Small Cars Set to Get Cheaper? GST Overhaul on Cards

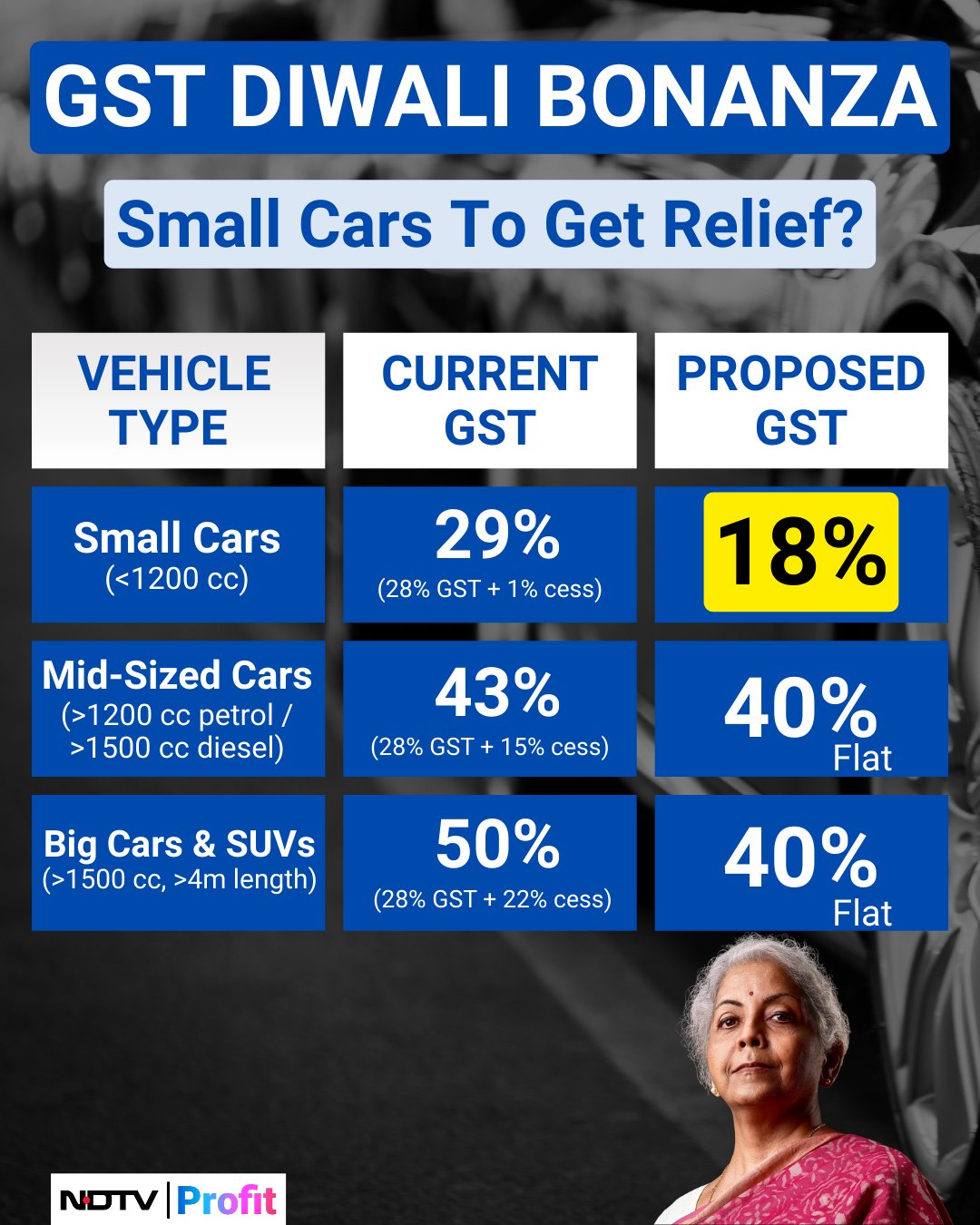

A significant reduction in the price of small cars might soon be a reality for Indian buyers as per recent news reports. The Centre is considering a comprehensive overhaul of the Goods and Services Tax (GST) regime for automobiles. At the heart of this potential reform lies a proposal to tax small cars with engine capacities below 1200cc at 18% GST, compared to the current 28% plus cess. This could bring notable relief to consumers, stimulate demand in the entry-level car segment, and eliminate existing ambiguities in vehicle classification.

GST Council’s Overhaul Agenda: Rationalising the Tax Structure

The GST Council has long acknowledged the need for reform in the auto sector’s taxation system. With the current GST framework imposing varying rates based on multiple factors such as length, fuel type, engine capacity, and even ground clearance, classification disputes have become common. The government now aims to simplify this by focusing on one clear criterion: engine capacity.

The proposed reforms are part of a larger exercise to rationalise GST slabs across various sectors. As per reports, many goods currently taxed at the highest 28% slab are being considered for a move to the 18% bracket. Small cars stand to benefit the most from this rationalisation. This could be a strategic move to revive entry-level car sales, which have been sluggish in recent years.

SUV Definition May Be Dropped: Ending Ambiguity in Classification

One of the most noteworthy aspects of the proposal is the potential elimination of the current SUV definition under GST. As it stands, a vehicle is categorised as an SUV if it meets all the following conditions:

- Engine capacity of over 1500cc

- Length over 4 metres

- Ground clearance of 170mm or more

This definition has often created confusion and led to litigation, especially for compact SUVs and crossovers that blur the lines between segments. Sources indicate that the GST Council may discard this complex definition in favour of a straightforward classification based purely on engine capacity. If this happens, entry-level hatchbacks, small sedans, and compact SUVs that fall below 1200cc will uniformly attract the lower 18% GST rate, significantly simplifying the structure.

Current GST Rates on Cars: A Complex Matrix

Presently, the taxation of cars under GST is layered and varies with vehicle specifications:

|

Car Category |

Engine Capacity & Length | GST Rate | Compensation Cess | Total Tax Rate |

| Small Petrol Cars | Up to 1200 cc, less than 4m length | 28% | 1% | 29% |

| Small Diesel Cars | Up to 1500 cc, less than 4m length | 28% | 3% | 31% |

| Mid-sized Cars | Above 1200 cc (petrol) or 1500 cc (diesel) | 28% | 15% | 43% |

| Luxury Cars | Above 1500 cc | 28% | 20% | 48% |

| SUVs | Above 1500 cc, more than 4m length | 28% | 22% | 50% |

| Electric Vehicles | All capacities | 5% | 0% | 5% |

Such a tax structure not only makes vehicle pricing opaque but also affects consumer choices, often pushing buyers toward higher-taxed yet popular SUV models.

Proposed GST Changes: What Could Change?

The proposed changes aim to simplify and rebalance the auto tax structure:

- Cars with engine capacity under 1200cc: A flat 18% GST with no cess

- Cars with engine capacity above 1200cc: Taxed at 40% GST (including cess)

- Electric Vehicles: Will continue to be taxed at 5% GST

This means that:

- Entry-level hatchbacks and compact sedans would see an approximate 11% reduction in tax.

- Compact SUVs under 1200cc could also enjoy lower taxes, ending disputes about their classification.

- Larger vehicles, while still taxed higher, would see a modest drop from 43–50% to 40%.

Market Impact: What Will the GST Rate Cuts Mean for You?

Lower Car Prices for Budget Buyers:

For middle-class families and first-time buyers, this proposal could mean a significant reduction in the cost of small cars. For example, a Rs. 6 lakh hatchback might see a price cut of Rs. 30,000–50,000.

Renewed Interest in Entry-Level Segment:

With lower taxes, automakers might shift focus back to compact models, which have lost market share to SUVs over the last few years.

Simplified Tax Structure:

The removal of the SUV classification based on height and ground clearance will make tax administration and vehicle pricing more transparent.

Balanced Consumer Preferences:

High taxes on SUVs had not deterred their demand. However, with rebalancing, consumer decisions might tilt back toward more affordable and fuel-efficient small cars.

Revenue Neutrality for Government:

While there may be a dip in tax collection from small cars, the consistent 40% rate on larger vehicles and continued high taxes on sin goods like tobacco and aerated drinks could offset this.

Will Cars Get Cheaper? Here’s What to Expect

Yes, if this proposal gets implemented, prices of small cars could decline significantly. The GST reduction from 29% to 18% can directly impact ex-showroom prices. This price drop, coupled with potential dealer discounts, could lead to better affordability for buyers. However, final prices will depend on state registration charges and insurance premiums.

It is also expected that carmakers will pass on the benefits to consumers promptly, especially in the competitive hatchback segment.

Conclusion: A Timely Move for Auto Sector Revival

The proposed GST rejig represents a significant and much-needed step toward rationalising India’s auto tax policy. Simplification, fairness, and demand revival appear to be the key objectives. For car buyers, this could mean more value for money. For the industry, it may open up new volumes in the lower segments and reduce the compliance burden.

As we await formal discussions and potential rollout from the GST Council, it is essential for manufacturers, dealers, and consumers to stay alert to changes. Companies must prepare for rapid implementation, while buyers might do well to wait and watch. At the same time, it is imperative that the Government promptly confirms the veracity of these reports. In the absence of official clarification, vehicle sales in the entry-level segment could stagnate over the next two months, as consumers delay purchases in anticipation of a tax cut. This uncertainty may place considerable pressure on OEMs, dealers, and the broader automobile ecosystem.