Industry News

- Home

- Industry News

- Page 8

admin0 Comments

SC Stays GST Notices on Online Gaming Dispute

In a significant relief for India’s burgeoning online gaming industry, the Supreme Court (SC)

admin0 Comments

GST Not Applicable On Transfer Of Industrial Land

In a significant ruling, the Gujarat High Court has quashed Goods & Services Tax

admin0 Comments

Understanding the GST Treatment of Vouchers

The Goods and Services Tax (GST) landscape is ever-evolving, and one of the areas of

admin0 Comments

GST on Selling Old Cars: Busting Myths and Simplifying the 18% Tax Rule

The 18% GST on the sale of old cars has stirred

admin0 Comments

Advisory on Entry of Receipt Numbers for Leased Wagons in E-Way Bill System

In line with ongoing efforts to streamline the

admin0 Comments

Unique Mark on Cigarette & Gutka Packs to Tackle GST Evasion

Tobacco products, a key contributor to India’s GST revenue, are about to undergo changes

admin0 Comments

Key Outcomes from the 55th GST Council Meeting

The 55th meeting of the GST Council, chaired by Union Finance Minister took place

admin0 Comments

GST Council to Undo Safari Retreats SC Verdict?

In a significant development, the GST Council is set to revisit the recent SC ruling

admin0 Comments

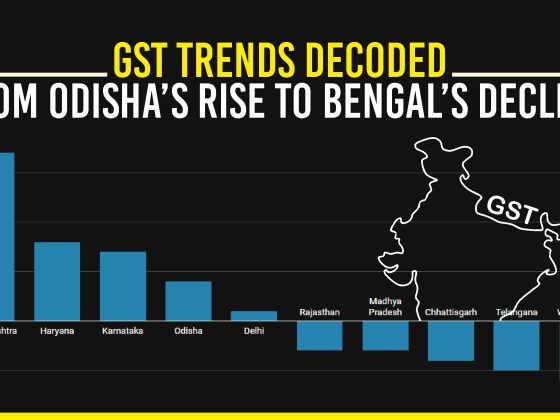

From Odisha’s Rise to Bengal’s Decline: GST Trends Decoded

The state-wise contributions to the national GST pool have exhibited notable trends

admin0 Comments

CBIC Advisory: Resolving ITC Mismatches in GSTR-9 for FY 2023-24

The CBIC has issued an advisory to address concerns about discrepancies in Annual Return

Recent Posts

admin0 Comments

Case of Vikram Solar Limited by Andhra Pradesh High Court

admin0 Comments