Introduction:

In GST law, complexities relating to Input Tax Credit (ITC) remain a constant challenge even after almost seven years of GST implementation. It is important to take note that ITC-related issues have been a focal point of litigation. Despite the continuous efforts by the tax authorities to clarify issues through amendments, issuing circulars, advisory, and press releases, the issues concerning ITC are not yet settled. The complexity of GST laws, Indirect Taxation, frequent amendments, and evolving interpretations have led to an ongoing struggle for both taxpayers and authorities.

Among other issues, one of the important concerns relating to ITC is the entitlement of ITC when the Place of Supply (PoS) differs from the state in which the recipient of the supply is registered. There are numerous business transactions where the PoS of the transaction differs from the location of the recipient’s business resulting in uncertainty as to whether one is eligible for ITC or not, if availed tax authorities deny the input tax credit based on the ground that the PoS of the supply is other than the place of the recipient by taking the shelter of restriction imposed in Table 4(D)(2) of Form GSTR 3B.

Example explaining the issue under consideration:

The transactions that involve the PoS other than the registered place of business of the recipient among others are as follows:

The classic illustration of this concept is the provision of hotel accommodation services or any other type of service in relation to immovable property. In the case of a hotel stay, the accommodation service is consumed by a person at the place where the immovable property is located. The PoS for the said transaction would be the state where the hotel is located. For instance, if a director of a company registered in Gujarat travels to Delhi for a business meeting and stays at a hotel in Delhi, the hotel will invoice the accommodation service with the details of the company’s GSTIN in Gujarat and the hotel will charge CGST and (Delhi) SGST instead of IGST, as the PoS would be the state of Delhi and not Gujarat.

There are other types of transactions also where the PoS is other than the place where the recipient is located like renting of immovable property. Additionally, there are possibilities where wrong PoS is reported by a supplier in its GSTR 1, in that case also the PoS would be other than the state where the recipient is located.

In service tax regime, ITC in such cases was universally available throughout India without any kind of restriction. This was facilitated by the centralized law as well as centralised nature of Service Tax registration and not state-wise.

Question arises with reference to the entitlement of the ITC when the PoS is other than the state where the recipient of supply is located.

Definitions:

Input Tax

2(62) “input tax” in relation to a registered person, means the central tax, State tax, integrated tax or Union territory tax charged on any supply of goods or services or both made to him and includes—

- (a) the integrated goods and services tax charged on import of goods;

- (b) the tax payable under the provisions of sub-sections (3) and (4) of section 9;

- (c) the tax payable under the provisions of sub-sections (3) and (4) of section 5 of the Integrated Goods and Services Tax Act;

- (d) the tax payable under the provisions of sub-sections (3) and (4) of section 9 of the respective State Goods and Services Tax Act; or

- (e) the tax payable under the provisions of sub-sections (3) and (4) of section 7 of the Union Territory Goods and Services Tax Act,

- but does not include the tax paid under the composition levy;

Input Tax Credit

- 2(63) “input tax credit” means the credit of input tax;

State Tax

- 2(104) “State tax” means the tax levied under any State Goods and Services Tax Act;

On careful reading of the above definitions, it is evident that there is no distinction made regarding the CGST / SGST, or IGST charged by the supplier where the PoS is other than the place where the recipient is registered. Hence, the definition of ITC includes the input tax charged as CGST or SGST, or IGST of any state. Also, the definition of the state tax as given in the above section stated that the “State tax” means tax levied under any state GST Act.

Conditions and restrictions prescribed for ITC under the GST Law:

To be eligible to claim ITC a registered person needs to fulfil the condition mentioned in section 16 of the CGST Act, 2017, the conditions mentioned in the section are given below:

- a. Goods or Services or both on which input tax is charged are used or intended to be used in the course or furtherance of his business.

- b. Recipient should be in possession of tax invoice or debit note issued by a supplier registered under the Act.

- c. Details of the invoice or debit note referred above should be furnished by the supplier in his GSTR 1 and the details should be communicated to the recipient of such invoice or debit note.

- d. Received the goods or services or both.

- e. Details of ITC in respect of the said supply communicated to such registered person under section 38 has not been restricted.

- g. Tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilisation of input tax credit admissible in respect of the said supply.

- e. Return under section 39 has been furnished.

Additionally, after fulfilling all the conditions mentioned in section 16 the said ITC should not be blocked by section 17 of the CGST Act, 2017.

On examination of section 16 and 17, there is no provision which debars availment of ITC in cases the PoS mentioned in the invoice is other than the state where the recipient of the supply is registered. Hence, on perusal of these sections i.e., section 16 and 17, there is no restriction whatsoever prescribed in the law for disallowing of ITC in cases where the PoS is the state other than the state where the recipient is registered.

Most importantly, CGST Act and IGST Act are implemented across India without any state-specific applicability.

Amendment made in Form GSTR 3B:

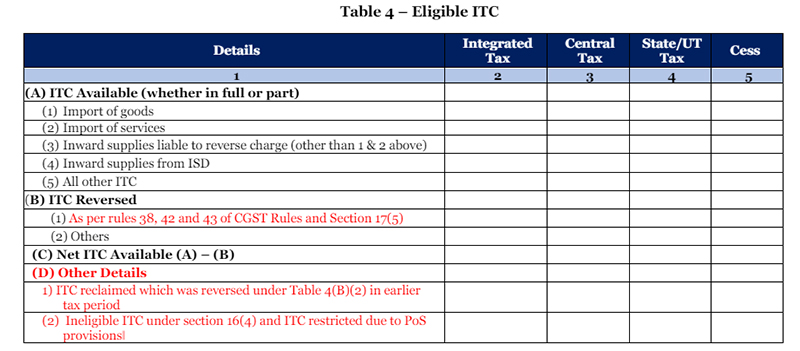

There are certain changes made in Form GSTR 3B vide Notification No. 14/2022 – Central Tax dated 05th July 2022. In Table 4 of Form GSTR 3B, the changes have been made effective for GSTR-3B to be filed for the period August 2022 onwards. The changes given effect through the said notification has been given below (Highlighted in red):

The changes made in Form GSTR 3B vide Notification No. 14/2022–Central Tax through the Central Goods and Services Tax (Amendment) Rules, 2022.

On perusal of the above Table 4 of GSTR 3B, in Table 4(D)(2), ineligible ITC that is not available to the registered person either on account of the limitation of time period as delineated in section 16 (4) of the CGST Act or where the recipient of an intra-State supply is located in a different State / UT other than that of the PoS. This restriction has been imposed via amendment made in Form GSTR 3B and clarified through the issuance of a circular by the CBIC Board (Central Board of Indirect Taxes and Customs) vide Circular No. 170/02/2022-GST dated 06th July 2022.

Analysis of the restriction imposed:

The restriction on availing ITC where the PoS of the supply is other than the state where the recipient of the supply is located has been clarified vide Circular No. 170/02/2022-GST dated 06th July 2022. No restriction has been imposed under the law for denying the claim of ITC in case of PoS other than the location of the recipient. The only restriction imposed was through these amendment rules. Because of this restriction, the tax charged on the supply by the supplier was not allowed as input tax to the recipient of the supply.

Due to the restriction imposed the very objective for introducing the GST law with a promise of seamless flow of the tax credit to the businesses becomes defective as the ITC despite the goods or services used in the course or furtherance of business is not available and the input tax charged becomes the cost to the recipient of such supply.

In Table 4(D)(2) of the GSTR 3B, two ineligible ITC is required to be reported as discussed in the circular, which are given below:

- ITC not available, on account of limitation of time period as delineated in sub-section (4) of section 16 of the CGST Act or

- Where the recipient of an intra – State supply is located in a different State / UT than that of PoS, may be reported by the registered person in Table 4(D)(2).

Such details are available in Table 4 of FORM GSTR-2B.

In the circular issued the ITC denied was only for the purpose of intra-state supply where the PoS is other than the state where the recipient is registered. However, in the case of inter-state supply of goods or services where the PoS of the supply is in a state other than the state where none of the parties is registered i.e., the supplier and the recipient, then, in that case, the circular is silent, hence, there should be no dispute in case of inter state supply. The possibilities of the transaction where PoS is in a third state where none of the parties is registered are very remote, however, in case, when the goods are delivered by the supplier to a place of exhibition or like which is a state where none of the parties are registered or like situations and where the supplier has erroneously mentioned the wrong PoS in the GSTR 1 filed in that case the department cannot demand the ITC reversal even on account of the ineligibility vide the Amendment Rules and circular.

According to section 49 of the CGST Act,2017, manner of utilising ITC for payment of tax, there is no explicit provision stating that only ITC relevant to the PoS of the registered person’s state shall be allowed to be utilized for making SGST payments.

The CGST (Amendment) Rules, 2022 has been introduced through notification in exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017. Section 164 of the Act reads as under:

- “(1) The Government may, on the recommendations of the Council, by notification, make rules for carrying out the provisions of this Act.

(2) Without prejudice to the generality of the provisions of sub-section (1), the Government may make rules for all or any of the matters which by this Act are required to be, or may be, prescribed or in respect of which provisions are to be or may be made by rules.”

The rules are the subsidiary instruments that serve to specify the operational procedures, requirements, and enforcement mechanisms necessary for the effective execution and administration of the overarching legal framework established by the Act. It is a settled legal position that if there is a conflict between the substantive provision of the statute and the rules framed thereunder then it is the statute that will have an overriding effect. The rules must align with and be consistent with statutory law, they typically cannot contravene or supersede it.

The Rules cannot prescribe or takeaway any substantive right that is not expressly provided for the statutory law, if the rule tries to do so, it would be deemed to be ultra vires to the provision of the statutory law (GST Law). Concerning the current discussion, the CGST Act does not provide any kind of restriction imposed on the ITC availment in case the PoS of the supply is other than the state where the recipient is registered.

Through the amendment rules introduced vide the notification, changes were made in Form GSTR 3B, no change was made in the law or rules concerning Input Tax Credit.

Conclusion

The moot question that needs be answered is that whether the ITC on supply received, where the PoS of supply is other than the state where the recipient is registered, eligible? In other words, if we go by the example discussed above with regards to eligibility of ITC of CGST and SGST charged by hotel located in Delhi to a taxpayer registered in Gujarat, will the person in Gujarat be eligible to avail ITC of such tax?

Based on the above discussion, it is clear that there is no explicit provision mentioned in the Act that restricts the ITC in question and the only restriction imposed was through the Amendment Rules for amending GSTR 3B form which is ultra vires to the provision of law. Therefore, it can be concluded that the ITC in relation to PoS other than the state where the recipient is located shall be eligible and the restrictions imposed in Form GSTR 3B through the notification is bad in law and have no legs to stand under the provision of law.

Co-Authored by

CA Nitesh Jain

Managing Partner, NJ Jain & Associates