Flipkart’s New GST OTP Requirement Stirs Controversy Among Sellers

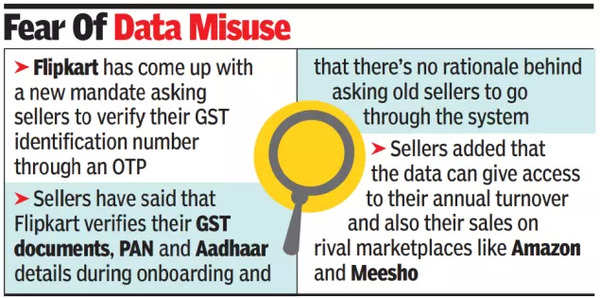

In a recent development, Flipkart has introduced a new mandate requiring sellers on its platform to verify their Goods and Services Tax Identification Number (GSTIN) through a one-time password (OTP) verification process. The Walmart-controlled e-commerce giant claims that this process is necessary to validate that the GST registration number belongs to the seller conducting business on Flipkart, thus preventing any unauthorized use of a seller’s GST number.

However, this move has sparked significant backlash among sellers, many of whom are concerned about the implications of this new mandate. Sellers argue that by requiring OTP verification, Flipkart might gain access to their confidential GST data, which could potentially include sensitive information such as annual turnover and sales figures from other platforms like Amazon and Meesho. Despite Flipkart’s assurances that the OTP process does not grant access to data submitted in GST returns, the seller community remains skeptical.

Understanding the Issue

The controversy surrounding Flipkart’s new GST OTP mandate highlights broader concerns about data privacy and the increasing scrutiny of related-party transactions under GST law. Sellers are particularly wary because the OTP verification process could enable Flipkart to access detailed financial information, which could be used to the platform’s advantage. This issue also raises questions about the broader implications for the e-commerce sector and the relationship between marketplaces and their sellers.

The Rising Tide of GST Fraud and the Need for Measures to Curb It

The Indian government’s implementation of GST was aimed at creating a unified tax structure and simplifying the indirect tax system. However, GST fraud has emerged as a significant challenge, with fraudulent transactions and misuse of GSTINs leading to revenue losses for the exchequer. The rising cases of GST fraud have prompted the government to introduce stringent measures, such as OTP verification, to ensure compliance and curb fraudulent activities.

While these measures are necessary to protect government revenue, they also need to be balanced with the interests of businesses, particularly small and medium enterprises (SMEs) that form the backbone of the Indian economy. The challenge lies in implementing these measures without overburdening businesses or infringing on their privacy.

The Flipkart GST OTP Mandate: Details and Seller Concerns

Flipkart’s new OTP verification process has been met with resistance from sellers, particularly those who have been on the platform for several years. Sellers argue that the platform already verifies their GST documents, PAN, and Aadhaar details during the onboarding process. They question the rationale behind requiring OTP verification for old sellers, viewing it as an unnecessary step that could lead to potential data breaches.

One of the primary concerns is that once sellers provide the OTP, Flipkart could potentially gain access to their entire GST history, including annual turnover and sales on rival platforms. This has led to fears of data misuse and competitive disadvantage, particularly during the crucial festive season when sales volumes are high.

In response, Flipkart has stated that the OTP verification is a one-time process aimed solely at validating the seller’s GSTIN. The company has emphasized that this process does not grant access to data submitted in GST returns. However, tax experts have pointed out that the sellers’ concerns are not entirely misplaced. Submission of the OTP could, in theory, allow Flipkart to access data filed on the GST portal, raising valid privacy concerns.

Balancing Compliance with Business Interests

The introduction of the OTP mandate by Flipkart has sparked a debate over the balance between ensuring compliance and protecting business interests. On one hand, the move can be seen as a necessary step to prevent GST fraud and unauthorized use of GST numbers, which is a significant issue in the Indian market. On the other hand, sellers argue that this measure could lead to potential misuse of their data, putting them at a competitive disadvantage.

Experts suggest that while the government and platforms like Flipkart are right to take steps to prevent fraud, it is crucial to ensure that these measures do not infringe on the privacy of businesses or create unnecessary hurdles for legitimate sellers. The key lies in finding a balance where compliance measures are effective without being overly intrusive.

The controversy over Flipkart’s GST OTP mandate brings to light the importance for the need for clear and transparent policies that protect both the interests of the government and the business community. As GST fraud continues to be a pressing issue, it is essential to implement robust measures that ensure compliance while also safeguarding the privacy and competitive interests of businesses. Moving forward, it will be crucial for platforms like Flipkart to engage with sellers and address their concerns to build trust and ensure a fair and secure business environment.