Future of GST Compensation Cess: What’s Next?

The Group of Ministers (GoM) on GST compensation cess, led by Minister of State for Finance Pankaj Chaudhary, convened on Wednesday to deliberate the future of the compensation cess, particularly focusing on merging it with the existing GST framework. The meeting was a critical follow-up to the recent 54th GST Council meeting, where the future of the compensation cess became a hot topic, especially as its levy is set to expire in March 2026.

The GoM, composed of representatives from various states, discussed the option of combining the compensation cess with the general GST tax.

During the meeting, several states referenced a 2016 discussion led by then-Union Finance Minister Arun Jaitley, who had suggested the possibility of merging the cess with the tax after the end of the five-year compensation period. States proposed that no new goods should be added to the cess list during the transition, which currently includes luxury, sin, and demerit goods. The GoM is expected to present its findings to the GST Council by December 31, with the next meeting scheduled for November.

The Origin and Evolution of the GST Compensation Cess

The GST compensation cess was introduced on July 1, 2017, as part of the broader GST reform, aimed at compensating states for any revenue shortfalls resulting from the transition to the GST regime. The Indian government had committed to ensuring a 14% compounded annual growth rate (CAGR) in tax revenues for states, and the compensation cess was created as a tool to cover potential shortfalls. This cess was levied on certain “sin goods,” luxury items, and products deemed harmful to health or the environment, such as tobacco, aerated beverages, luxury cars, and coal.

Initially, the cess was supposed to be in place for five years, until June 2022. However, due to the significant financial strain caused by the COVID-19 pandemic, the government borrowed ₹2.7 lakh crore to cover revenue deficits and extended the cess till March 2026 to repay this debt. The compensation scheme provided crucial financial support to states during the early years of GST implementation, ensuring that they did not face immediate financial difficulties.

GST Compensation Cess: Current Trends and Future Trajectory

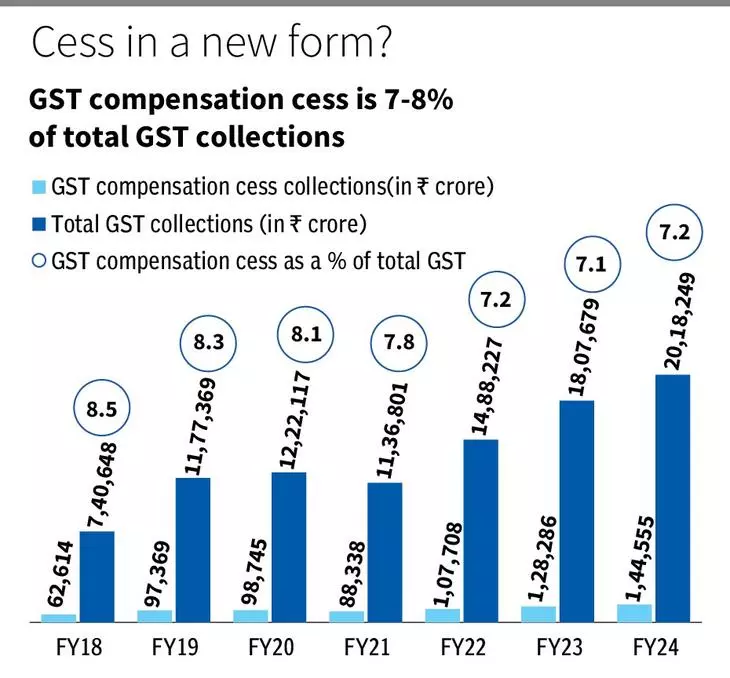

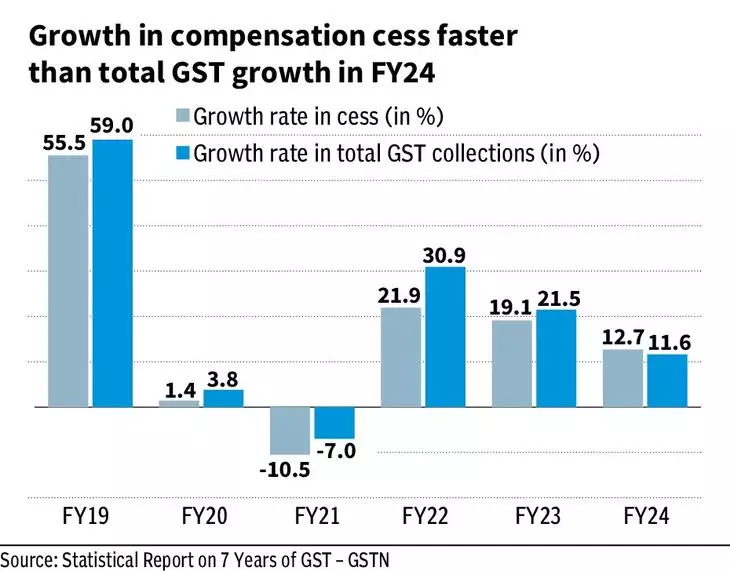

The compensation cess has played a pivotal role in revenue generation for both the Central and state governments. According to recent data, the cess has accounted for approximately 8% of the total GST collections between FY18 and FY24, showing remarkable growth. In fact, in post-COVID years, the cess’s growth has outpaced even overall GST collections, highlighting its increasing contribution to government revenue.

For example, while overall GST collections grew by 31%, 21.5%, and 11.6% in FY21, FY22, and FY23, respectively, the compensation cess grew by 35.4%, 19.5%, and 13.4%. This upward trend in the cess is largely due to the high consumption of taxed luxury and sin goods. The Central Goods and Services Tax (CGST) similarly saw growth. Still, the cess’s unique role in funding essential government obligations, such as the repayment of pandemic-related loans, makes its future especially important.

Debates at the GoM Meeting: Will the Cess Become a Permanent Tax?

During the GoM meeting, several states cited the discussions held during the 7th GST Council meeting in 2016, wherein then-Finance Minister Arun Jaitley had proposed that once the five-year compensation period concluded, the compensation cess could be merged with the GST tax rates. States reiterated that this idea should be considered, especially as the March 2026 deadline approaches. A major point of contention was whether the list of goods on which the cess is levied—primarily luxury, sin, and demerit goods—should be expanded or kept static.

States agreed that while restructuring the levy, no new goods should be added to the cess list, suggesting that any future levies should maintain their focus on these categories. Moreover, the GoM is considering introducing different tax rates for these goods once the cess merges with the general GST framework.

The overall consensus among the states is that the merger of the compensation cess with the GST would provide a long-term solution to the impending expiry of the cess in 2026, and could simplify the taxation process by eliminating the need for a separate cess.

What do the Proposed Changes mean for Taxpayers and Industries?

If the compensation cess is merged with the broader GST framework, it would have several notable impacts. First, the taxation process for luxury, sin, and demerit goods would be streamlined, simplifying compliance for businesses. For the government, this would also mean a more stable and predictable revenue stream without having to extend the cess again beyond 2026.

However, industries currently subjected to the compensation cess, such as automobiles and aerated beverages, may experience some relief if the restructuring results in lower tax rates for certain goods. This could boost industry growth, although the government will need to balance these interests carefully against the need for revenue generation.

On the other hand, consumers may continue to face higher prices for these goods, as any restructuring could still maintain high tax rates for products like tobacco and luxury cars. The final outcome of the GoM’s decision will depend on how the government chooses to balance these opposing interests—economic stimulation versus maintaining revenue for critical public services.

A Tipping Point for GST Reform

The ongoing discussions within the Group of Ministers (GoM) highlight the complex nature of the GST compensation cess and its future role in India’s taxation system. The original purpose of compensating states for revenue shortfalls is nearing its end, and the government must now decide how to handle this levy going forward. Whether the compensation cess is merged into the broader GST structure or continues in a modified form, the decision will have far-reaching consequences for industries, state revenues, and consumer prices.

As the GoM prepares its final report for the GST Council, the stakes are high, with the potential to reshape the future of India’s taxation on luxury and sin goods. The next few months will be crucial in determining how this long-standing component of the GST system will evolve.