The seventh stage of changes in the e-invoicing structure has been introduced by the GST Council effective from 1st August, 2023, which will cover companies with a turnover of Rs. 5 Crore or more. Many small and medium enterprises above this threshold turnover will come under the scope of this technological overhaul and will be required to issue electronic invoices from August 1, 2023.

In this blog, we will help you to understand e-invoicing changes and explain how businesses can prepare.

What is and How Does the E-invoicing System Work?

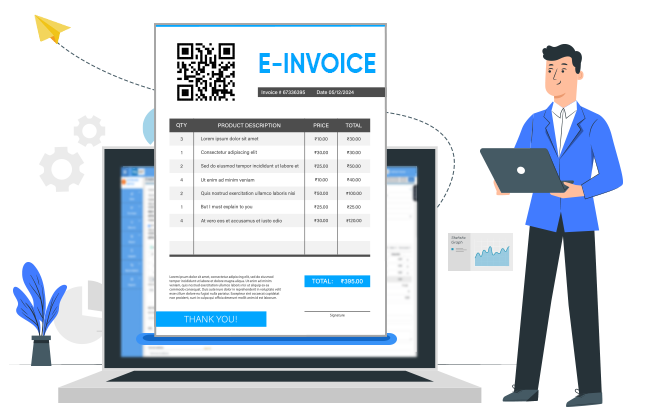

In e-invoicing, taxpayers independently create B2B invoices using their accounting system, following the standardized format provided by the government. The invoice is checked and approved on a common platform, the Invoice Registration Portal (IRP).

The IRP creates a one-of-a-kind invoice number or (IRN) after proper authentication. It also develops a QR code and a digital signature and resends them to the original taxpayer. In addition, the electronic invoice data is transmitted to the electronic waybill and GST portals to create electronic waybills and generate GST returns.

It is worth noting that only B2B and export invoices are subject to e-invoicing so far upto a turnover of 5 crore to 500 crore, taxpayers having turnover above 500 crores are required to have e-invoices for B2C sector as well. In addition, the government has granted exemptions to sectors such as insurance companies, banks, NBFCs, financial institutions, goods transport agencies (GTAs), passenger transport services, cinemas, and SEZ units.

A Brief Background of E-invoicing in India.

E-invoicing was originally introduced in October 2020 for companies with Rs. 500 crore or more annual turnover. However, after successful implementation, the government decided to expand the scope to businesses as under:

| Turnover Limit | Effective date | B2B and/or B2C |

| 500 cr and above | 1.10.2020 | B2B only |

| 500 cr and above | 1.04.2021 | B2B and B2C both |

| 100 cr and above | 1.01.2021 | B2B only |

| 50 cr and above | 1.04.2021 | B2B only |

| 20 cr and above | 1.04.2022 | B2B only |

| 10 cr and above | 1.10.2022 | B2B only |

| 5 cr and above | 1.08.2023 | B2B only |

| Below 5 cr | Optional / Normal Invoice to be issued | |

Ultimately, all taxpayers and transactions would be included in the e-invoicing system to promote seamless cooperation between taxpayers and tax authorities while curbing tax evasion.

How Businesses Can Setup for E-invoicing?

Most of these small enterprises need more technological expertise, thus expressing concerns over the limited time available to establish the e-invoicing system and meet the prescribed deadline. They rely on traditional ERP or billing systems throughout their organizations, involving numerous manual tasks. To implement e-invoicing, they must incorporate additional mandatory fields into their billing systems, adhering to the specified e-invoice schema or format. Such modifications can be carried out either by themselves or by service providers.

Moreover, they need to assess the invoice volume and frequency to establish a robust channel for invoice reporting with the e-invoice portal or Invoice Registration Portal (IRP). Therefore, thorough testing to ensure the efficiency of the e-invoicing process and continuous staff training has become crucial for this particular category of taxpayers to achieve e-invoicing compliance.

Small businesses can connect with government systems through direct API integration or integration via a GST Suvidha Provider (GSP) to facilitate real-time e-invoicing. Moreover, offline facilities offered by IRP, such as e-invoicing for GST, preparing, and printing, which otherwise would require additional time.

Additionally, businesses may consider utilizing cloud-based software services that offer e-invoicing solutions accessible through multiple devices.

What Are the Penalties of the Non-Generation of E-invoices?

Non-compliance with e-invoicing regulations by eligible companies can result in significant penalties, with penalties of up to INR 10,000 per invoice for non-compliance and up to INR 25,000 for incorrect e-invoicing.

Such non-compliance may have adverse consequences for their business. For example, an electronic invoice must be created for B2B invoices to be reported on GST returns. This affects the relationship between sellers and buyers, as buyers’ GSTR-2A/2Bs are not automatically updated, further as per GST law if recipient doesn’t receive e-invoice from an eligible supplier, recipient cannot claim an input tax deduction. In addition, the non-issuance of electronic invoices means that electronic waybills cannot be created for B2B shipments, as creating an IRN is now mandatory. This could lead to the detention of goods and the imposition of penalties.

What Are the Benefits of E-invoicing for the Government and Taxpayers?

The main goal of e-invoicing was to standardize the invoice format and promote interoperability in both the business and tax worlds. However, the benefits of e-invoicing go far beyond this. E-invoicing enables government agencies to monitor every B2B business transaction in real time, helping root out fake invoices and input tax credit (ITC) fraud. In addition, each e-invoice is tagged with a QR code, making it easier for tax officials to verify its authenticity, especially for goods in transit.

There are also numerous advantages for companies. Electronic invoices automatically transfer data to GST returns and electronic waybills, eliminating the need for redundant data entry. It speeds up the process of claiming ITC and gives taxpayers peace of mind that only legitimate ITC will be reported.

We are a professional chartered accountant firm providing tax consultancy services and GST audits to streamline financial management. Our services cater to the needs of businesses, encompassing invoicing, GST compliance, a diverse range of managed services, and credit solutions.