Here is a compilation for your quick reference:

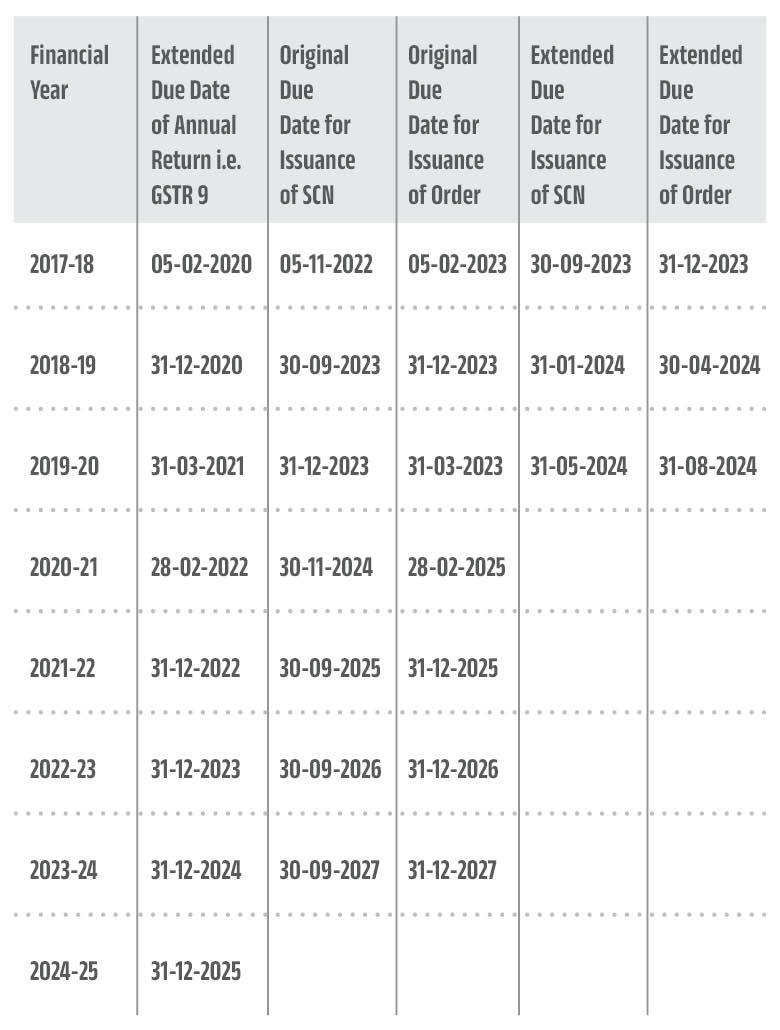

Time Limit for Issuance of SCN and Order under section 73:

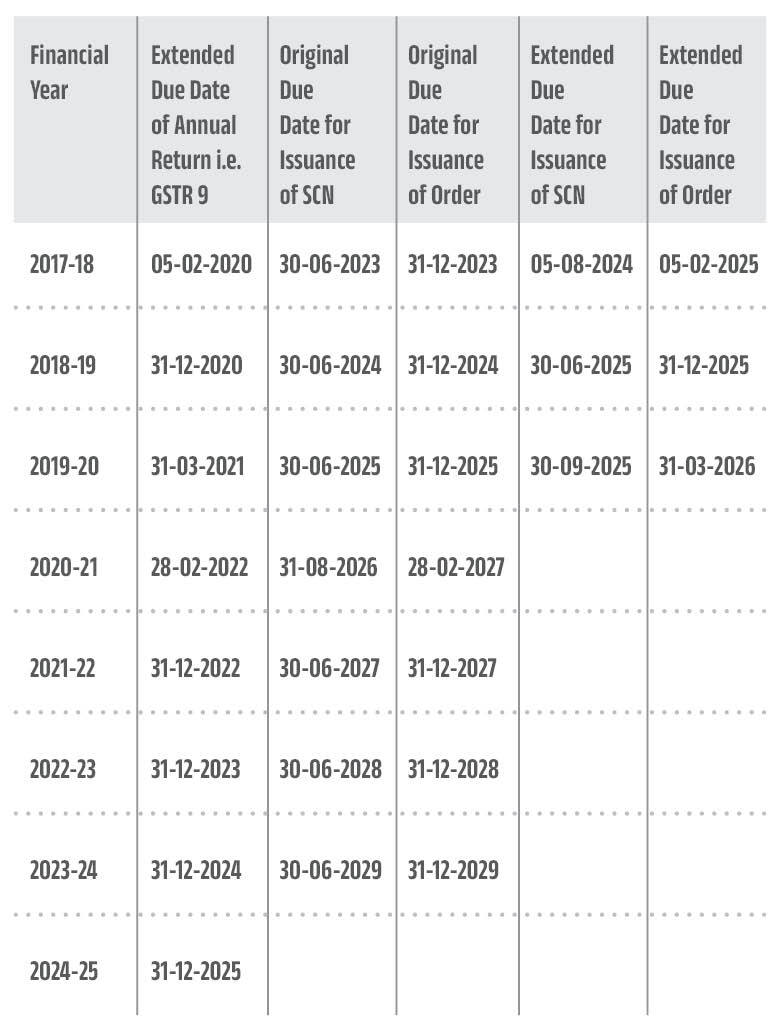

Time Limit for Issuance of SCN and Order under section 74:

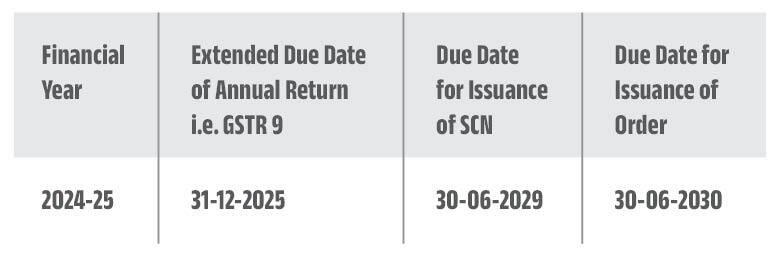

Time Limit for Issuance of SCN and Order under Section 74A (2024-25)

| FY |

Notification Ref. No:

|

| 2017-18 |

13/2022 Central Tax dated 05/07/2022

|

| 2017-18, 2018-19 and 2019-20 |

09/2023 Central Tax dated 31/03/2023

|

| 2018-19 and 2019-20 |

56/2023 Central Tax dated 28/12/2023

|

| 2024-25 |

The commissioner not below the rank of Joint Commissioner may extend the time limit to issue Order for another 6 months

|