GST to Excise Shift: What the 2025 Tobacco Tax Bills Mean

The Lok Sabha has now introduced the Central Excise (Amendment) Bill, 2025 to revise the excise duty structure on tobacco and manufactured tobacco products. In parallel, the Government has also brought in the Health Security se National Security Cess Bill, 2025, which proposes a new levy on pan masala and other notified sin goods. Together, these two moves are designed to replace the current GST compensation cess architecture for tobacco and pan masala with a fresh Central Excise plus cess regime.

This article focuses on the GST and indirect tax angle, and what this “return of excise” means for the tobacco and pan masala value chain.

The news and the policy context

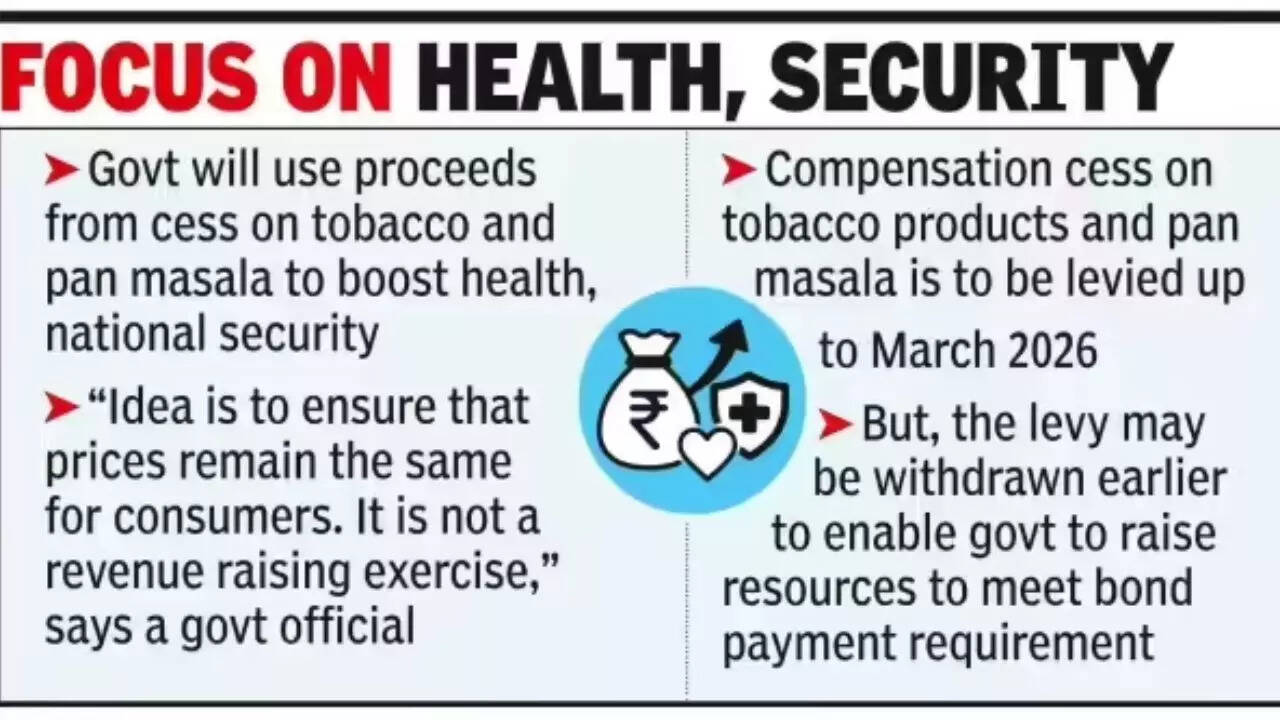

Since the introduction of GST in 2017, tobacco products have been taxed at the highest GST slab of 28%, along with a very high GST compensation cess. This cess is levied to compensate States for revenue loss due to GST and is credited to a dedicated Compensation Fund. The compensation cess regime, however, was always temporary. It has already been extended once and is expected to sunset after pending loan and interest obligations of the Compensation Fund are fully discharged, currently targeted around 2026.

If nothing changed, the expiry of this cess would sharply reduce the overall tax burden on “sin goods” such as tobacco and pan masala and would also shrink the Union Government’s fiscal space in this sector. The two new Bills are the Centre’s answer to that problem: they aim to preserve today’s high tax incidence while moving away from a time-bound cess mechanism.

What the Central Excise (Amendment) Bill, 2025 actually does

According to the text and explanatory notes, the Central Excise (Amendment) Bill, 2025 substitutes the tariff table for tobacco and manufactured tobacco products (headings 2401 to 2404) in Section IV of the Fourth Schedule to the Central Excise Act, 1944. In simple terms, excise that had receded mainly after GST is now coming back in a much stronger form for tobacco:

-

Unmanufactured tobacco moves from an earlier excise rate of 64% to a proposed 70%.

-

Cigars and cheroots move from 12.5% or ₹4,006 per thousand to 25% or ₹5,000 per thousand, whichever is higher.

-

Filter cigarettes see a dramatic jump in specific duty, with slabs moving from a few hundred rupees per thousand sticks to several thousand per thousand, depending on length.

-

Chewing tobacco, snuff, smoking mixtures and tobacco extracts also see sharp increases, with some categories more than doubling.

The Government has been explicit that these new excise duties are intended to replace the GST compensation cess on tobacco and maintain the overall tax burden at or close to current levels. Once loans and interest under the Compensation Cess fund are paid down, compensation cess on tobacco will end and excise will take over the “top up” role.

From a GST perspective, that means tobacco products will attract:

-

GST (which the Government has signalled at 40% for tobacco under the rationalised slab structure going forward); plus

-

Central Excise duty under the amended Fourth Schedule, rather than GST plus GST compensation cess.

The new Health Security Se National Security Cess: capacity-based taxation returns

The second leg of this reform is the Health Security se National Security Cess Bill, 2025. This Bill introduces a separate cess on pan masala and other notified goods, to be charged on the basis of the declared production capacity of machines or processes rather than actual output.

Under this Bill, manufacturers will be required to declare their machines, speeds, and production capacity. Cess will then be levied per machine per month, with different rates depending on product characteristics and capacity bands. Even manufacturers using manual processes are brought into the net through fixed monthly cess amounts.

The key design choices are therefore:

-

The levy is capacity-based, not clearance-based.

-

It is in addition to GST, not a substitute for it.

-

It is intended to fund health and national security programmes, and the proceeds are credited to the Consolidated Fund of India for appropriation by Parliament.

In other words, this cess is not a GST compensation cess. It is a standalone Central cess, owned and controlled by the Union Government, and it sits outside the GST compensation framework.

Before GST: how tobacco and pan masala were taxed

To understand why many practitioners feel that “life has come full circle”, it is important to recall the pre-GST regime. Tobacco products were then mainly taxed through:

-

Central Excise duty, often specific per 1,000 sticks or per kilogram, coupled with NCCD and various cesses; and

-

State VAT on sale.

For pan masala and gutkha, the Centre went a step further. It introduced a capacity-based levy under section 3A of the Central Excise Act, through the Pan Masala Packing Machines (Capacity Determination and Collection of Duty) Rules, 2008. Duty was computed per packing machine per month, based on the number of machines, their speed and the retail sale price of pouches, not on actual clearances recorded in invoices.

That regime generated intense litigation on issues such as deemed production, sealing and de-sealing of machines, abatement for shutdowns, and even the constitutional validity of capacity-based excise. When GST was introduced in 2017, most central excise on goods was subsumed, the machine-based scheme for pan masala was removed, and the focus shifted to invoice-based GST and compensation cess.

Eight years later, the proposed Health Security Se National Security Cess again takes us back to a per-machine, per-month model for pan masala and related products, while the Central Excise (Amendment) Bill restores a strong excise layer on tobacco.

From GST Compensation Cess to a Centre-owned cess

Under the GST Compensation Cess Act, cess collections form a dedicated fund used only to compensate States for GST revenue shortfalls and to service borrowings raised for that purpose. It is not a general revenue of the Union and is time-bound by design.

The new machine-based cess takes a very different route. It is credited to the Consolidated Fund of India and is earmarked for health and national security objectives as may be approved by Parliament. There is no automatic sharing with States as “compensation,” nor is it sunset-linked, as the GST compensation cess is.

Similarly, the enhanced excise duty on tobacco under the Central Excise (Amendment) Bill, 2025, is a pure Union tax. Once compensation cess on tobacco is discontinued, the Centre will steer tobacco taxation through a combination of GST rate decisions (which involve the GST Council) and independent excise notifications (which do not).

From a federal and fiscal perspective, therefore:

This cess and excise structure is the exclusive property of the Central Government, unlike the GST compensation cess, which was conceptually part of a Centre–State revenue-sharing compact.

Impact on the tobacco and pan masala industry

For cigarette and other tobacco manufacturers, the immediate challenge will be to re-model pricing and margins around a very different duty structure. The headline policy aim is to keep the total tax incidence broadly stable when the compensation cess goes, but the duty mix shifts heavily towards specific excise, which can amplify the effect of future rate revisions.

Large organised players are already familiar with excise. However, they will still need to reconfigure systems, contracts, and compliance processes to handle the revised Fourth Schedule, excise returns, and assessments alongside GST. The risk of classic excise disputes on classification, valuation, and length-based slabs will return.

For pan masala and gutkha manufacturers, the move to a capacity-based cess is even more structural. High-utilisation, high-volume units are likely to be relatively better placed, because a fixed monthly cess per machine gets spread over more output. Smaller, seasonal, or cash-constrained units may find that the cess creates a high fixed cost, even in lean months.

Compliance will no longer be only about invoice-level GST. Manufacturers will have to manage machine declarations, capacity changes, continuous downtime claims, and inspections, and they should expect a level of physical control and audit reminiscent of the old section 3A regime.

Impact on consumers

From a consumer standpoint, the reforms are not designed to make tobacco or pan masala cheaper. The stated objective is to prevent any fall in tax incidence when the GST compensation cess ends, and several analyses point to an effective tightening of the duty regime in some segments.

In practice, that means two things. First, retail prices are likely to remain at current levels or rise, especially for products where specific excise rates have been raised sharply. Second, because the new structure strengthens the Central Government’s ability to increase excise or cess without reopening the GST compensation debate, it may be easier to introduce further hikes in the name of public health.

At the margin, higher taxes can push more consumption towards cheaper or illicit products and may encourage under-reporting or smuggling if enforcement does not keep pace. These are familiar risks in tobacco taxation globally and will need to be managed through a mix of tax policy, enforcement, and public health interventions.

Conclusion: Life comes full circle for the tobacco industry

For the tobacco and pan masala industry, life has come full circle in terms of indirect taxes. Under the old Central Excise regime, pan masala and gutkha were taxed on a per-machine basis under the Pan Masala Packing Machines Rules. After eight years of destination-based GST with an invoice-linked compensation cess, we are again moving to a per-machine levy through the Health Security Se National Security Cess, while tobacco products face a strengthened excise duty overlay.

Two aspects stand out for practitioners and policy observers:

-

The return of capacity-based taxation through a monthly machine-wise cess, echoing the pre-GST excise model for pan masala.

-

The shift from a shared, time-bound GST compensation cess to Centre-owned, permanent levies, including tobacco excise and the new health-and-security cess.

High indirect tax incidence on tobacco and pan masala is clearly here to stay. What changes with these Bills is who controls the levers and how the burden is structured. For manufacturers, the next steps should include detailed scenario modelling of tax incidence, a fresh look at machine deployment strategies, and a careful review of documentation, plant controls, and litigation exposure as this new regime moves from Bill to binding law.