Welcome to the world of Goods and Services Tax (GST) as it completes a remarkable seven-year journey in India. Since its inception, GST has played a pivotal role in reshaping the country’s indirect tax structure, fostering economic growth, and simplifying compliance for businesses.

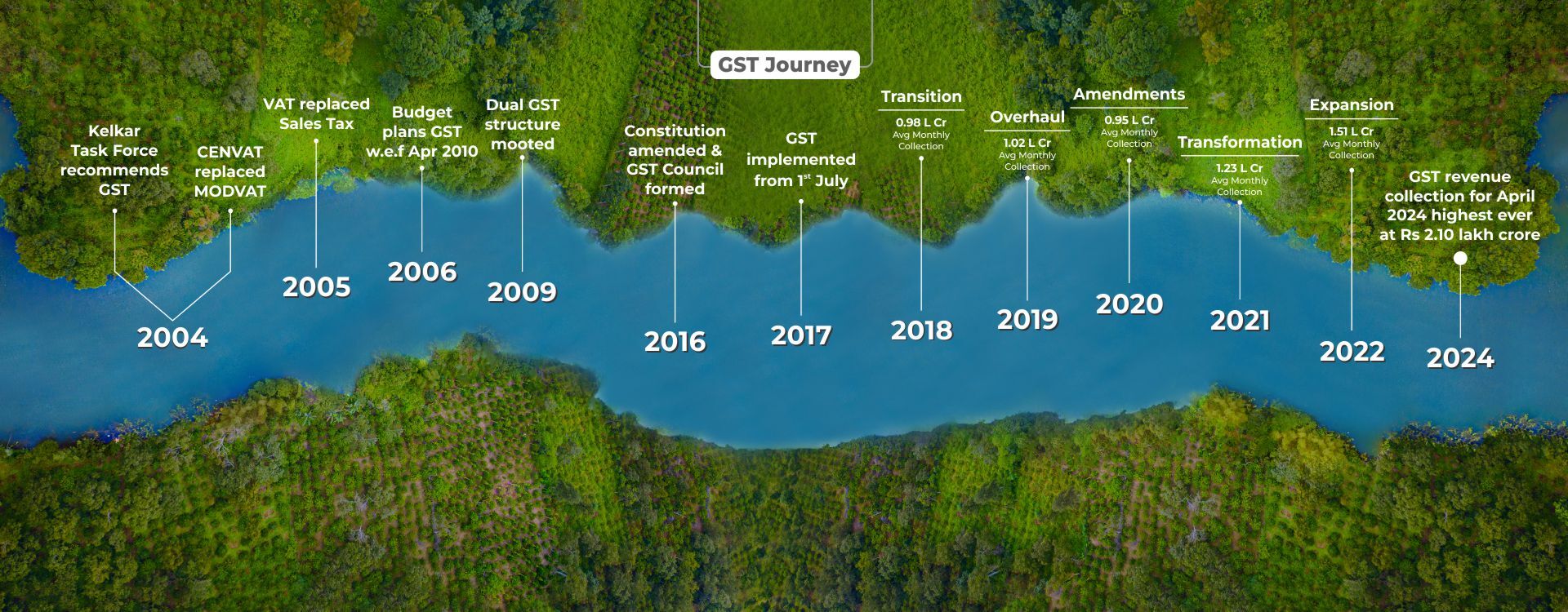

Introduced on July 1, 2017, GST replaced a complex web of indirect taxes, creating a unified tax structure across the nation. Over the past seven years, it has evolved, adapted, and become an integral part of India’s economic landscape.

From its initial implementation to subsequent amendments, GST has undergone significant changes to streamline processes, enhance transparency, and boost the ease of doing business. As we celebrate the seventh anniversary of GST, we reflect on its impact and evolution in shaping a more efficient and integrated tax system.

As we mark seven years since GST was implemented, it is imperative to acknowledge its role as a catalyst for economic transformation. The book GST at 7, below, explores the intricate nuances of GST’s impact, the challenges faced, and the road ahead through case studies, expert analyses, and success stories.

Additionally, it offers a comprehensive GST toolkit including,

Never miss a deadline with our easy-to-follow compliance calendar.

Ensure your GST practices are in top shape with our expert-guided health check-up.

Test your knowledge and stay s harp with our engaging GST quiz.

Stay informed on critical legal

precedents that impact your business.

Navigate the Reverse Charge

Mechanism with our detailed chart.

Gain insights with our curated

videos that simplify complex GST concepts.

Keep track of key timelines with our essential timebarring chart.

Stay on top of your filing obligations with our comprehensive due date chart.

Deepen your understanding with

articles crafted by our GST experts.

Explore the labyrinth of GST in India with us as we explore its successes, challenges, and future prospects. “GST at 7” is not just a book; It is a testament to India’s commitment to fostering economic growth, transparency, and inclusivity.