Explore the complexities of Compensation Cess amid COVID-19 challenges and the imperative of GST compliance for economic stability.

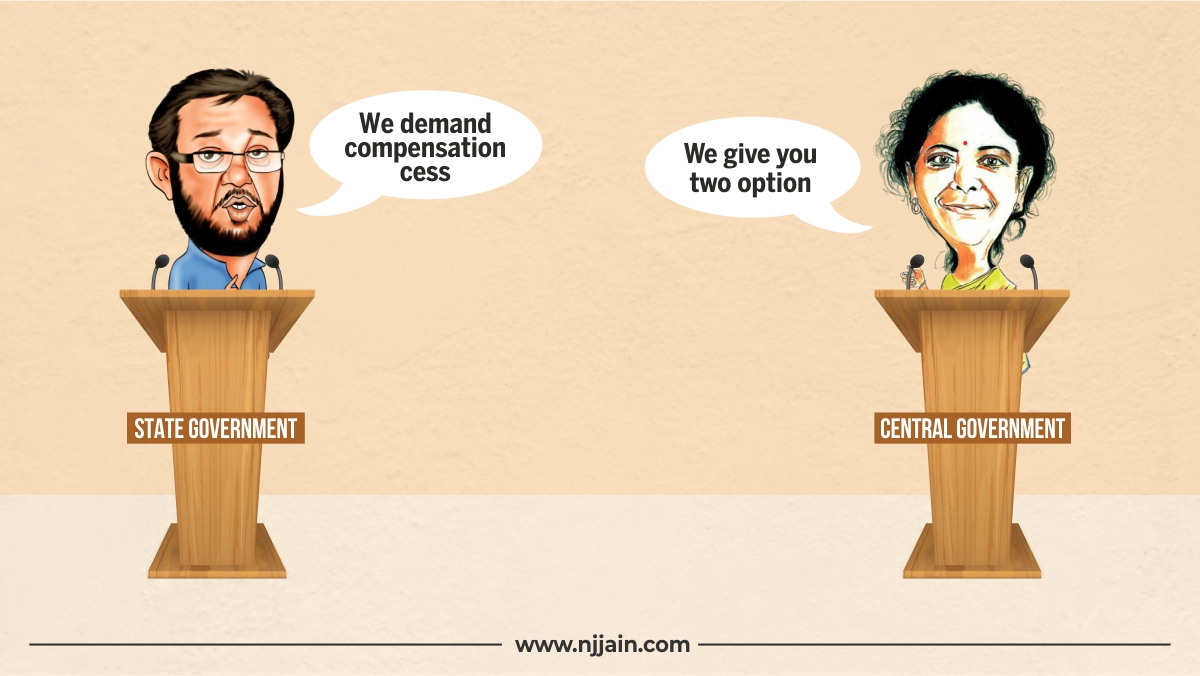

Our economic trajectory has taken an unexpected turn due to COVID-19, and the debate of massive revenue degrowth for Central Government or individual states is now raging. In the recently concluded 41st GST Council meeting, held on 27th August 2020, Central government has proposed two alternatives to the states for recouping their losses in absence of adequate receipts of Compensation cess.

With this topic re-surfacing throughout news channels and economic newsletters, let’s answer the question of: What is Compensation Cess?

In 2017, the then finance minister, late Shri Arun Jaitley, proposed the system of compensation cess to recover any revenue losses incurred by the state due to implementation of Goods & Services Tax (GST). To compensate the states for giving up their power of collecting tax on goods and services, the Centre took the responsibility of funding them to recover the losses and simultaneously help the states maintain a 14% tax revenue growth taking base year as 2015-16. A promise which brought the states onboard and India could realise a more decade old dream of GST.

Vide Section 18 of The Constitution (One Hundred and First Amendment) Act, 2016, Parliament instituted the power to compensate the state for loss of revenue arising on account of implementation of GST for a period of 5 years. Text from the Constitution reads as under:

18. Parliament shall, by law, on the recommendation of the Goods and Ser-vices Tax Council, provide for compensation to the States for loss of revenue arising on account of implementation of the goods and services tax for a pe-riod of five years.

Four things that are evident from above Section are:

- a. Parliament shall have the sole power of making a law

- b. Law shall be made on the recommendation of the GST Council

- c. Compensation to the States for loss of revenue shall be on account of implementation of GST

- d. Such compensation shall be provided for 5 years from the implementation of GST, i.e. from 1.07.2017 to 30.06.2022

Based on above power, Parliament enacted Goods and Services Tax (Compensation to States) Act, 2017. This act lays down the mechanics of how the Cess will be levied, collected and distributed amongst the states. Section 10 (2) of this Act, reads as under:

10 (2) All amounts payable to the States under section 7 shall be paid out of the Fund.

Centre is of the view that Constitution Amendment provides for compensating any loss accruing to the states on account of implementation of GST and not on any other count. In other words if the deficit of taxes collected under GST is due to a pandemic then Centre is not bound to fund the deficit. Further, the loss can be financed from the cess fund only to the extent it is collected. Centre will not assume any responsibility beyond the Compensation cess collected. They seem to have presented an opinion of the Attorney General of India also to the council.

Compensation Cess is collected by levying sin taxes on luxury goods, like tobacco, alcohol, aerated drinks, and luxury cars. For example, an aerated drink is charged a GST of 40%, out of which only 28% is for the GST and the rest 12% is for compensation cess.

The system progressed in its initial years, as the Centre collected a cess fund of Rs. 62,596 crores in FY17-18 of which Rs. 41,146 crores were paid to the states and in the subsequent year, they collected Rs. 95,081 crores out of which Rs. 69,275 crores were paid to the states. But in the FY19-20, the government observed that the monthly estimated payment was doubling up to the actual funds collected from compensation cess. For the time being, the Centre gapped the deficit with the help of excess funds accumulated in the previous two fiscal years and Rs. 33,412 crores from Consolidated Funds, but the prospects of future payments seemed doubtful.

And in such a precarious situation, the economy was hit by the repercussions of COVID-19 virus which increased the states expenditure, while the revenues are decreasing.

After deeming the economic havoc, caused by COVID-19, as an ‘Act of God’, Union finance minister, Nirmala Sitharaman, stated that the Centre would not be able to recover the income shortfall faced by the states during the pandemic. Following estimates were presented by the Finance Minister in the council:

- Estimated Compensation Cess owed to states in FY 2020-21: Rs 3 lakh crore

- Estimated compensation cess collection for FY 2020-21: Rs 65,000 crore

- Estimated compensation cess shortfall for FY 2020-21: Rs 2.35 lakh crore

As per Centre, only 97000 crores of the shortfall is on account of implementation of GST and rest is due to Covid-19, and not provided for under the GST Constitution Amendment.

To come out of this Cess Mess, Centre has proposed two alternatives which the states have to choose from:

- The states can borrow the amount of Rs. 97,000 crores to meet the shortfall in income, as estimated by the Centre to have risen due to GST (Goods and Sales Tax) implementation, as a loan under a Special Window of reasonable interest rate, coordinated by the Ministry of Finance.

- The entirety of the amount, including the shortfall in income due to COVID-19 impact (which rounds up to Rs. 2,35,000 crores), can be borrowed by the state from RBI as a market debt.

The states are blaming the Central Government for not upholding their promise of providing compensation, at an economic period where sales and production is going downhill. Various non-BJP parties, including West Bengal, Kerala, Punjab and Delhi, have rejected both the options, stating that this move will affect the financial health of the states.

With either of the options, the repercussions will be heavy for the state, which would lead to further drop of GDP. Economists say that the states cannot bear the losses as they don’t have the machinery to recover them. Such an economic situation requires an external agent to step in and provide funding, which, at the given moment, can only be executed by the Central Bank. Furthermore, the burden of the losses will eventually trickle down to the citizens as the states will have to cut back on developmental spending.

The states had been given 7 days to decide according to which the future course of action will be decided. In either way, the conclusion of this debate will become a momentous moment in Indian economic history, as it will either open gates for economic restoration or destroy the trust of the country on the government that united its people under GST.

Hope this issue doesn’t result in unravelling of GST, some Chief Ministers have started to make some undesirous noises.