Return Due Date Chart

- Home

- Return Due Date Chart

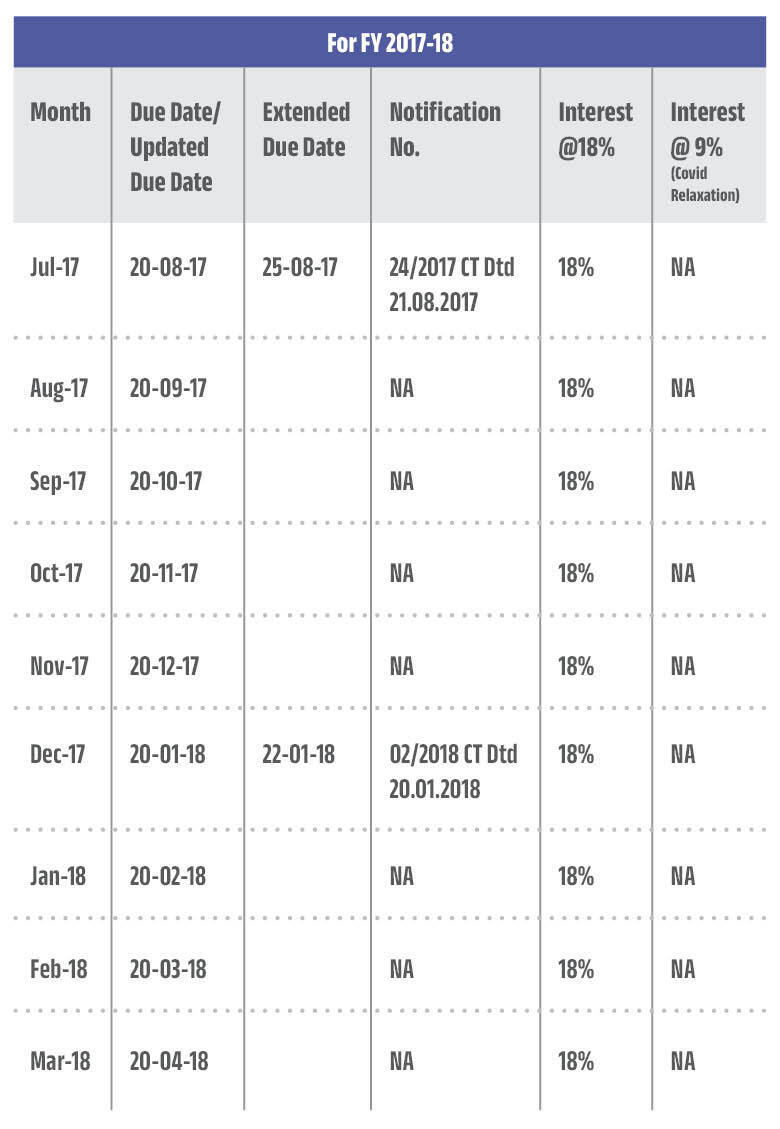

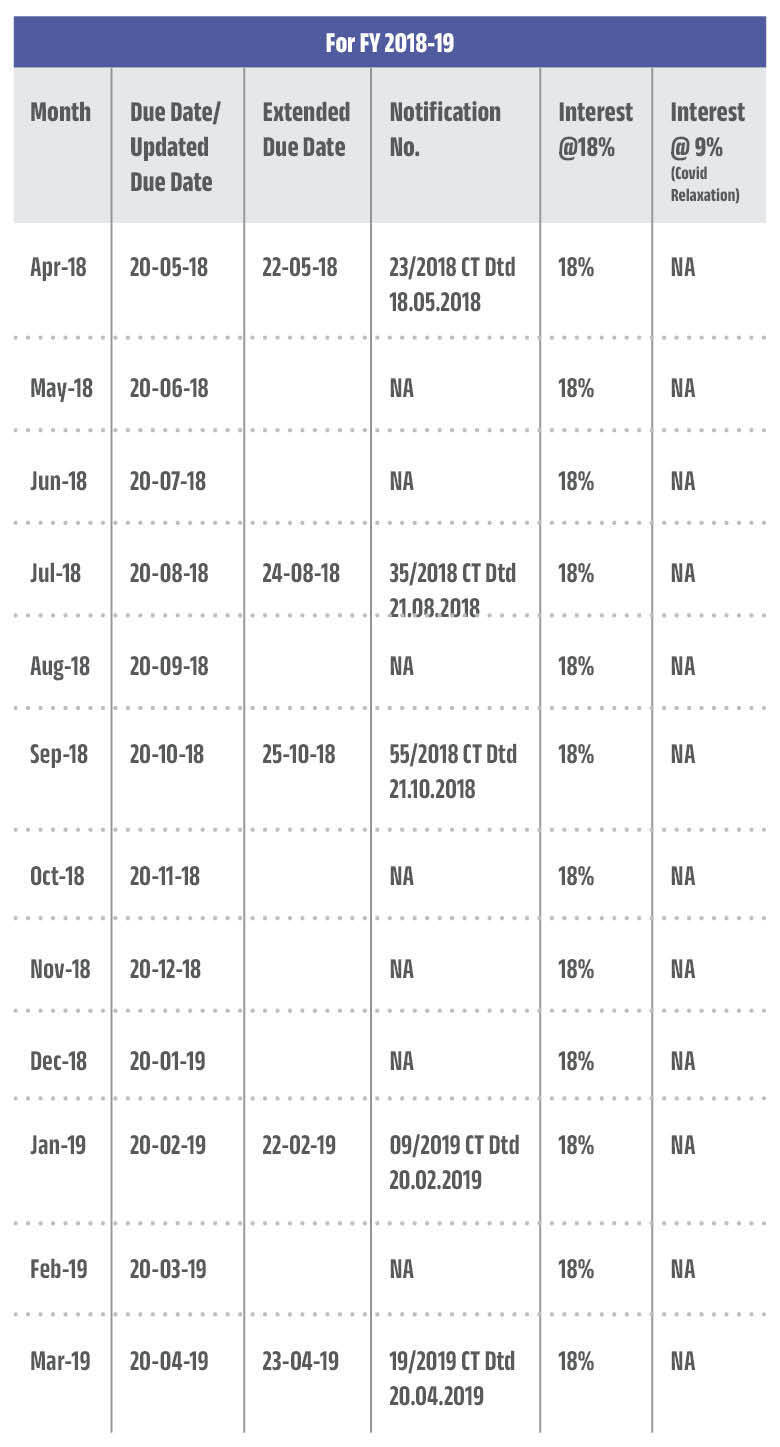

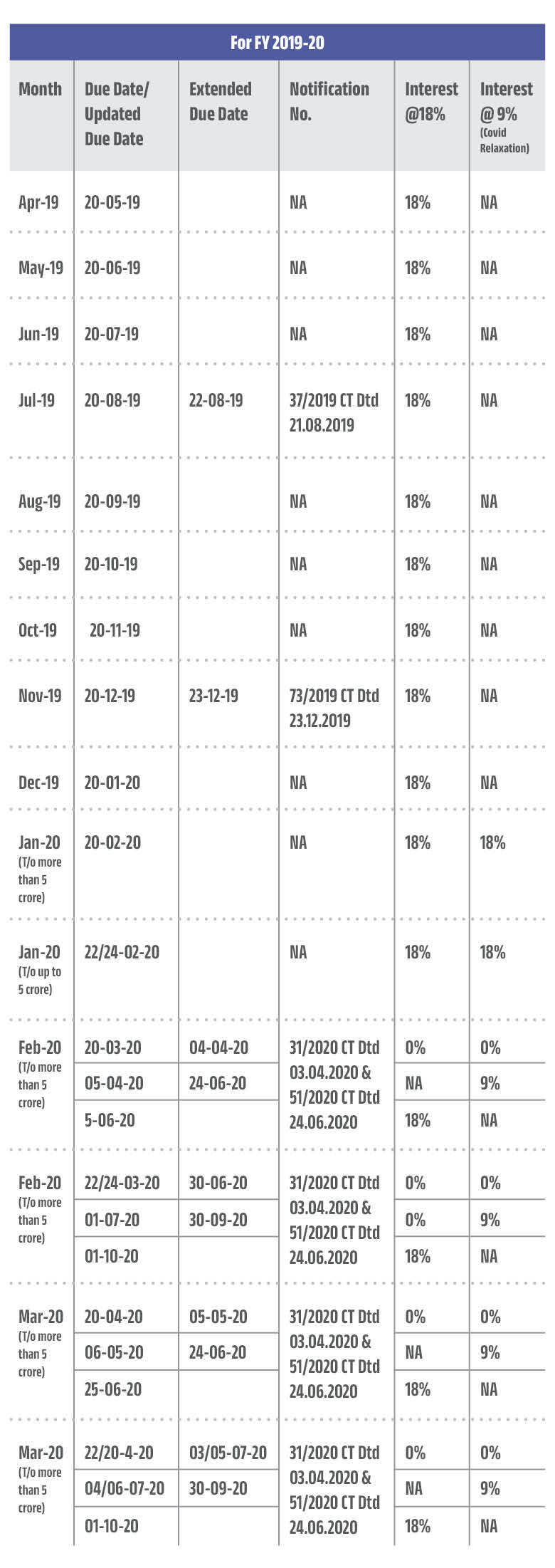

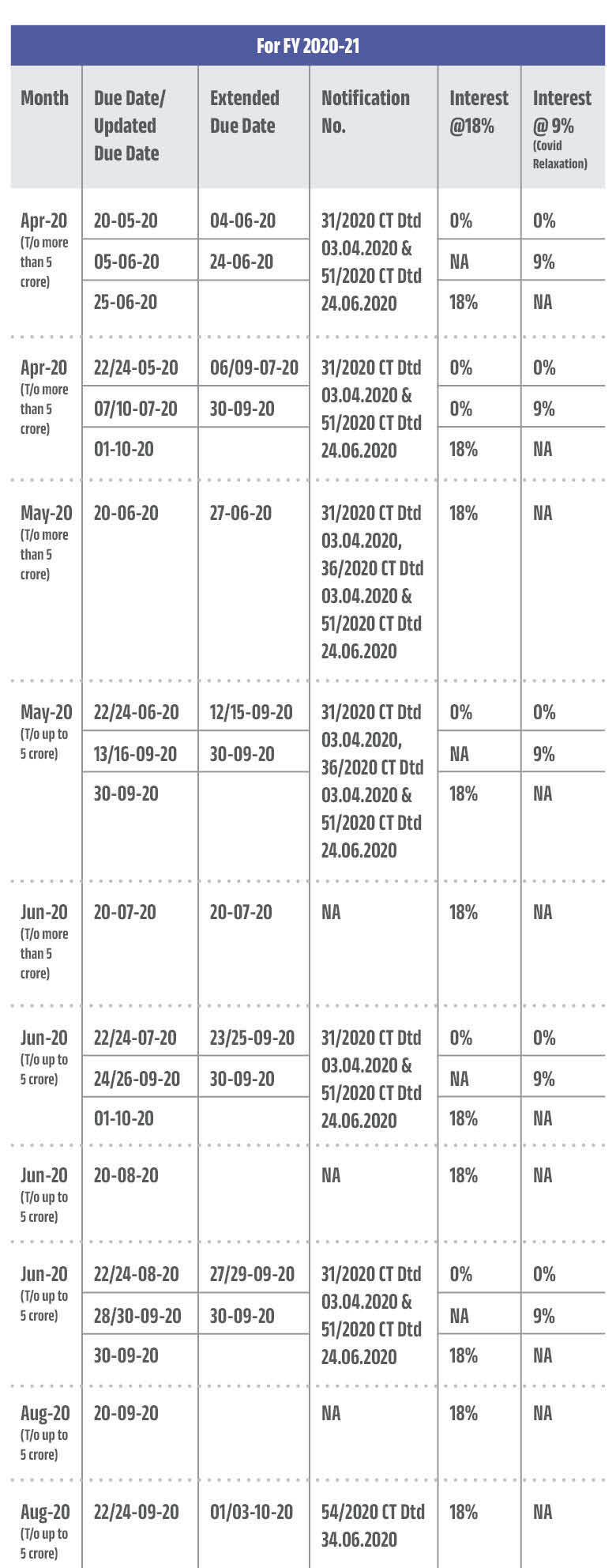

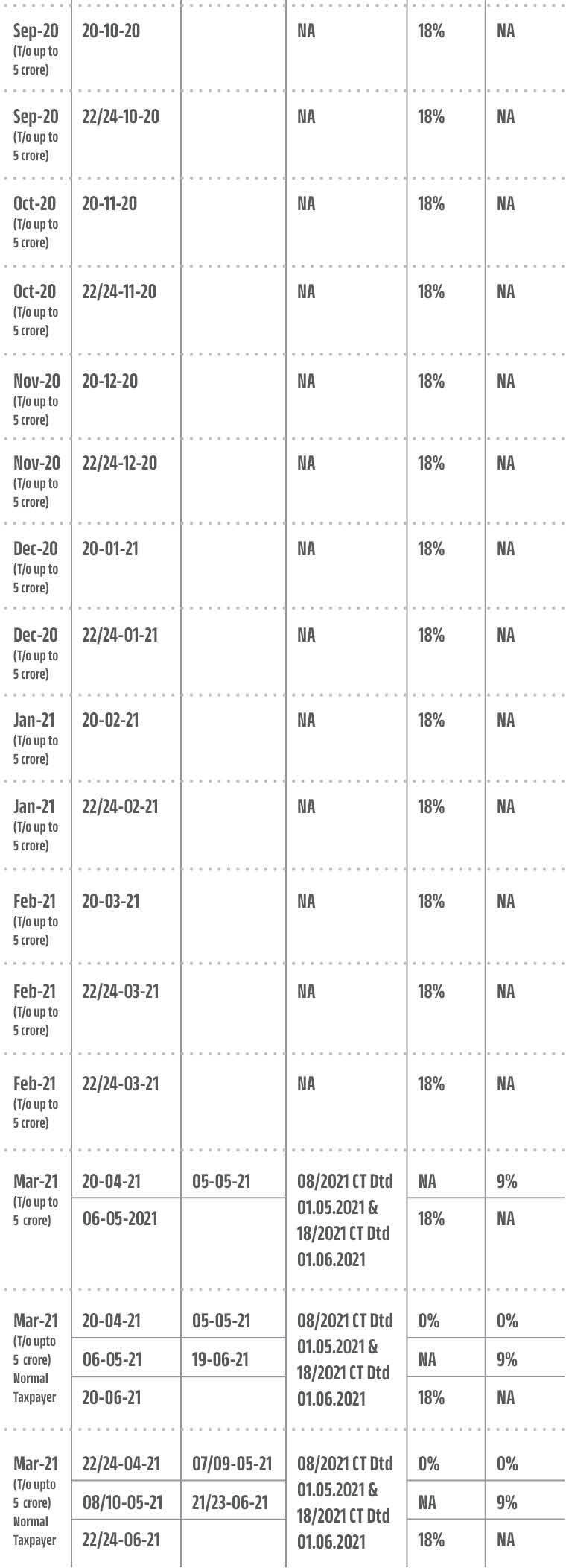

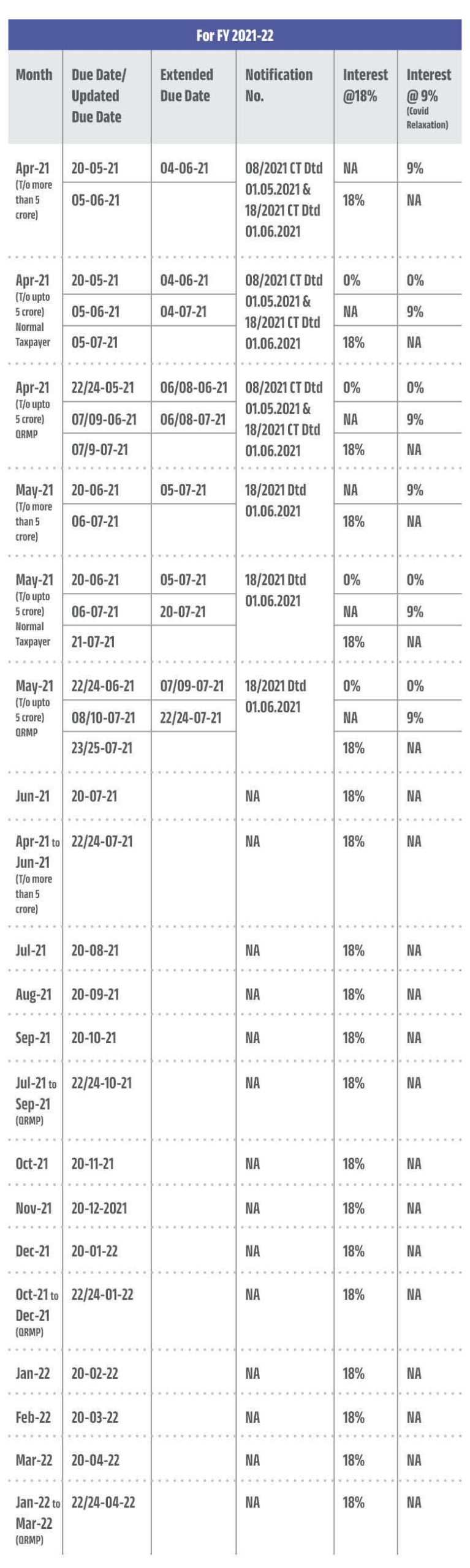

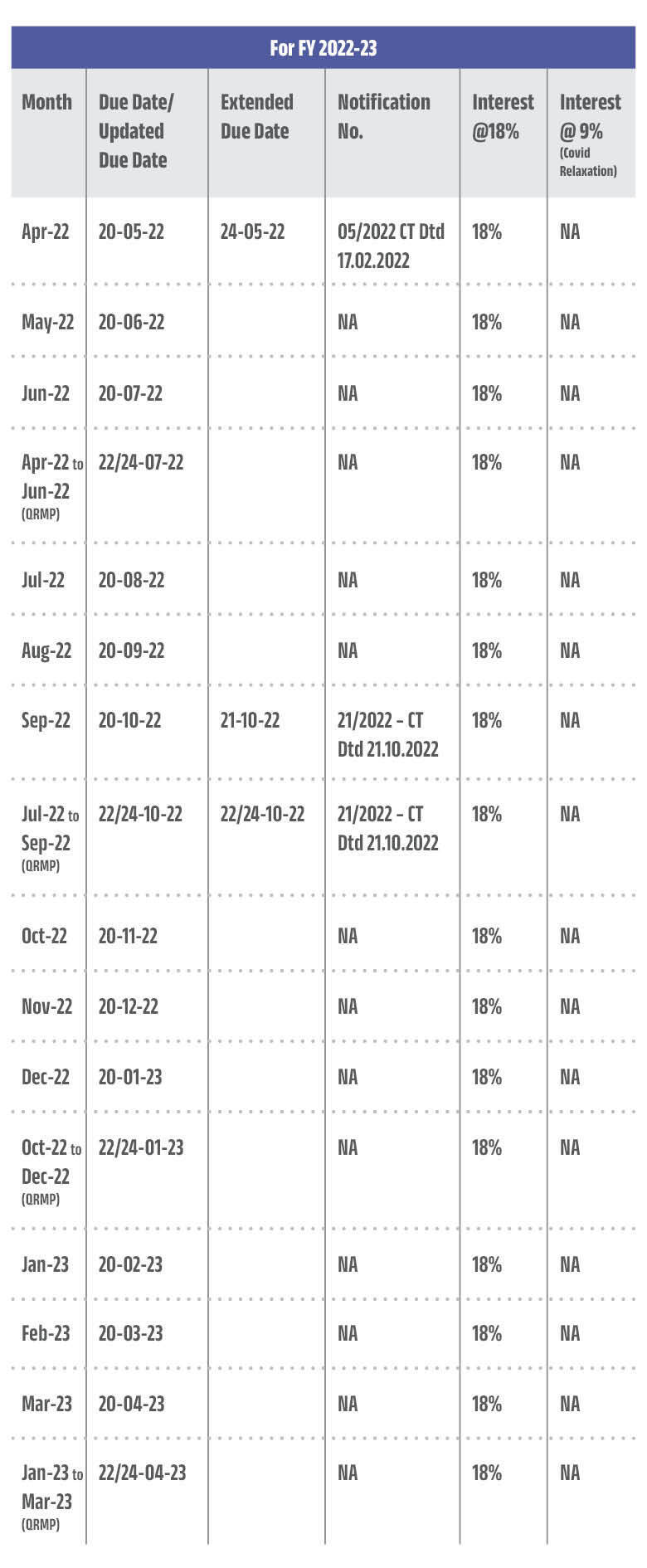

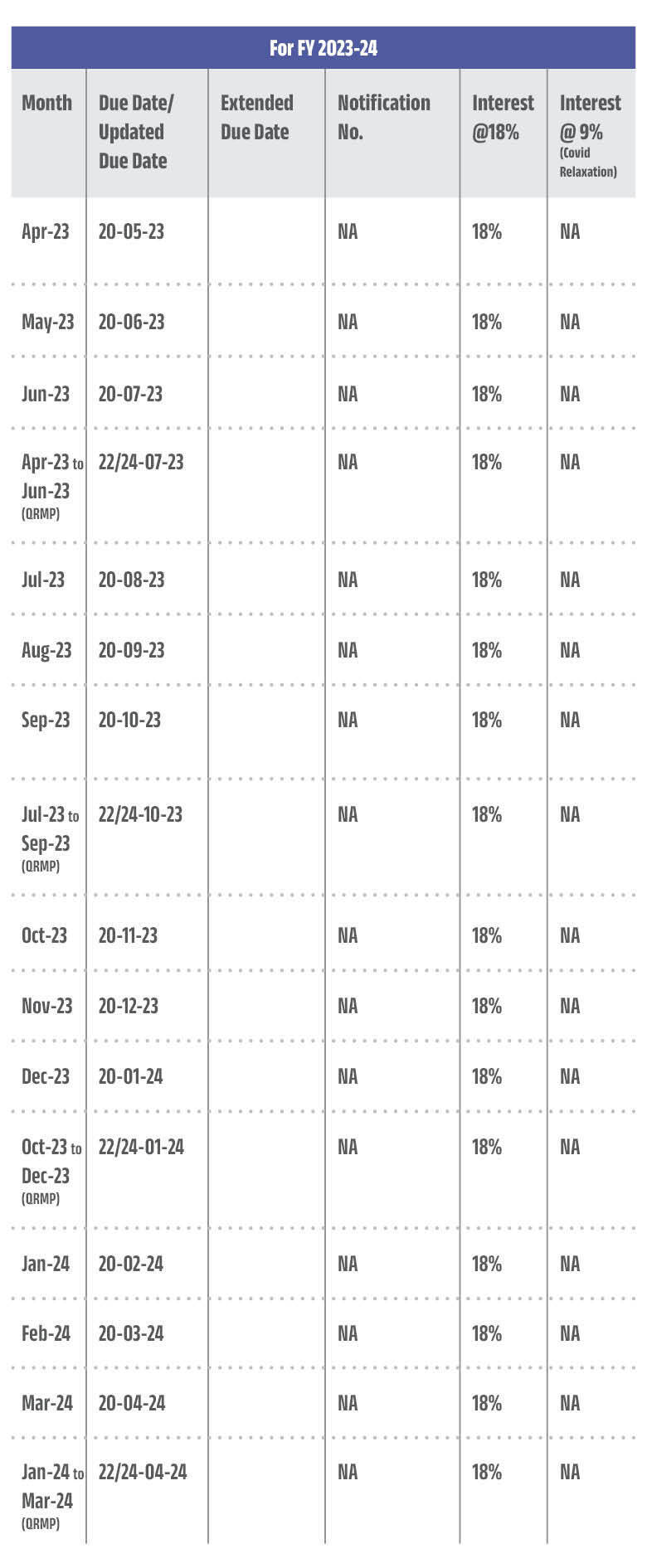

Summary of Extension of GSTR 3B and Relaxation in Interest

GSTR-3B is a crucial self-declaration return form under the GST regime, which businesses use to report summarized details of their monthly or quarterly sales and make the necessary tax payments. The timely and accurate filing of GSTR-3B ensures compliance with GST laws, enabling businesses to avoid penalties and interest charges.

Given the complexities and challenges associated with GST compliance, understanding the extensions, interest relaxations, and late fee waivers provided by the government can be immensely beneficial. This ready reckoner serves as a valuable resource for taxpayers, helping them stay informed about the latest updates and ensuring they can take full advantage of the relief measures available.

Note:

1. From January 2020, to manage the workload of the GSTN portal, CBIC has introduced GSTR-3B filing in a staggered manner. If turnover (T/o) > 5 crore, the return shall be filed by the 20th of the next month. If turnover < 5 crore, the return shall be filed by the 22nd or 24th of the next month, with the 22nd being for List A states and the 24th for List B states. Refer to Notification 07/2020.

2. List A – States (Due Date is 22nd): Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, and the Union territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands, and Lakshadweep.

3. List B – States (Due Date is 24th): Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, and the Union territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi.

4. What is the QRMP Scheme? The Quarterly Return Monthly Payment (QRMP) Scheme allows taxpayers (who are required to furnish Form GSTR-1 and GSTR-3B and have an aggregate turnover of up to Rs. 5 crores) to furnish returns quarterly along with the monthly payment of tax via a simple challan in FORM GST PMT-06, effective from January 01, 2021.