Behind the Numbers: Decoding the Impressive Surge to 9.52 Crore E-Way Bills

Behind the Numbers: Decoding the Impressive Surge to 9.52 Crore E-Way Bills

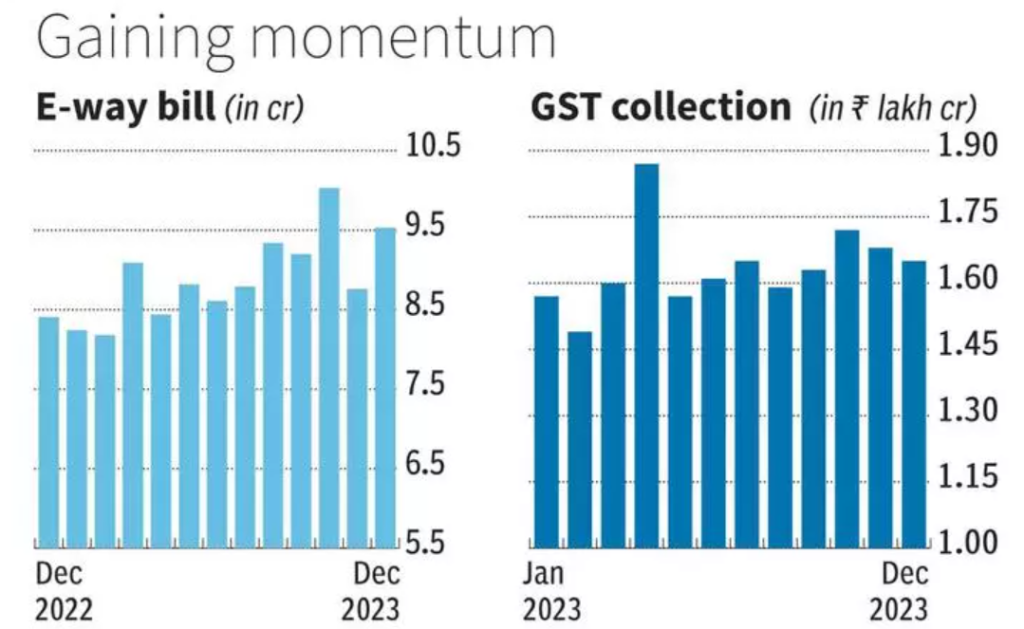

In a noteworthy development, the month of December witnessed a substantial surge in the generation of e-way bills, reaching a formidable figure of 9.52 crore. This marks the second-highest monthly total to date, showcasing a robust economic trend. The impact of this surge is expected to resonate in the realms of GST collections for the ensuing months of January and February.

After achieving a record-breaking high of 10.03 crore in October 2023, the e-way bills experienced a significant dip, settling at 8.75 crore in November. However, the resurgence observed in December suggests a possible connection to heightened year-end dispatches, particularly in the electronic and automotive sectors. Contributing to this surge is not only the increased compliance among businesses but also the elevated scrutiny by revenue authorities, reflecting a positive shift in taxpayer behavior.

Source: GSTN

Understanding E-Way Bills and Their Significance

An e-way bill serves as an electronic document generated on a designated portal, providing evidence of the movement of goods and indicating whether the applicable taxes have been duly paid. According to Rule 138 of the CGST Rules, 2017, any registered entity causing the movement of goods, irrespective of whether it is on account of a supply, with a consignment value exceeding ₹50,000 (potentially lower for intra-state movement) is mandated to generate an e-way bill.

Analyzing the Surge: Improved Compliance and Economic Growth

The notable increase in e-way bill generation numbers signifies two critical trends. Firstly, it reflects an improvement in compliance among businesses, highlighting a positive trend toward greater adherence to regulatory requirements. Secondly, and more significantly, it indicates a surge in economic activity, as the movement of goods is intricately linked to the demand and supply chain.

This surge can be attributed to a combination of factors, including high year-end dispatches, particularly in electronic items and automobiles. Year-end discounts offered by manufacturers on automobiles, electronic goods, and garments have been a driving force behind the push in e-way bill generation. Manufacturers, especially in the automotive sector, often clear their stocks by offering attractive discounts to liquidate inventory, resulting in a spike in year-end sales.

Impact on Tax Collection: A Positive Outlook

The correlation between higher e-way bill generation and an increase in tax collections is evident. A surge in GST collections is typically associated with heightened demand from end consumers, underpinned by improved compliance. The augmented tax collections provide essential support to the government’s revenue, aiding in meeting fiscal deficit targets.

In essence, the surge in e-way bill generation not only reflects positive economic trends but also bodes well for the government’s fiscal health. The sustained momentum in compliance and economic activity is anticipated to contribute positively to overall tax collections, reinforcing the financial stability of the nation.