GST Alert 03 – Change in effective rate of tax on Utility Vehicles

GST Alert 03/2023-24

Date 27.07.2023

Vide Notification no. 3/2023-Compensation Cess (Rate) dated 26.07.2023 GST rate for Utility vehicles has been increased by 2% effective from today (27.07.2023) – effective GST and Cess rate has been increased from 48% to 50%.

Increased rate of 50% would be applicable on vehicles which fulfil ALL the below conditions:

1. Vehicles known as Utility Vehicles, by whatever name called including Sports Utility Vehicles (SUV), Multi Utility Vehicles (MUV), Multi-purpose vehicles (MPV) or Cross-Over Utility Vehicles (XUV),

2. Engine capacity exceeding 1500cc ;

3. Length exceeding 4000 mm and

4. Ground Clearance of 170mm and above. Please note Ground Clearance has to be taken in unladen condition. *

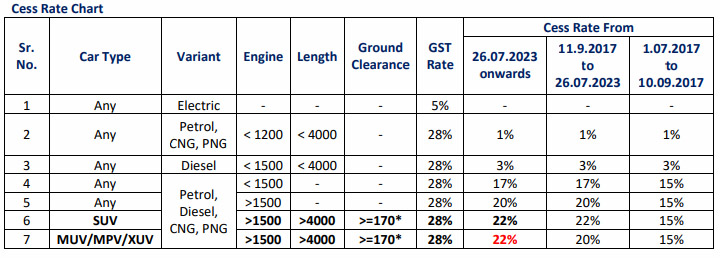

Following would be the holistic matrix of GST rates applicable on all type of cars:

*Note on Ground Clearance

1 From 1.07.2017 to 26.07.2023 – Ground clearance to be measured in LADEN Condition

2 From 26.07.2023 onwards – Ground clearance to be measured in UNLADEN Condition.

Notations

< Less than

> More than

> = More than or is equal to

Suggestions:

a. Any car (fulfilling all conditions as above) sold today or thereafter will be taxed at new rate, it would not make any difference whether the car was held in stock (purchased at lower GST rate) or it is sold from a fresh purchase in new rate.

b. Please take a list of those vehicles from the OEM which have impacted due to this rate change.

c. Most of the car dealers are E-invoice enabled, hence please note that cars sold on 26.07.2023 or before in B2B segment would have to be given an e-invoice.

d. CRTM and other formalities / documentation would also have to be taken care of.