Growth of GST Compensation Cess Outpaces Overall GST in FY24

The recent surge in the GST compensation cess has become a focal point of discussion after the 54th GST Council Meeting, where a Group of Ministers (GoM) was tasked with determining the future of this tax component. With the cess showing remarkable growth, there is a strong case for its continuation or reformation once its levy ends in March 2026.

The Role of GST Compensation Cess

The GST compensation cess was introduced to help the Central government fulfill its promise to compensate states with a 14% compounded annual growth rate (CAGR) in tax revenue for five years following the GST rollout in 2017. This cess is primarily levied on “sin goods,” luxury products, and items with adverse environmental or health impacts, such as tobacco, pan masala, carbonated beverages, large motor vehicles, and certain coal products. It also applies to specific imported goods.

The original objective of the compensation cess was to bridge the revenue shortfall for states during the transition to GST. Though the payouts to states officially ended in June 2022, the levy was extended until March 2026 to repay a ₹2.7 lakh crore loan the Centre borrowed during the pandemic to meet the deficit.

Growth Trends of the GST Compensation Cess

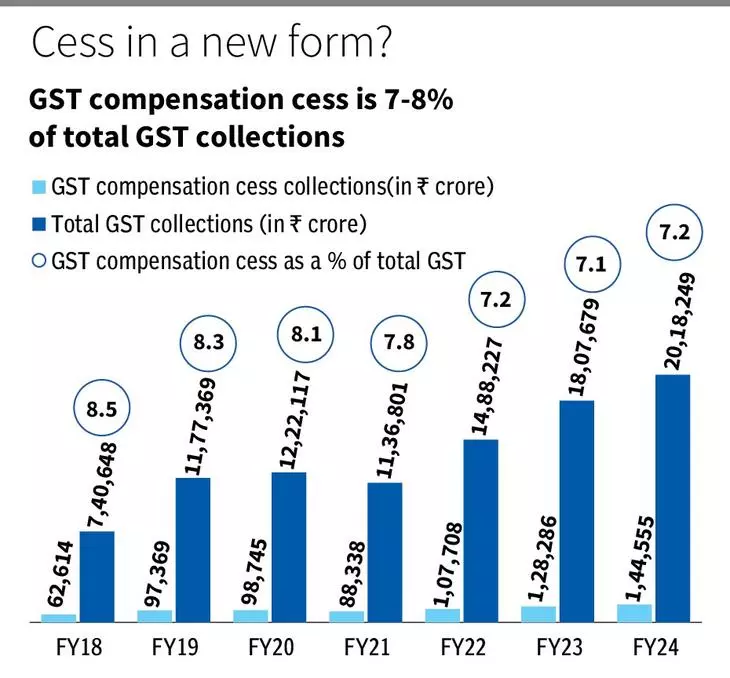

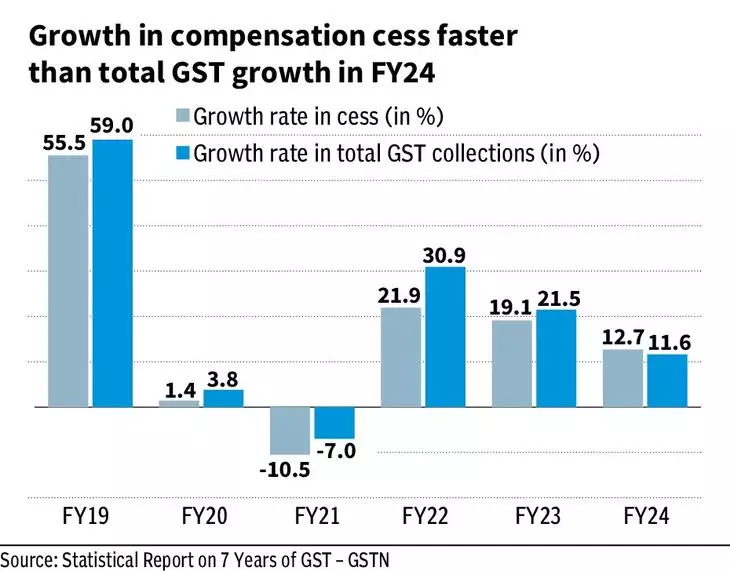

Data analysis by Businessline highlights that the GST compensation cess has been a significant contributor to the government’s revenue, averaging 8% of total GST collections between FY18 and FY24. Notably, its growth has been in tandem with the rise in overall GST collections, even surpassing it in recent years.

Here’s a closer look at the growth trends:

- FY22: Cess grew by 22% to ₹1.07 lakh crore

- FY23: Cess increased by 19% to ₹1.28 lakh crore

- FY24: Cess saw a 12.7% rise, reaching ₹1.44 lakh crore

Comparatively, overall GST collections grew by 31%, 21.5%, and 11.6% in the same post-COVID years. Meanwhile, the Central Goods and Services Tax (CGST) registered growth rates of 29%, 19.7%, and 16% during this period.

Balancing Industry Expectations and Revenue Interests

As industries like automobiles and aerated beverages hope for the cess’s discontinuation post-March 2026, the GoM faces a complex balancing act. While the compensation cess has served as an effective tool to influence consumer behavior (particularly with goods like tobacco), there is also a growing demand for a reevaluation of items on which the cess is imposed, especially given evolving definitions of luxury goods.

Tax experts emphasize that the government must consider both industry expectations and the need to maintain this critical revenue source, possibly in a revised form.

Future of the GST Compensation Cess

Finance Minister Nirmala Sitharaman indicated at the 54th GST Council Meeting that the government aims to clear the back-to-back loan and its interest by January 2026. This could result in surplus cess collections of approximately ₹40,000 crore for February and March 2026. The GoM will be responsible for deciding the future course of action, as the cess will no longer be labeled as “compensation cess” beyond March 2026.

The growth of the GST compensation cess highlights its importance as a revenue-generating tool for the government. As the GoM deliberates on the cess’s future, the challenge lies in striking a balance between industry demands and the need to sustain government revenue. The decision made will have significant implications for both taxpayers and the broader economy.