Banks in a GST Fix Over RBI’s Directive to Levy Penal Charges

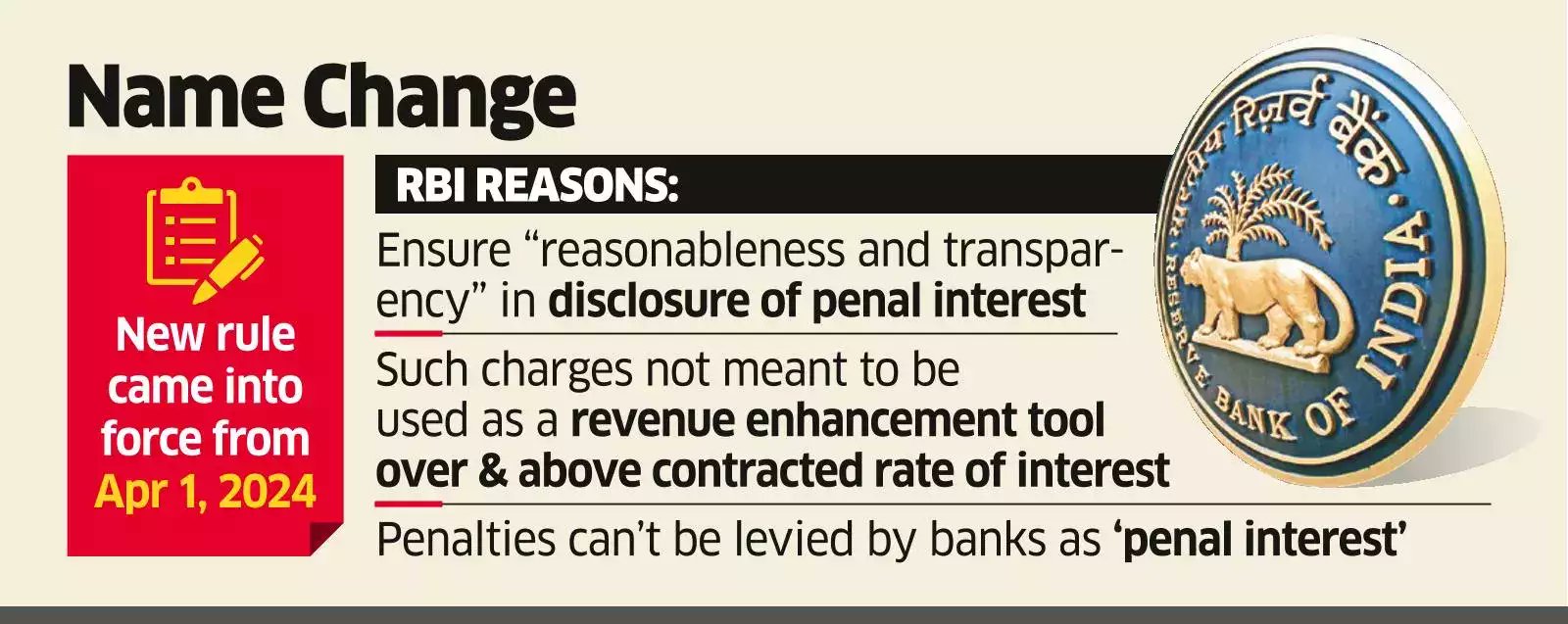

The Reserve Bank of India’s (RBI) recent directive to impose penalty charges instead of penal interest on borrowers has created a tax conundrum for banks. This shift, while intended to promote transparency, has significant implications for the application of Goods and Services Tax (GST) on such penalties.

The Directive and Its Implications

The RBI’s directive mandates that penalties on borrowers be levied as ‘penal charges’ rather than ‘penal interest.’ This change, effective from April 1, 2024, aims to ensure that such charges are reasonable and transparent, rather than serving as additional revenue for banks. However, this has led to concerns among banks regarding the potential application of GST on these charges.

GST Applicability on Penal Charges

Under current GST regulations, interest rates are exempt from GST. However, certain fees for services, such as processing loan proposals, are subject to this tax. Banks fear that the shift from penal interest to penal charges will attract GST, increasing their tax liabilities. This concern arises because, unlike interest, penal charges are not explicitly exempt from GST.

In light of this directive, banks have approached tax authorities seeking clear guidance on the matter. They are particularly worried about the implications in accrual accounting, where GST may need to be paid before collecting the penalty from customers. This scenario poses a significant financial risk if banks are unable to recover the GST paid to the government.

Challenges in Accrual Accounting

Accrual accounting practices could exacerbate the issue. For instance, if a bank imposes a penalty of X amount but later reduces it following negotiations with the customer, the GST paid on the original amount (X) cannot be refunded once the penalty is lowered to X minus Y. Additionally, if a loan account becomes a non-performing asset, with the borrower ceasing to pay even the regular interest, banks could face substantial unrecoverable GST amounts.

Historical Context and Legal Precedents

Historically, foreclosure charges on the premature termination of loans and additional/penal interest on delayed EMI payments have not been subject to service tax, a position that remains valid under GST. Furthermore, interest charged by banks on credit card dues is also exempt from GST, as clarified by the Central Board of Indirect Taxes and Customs (CBIC) in its circular dated June 28, 2019. Despite these precedents, banks are seeking explicit clarification to avoid any potential misinterpretation by GST authorities.

Despite the legal precedents indicating that such charges might not attract GST, banks prefer to err on the side of caution. They seek unambiguous directives from the government to avoid any potential disputes with tax authorities. Some banks have already started accounting for GST on these penal charges, reflecting their cautious stance on this complex issue.

Conclusion

The RBI’s directive to levy penal charges instead of penal interest is a well-intentioned move to enhance transparency and fairness in the banking sector. However, it has inadvertently created a tax dilemma for banks regarding the applicability of GST. As banks await clear guidelines from tax authorities, the industry remains in a state of uncertainty, navigating the intricate landscape of financial regulations and tax compliance.