Spice, Dry Fruit & Food Importers Facing GST Notices

Spice, Dry Fruit, and Food Importers Facing GST Notices

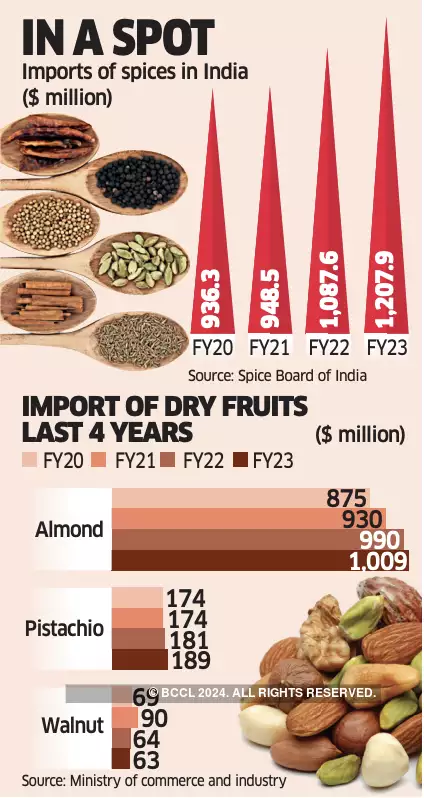

The Goods and Services Tax (GST) regime has brought about significant changes in India’s tax landscape, aiming for a simplified and unified tax structure. However, recent notices issued by GST authorities to around 50 importers of spices, dry fruits, processed foods, and poultry have sparked concerns and debates within the import-export community. These notices, seeking additional tax payments amounting to approximately Rs 1,000 crore, along with warnings of registration cancellations, have raised questions about compliance and operational challenges faced by importers.

Challenges Faced by Importers:

Importers of perishable agricultural commodities often rely on warehouses close to ports or specialized cold storage units for storing their products temporarily. However, the GST authorities are now demanding that these temporary storage warehouses be registered under GST, citing provisions in the GST law regarding the registration of the place of supply. This demand poses significant challenges for importers, especially in terms of compliance burden and operational logistics.

One of the primary contentions raised by importers is the practical necessity of having warehouses near ports or places of final supply for perishable goods. Importers argue that the current demand by tax authorities would not only increase compliance burdens but also disrupt operational efficiency. Many importers, particularly Micro, Small, and Medium Enterprises (MSMEs), find themselves caught in this dilemma, facing the prospect of additional tax liabilities and complexities in claiming input tax credits.

Understanding Input Tax Credit Challenges:

Under the GST framework, input tax credit is a crucial mechanism for businesses to offset taxes paid on inputs against their final tax liability. However, discrepancies between the address on the bill of delivery and the bill of supply pose challenges for importers in claiming input tax credits. For instance, if a trader based in Delhi imports goods via a port in Gujarat and subsequently supplies them to retailers in Maharashtra, the trader would typically store the goods in a warehouse near the port or in Maharashtra. Despite the practical necessity of such arrangements, tax authorities insist on registration for the warehouse from where the supply is made, complicating the process of claiming input tax credits.

Legal Interpretations and Challenges:

The crux of the issue lies in determining whether warehouses used for temporary storage constitute additional places of business under GST regulations. Legal experts suggest that the provisions of the GST law require registration from the location where supplies occur. However, the practical realities of import-export operations, particularly for perishable goods, necessitate temporary storage near ports or places of final supply. Resolving this discrepancy requires a nuanced understanding of both legal interpretations and operational necessities.

The challenges faced by importers of spices, dry fruits, and processed foods highlight the complexities inherent in the GST framework, particularly concerning input tax credit mechanisms and registration requirements for warehouses. Addressing these challenges requires a collaborative approach involving policymakers, tax authorities, and industry stakeholders to strike a balance between regulatory compliance and operational feasibility. Importers, especially MSMEs, need clarity and pragmatic solutions to navigate the evolving landscape of GST regulations effectively. As India continues its journey towards economic growth and tax reform, ensuring a conducive environment for import-export businesses is crucial for sustaining momentum and fostering competitiveness in the global market.