On 3 September 2025, the GST Council announced a significant package of changes to the Goods and Services Tax, following the Prime Minister’s Independence Day address. The proposals go beyond routine rate adjustments; they aim to simplify the structure, move toward a two-rate framework, and extend targeted relief to sectors such as agriculture, labor-intensive manufacturing, healthcare, and the automotive sector. The emphasis is on making GST easier to comply with and more responsive to everyday consumption. That said, the benefits will hinge on clear notifications, uniform implementation, and genuine pass-through to consumers. For taxpayers and policymakers alike, this is a crucial stage in GST’s evolution – one that merits careful analysis alongside the ongoing celebration.

The Headlines – What Has Changed in GST 2.0

The 56th GST Council meeting has rolled out a wide set of rate and policy changes. While there’s a lot in the fine print, the ten items below are the big headlines most taxpayers will feel first.

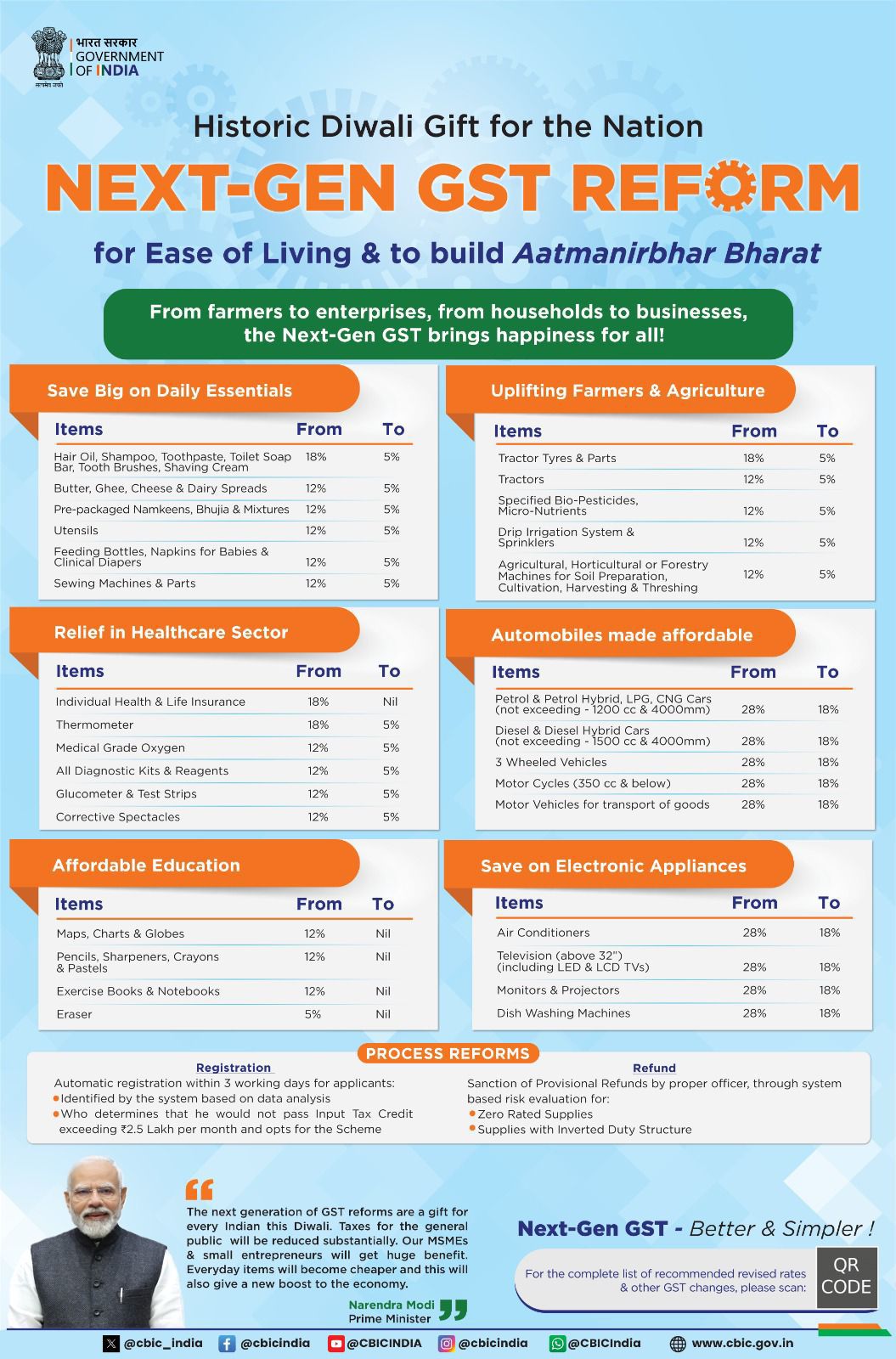

1) Simpler Two-Rate GST

The 56th GST Council meeting approved the rationalization of the existing four-tiered GST rate structure into a more citizen-friendly “Simple Tax” system. This new structure consists of a two-rate framework: a merit rate of 5% and a standard rate of 18%. Additionally, a special de-merit rate of 40% has been introduced for a select few goods and services. This strategic move is intended to enhance the quality of life for all citizens and to simplify the GST framework, which has been a landmark tax reform.

The adoption of this streamlined system is expected to simplify pricing decisions for businesses, reduce the number of classification disputes, and make enterprise resource planning (ERP) setups easier to manage over time as the changes are officially notified.

2) Insurance Made GST-free (individual policies)

A significant decision from the meeting was the exemption of GST on all individual life insurance policies, including term life, ULIP, and endowment policies. This exemption also applies to the reinsurance of these policies, making insurance more affordable for the general public and encouraging wider insurance coverage nationwide. Similarly, GST has also been exempted on all individual health insurance policies, including family floater and senior citizen policies, as well as their reinsurance. This policy change aims to significantly lower premiums for households, which will necessitate that insurers and aggregators reevaluate and revise their invoicing and disclosure processes to reflect the new GST-free status.

3) Everyday FMCG Relief

The GST Council has approved a reduction in the GST rate for a wide range of daily-use items from 18% or 12% to a uniform 5%. This includes essential fast-moving consumer goods (FMCG) such as hair oil, toilet soap bars, shampoos, toothbrushes, and toothpaste. The change also covers other everyday household items, such as bicycles, tableware, and kitchenware. The practical implication of this is that the retail Maximum Retail Prices (MRPs) for these items are expected to be adjusted, resulting in lower costs for consumers. In response, FMCG distributors will need to update their price lists, re-label products with new MRP stickers, and adjust their channel schemes to align with the revised rates.

4) Food Basket Rationalised

The GST rate on several food items has been rationalized to provide relief to consumers. Ultra-High Temperature (UHT) milk, which was previously taxed at 5%, is now at a NIL rate. All Indian breads, including chapati, roti, paratha, and parotta, will also see NIL rates. Additionally, a broad category of packaged foods has seen a rate reduction from 12% or 18% to 5%. This includes popular items such as namkeens, bhujia, sauces, pasta, instant noodles, chocolates, coffee, preserved meat, cornflakes, butter, and ghee.

These changes will require restaurants, QSRs (Quick Service Restaurants), and food brands to adjust their pricing and packaging strategies. Furthermore, distributors will need to plan for changes in their input tax credit (ITC) utilization due to the new rates.

5) Healthcare – Big Cuts and Exemptions

The healthcare sector has received significant relief with a series of GST rate cuts. The Council approved a reduction of GST from 12% to NIL on 33 lifesaving drugs and medicines, as well as a reduction from 5% to NIL on 3 other lifesaving drugs and medicines used for severe chronic diseases, cancer, and rare diseases. GST on all other drugs and medicines has been reduced from 12% to 5%. Furthermore, a reduction from 18% to 5% was announced for various medical apparatus and devices used for medical, surgical, dental, or veterinary purposes, as well as diagnostic kits and reagents.

These changes are expected to provide working capital relief for hospitals, pharmacies, and device manufacturers, while also requiring revisions to rate contracts and tenders.

6) Automobile Sector Restructuring

The auto sector will undergo a significant restructuring of its tax rates. The GST on small cars and motorcycles with an engine capacity of 350 CC or less has been reduced from 28% to 18%. The same reduction applies to buses, trucks, and ambulances. A key change is the introduction of a uniform rate of 18% on all auto parts, irrespective of their HSN code. Additionally, the GST on three-wheelers has been cut from 28% to 18%. These changes will lead to an overall reduction in fleet procurement costs and a decrease in aftermarket parts classification disputes, while also requiring original equipment manufacturers (OEMs) to adjust their pricing strategies.

These changes will drastically reduce cost of ownership across all auto segments. However, issues relating to Compensation Cess ITC getting lapsed needs to be addressed quickly.

7) Cement Down to 18%

In a major move for the construction and real estate sectors, the GST rate on cement has been reduced from 28% to 18%. This rate cut applies to all types of cement, including Portland, aluminous, slag, and similar hydraulic cements. The primary benefit of this change is input cost relief for construction and real estate projects. This will be particularly impactful for large-scale infrastructure projects. Furthermore, it may necessitate the recalculation of contracts that have escalation clauses tied to the tax rates of raw materials, such as cement.

8) Textiles – IDS correction

The GST Council has addressed the long-standing issue of inverted duty structure (IDS) in the man-made textile sector. To correct this, the GST rate on man-made fibre has been reduced from 18% to 5%, and on man-made yarn from 12% to 5%. This reform is crucial because an inverted duty structure occurs when the tax on inputs is higher than the tax on the finished product, leading to accumulated tax credits and working capital issues for manufacturers. The rate reduction will enable better utilization of input tax credits and reduce the need for refunds for mills, facilitating a realignment of pricing across the entire fabric and apparel supply chain.

9) Agriculture Sectors Green Economy Push

The reforms include a strong push for the primary and green sectors of the economy. The GST rate on agricultural machinery, including tractors and other machinery for soil preparation, cultivation, and harvesting, has been reduced from 12% to 5%. This aims to lower capital expenditure for farmers and make agricultural activities more viable. The Council also corrected the inverted duty structure in the fertilizer sector by reducing the GST on key inputs, such as sulphuric acid, Nitric acid, and Ammonia, from 18% to 5%.

Furthermore, GST on renewable energy devices and their parts has been reduced from 12% to 5%. These measures are designed to lower both capital and operational expenditure for farming and renewable energy projects, prompting OEMs to recalibrate their supply contracts and bids.

10) Services and System Changes

The GST Council introduced several key changes for services and the overall GST system. The GST rate on hotel accommodations with a value of supply less than or equal to ₹7,500 per day has been reduced from 12% to 5%. Similarly, beauty and physical well-being services, including gyms, salons, barbers, and yoga centers, have seen their rate cut from 18% to 5%. These changes will require hospitality and salon chains to update their pricing and input tax credit positions.

The Goods and Services Tax Appellate Tribunal (GSTAT) is expected to be operational by the end of September 2025, accepting appeals and commencing hearings by the end of December 2025. This provides clarity on litigation timelines and strengthens the dispute resolution mechanism. The changes in GST rates for services will be implemented from September 22, 2025. For goods, the changes will take effect from September 22, 2025, with the exception of pan masala, gutkha, cigarettes, chewing tobacco products, and bidis, which will continue at their existing rates.

Additionally, the Council recommended a new retail sale price-based valuation for pan masala and other tobacco products. The Central Board of Indirect Taxes and Customs (CBIC) will also administratively start implementing a revised system for granting 90% provisional refunds arising from inverted duty structures.

Structural Reforms – Key Changes & What They Mean

These reforms go beyond rate-cuts. They reshape how GST is administered, speeding up refunds, clarifying valuation, and strengthening dispute resolution. Here are the major reforms:

1) Risk-based Provisional Refunds (Exports)

The GST Council has recommended amending Rule 91(2) to allow for a 90% provisional refund for zero-rated supplies, such as exports, based on system-driven risk checks. The new system is designed to accelerate cash flows for exporters. Certain categories of supplies may be excluded from this new system via a separate notification. This change will be operational starting November 1, 2025. To benefit from these faster refunds, exporters will need to maintain data-clean invoicing and ensure that their shipping bills and e-invoices are accurately reconciled to pass the system’s risk filters. The goal is to provide a more streamlined and efficient refund process, reducing the burden on exporters.

2) Provisional Refunds for Inverted Duty Structure (IDS)

The Council has approved an amendment to Section 54(6) to extend the 90% provisional refund mechanism to claims related to the inverted duty structure (IDS). The CBIC will operationalize this through official instructions starting November 1, 2025, and will also begin the process administratively even before the formal amendments are in place. This is a major step towards easing the working-capital strain on industries like textiles and fertilizers, which are often affected by IDS. Businesses in these sectors should anticipate that the new system will include automated validations, making it critical to maintain clean input/output mapping to avoid flagging any risks.

3) Low-value Export Refunds Enabled

The 56th GST Council meeting has decided to amend Section 54(14) to eliminate the current threshold that blocks refunds on exports where tax has been paid, particularly those made through courier or postal services. This will significantly benefit MSME e-commerce exporters. To take advantage of this change, these exporters must align their ERP (Enterprise Resource Planning) and shipping processes so that courier Airway Bills (AWBs) accurately map to GST/ICEGATE data, ensuring a smooth and successful refund process.

4) GST Appellate Tribunal (GSTAT) made Operational + National Appellate Authority Role

The Goods and Services Tax Appellate Tribunal (GSTAT) is expected to be operational by the end of September, accepting appeals and commencing hearings by the end of December 2025. The Principal Bench of the GSTAT will also serve as the National Appellate Authority for Advance Rulings. A limitation date of June 30, 2026, has been set for filing backlog appeals. This creates a clear and consistent appellate pathway for taxpayers, providing greater certainty and a robust mechanism for dispute resolution. Businesses with pending disputes should take this opportunity to prepare their appeal dossiers and pre-deposit budgets.

5) Phased Go-Live for New Rates (Tobacco Deferred)

The Council has recommended a phased implementation of the new GST rates. Changes in GST rates for services will be effective from September 22, 2025. Similarly, the new rates for most goods will also be implemented on this date. However, the GST rates and cess on specific goods, such as pan masala, gutkha, and cigarettes, will remain unchanged until the compensation cess loans are fully serviced. Additionally, the CBIC will administratively initiate the process of granting 90% provisional refunds for IDS on a risk-based basis, even before the legal amendments are implemented. Businesses must therefore plan their ERP and pricing changes in stages and include transition clauses in long-term contracts to handle dual-rate scenarios effectively.

6) RSP-based Levy For Specified “Sin-Goods”

There shall be a shift in the valuation method for “sin-goods” such as pan masala, gutkha, cigarettes, and chewing/unmanufactured tobacco, from “transaction value” to Retail Sale Price (RSP). This change is part of a broader effort to strengthen the anti-evasion framework. Manufacturers of these products will need to ensure accurate declaration of their MRP/RSP. They may be required to rework their pricing and discount practices to comply with the new valuation rules.

7) Restaurant “Specified Premises” Clarified

The much-needed explanation of the definition of “specified premises” in the context of restaurant services has been added. The clarification explicitly states that a standalone restaurant cannot declare itself as a “specified premise” to opt for the 18% GST rate with Input Tax Credit (ITC). This measure aims to reduce disputes and prevent artificial structuring within the hospitality industry. Hospitality players will need to re-evaluate their outlet categorization and ITC positions in light of this clarification.

8) Valuation Rules Aligned for Lottery/Other Actionable Claims

The GST Council has recommended amending the GST valuation rules to align them with the new tax treatment for lottery and other specified actionable claims. This will have a direct impact on state lotteries and other service providers (ECOs), which will need to reconfigure their margin and face-value calculations. Furthermore, they will need to update contract terms with their distributors to reflect these changes.

9) Process Reforms (Annexure-V) to be Notified

The GST Council has approved a comprehensive package of law and procedural reforms, which will be notified separately. This implies that taxpayers should expect forthcoming changes to various forms, validations, and timelines. Businesses should proactively track these notifications and ensure their Standard Operating Procedures (SOPs) and version control systems are ready for these future changes.

10) Administrative Fast-Track on IDS Refunds (Interim)

In a move to provide immediate relief, the CBIC will administratively begin granting 90% provisional refunds for inverted duty structure (IDS) claims on a risk-based basis, even before the necessary law changes are enacted. This measure aims to provide working-capital relief sooner for affected businesses. To ensure a smooth process and minimize risk flags, businesses must maintain a robust vendor master and ensure accurate HSN classification. This interim step signifies the Council’s commitment to providing timely support to taxpayers while the legislative process catches up.

GST on Services: What’s Changing?

The Council has proposed a broad review of service rates, with a clear tilt toward public-facing services (hotels, salons, cinemas), and a rationalization of transport and job-work entries. Headline moves include hotel stays ≤₹7,500 shifting to 5% (no ITC), beauty & physical well-being services dropping to 5% (no ITC), non-economy air travel moving up to 18%, specified gaming/lottery moving to a 40% de-merit rate, and individual life/health insurance becoming exempt. Most service-rate changes take effect from 22 September 2025, once notified.

Comprehensive list of Major Service-rate Changes

Accommodation & Hospitality

- Hotel accommodation with a value of supply up to ₹7,500 per unit per day moves from 12% GST with Input Tax Credit (ITC) to a concessional 5% with no ITC.

- Impact: This offers effective rate relief for budget and mid-market hotels. These establishments will need to revise their pricing and block any ITC on their inputs.

- Beauty & physical well-being services (gyms, salons, barbers, yoga, etc.) have their GST rate reduced from 18% to 5% with no ITC.

- Impact: Consumer prices for these services may decrease, while service providers will need to block ITC on their inputs.

- Restaurant “specified premises” now have a clarified definition. A stand-alone restaurant cannot declare itself as a “specified premise” to opt for the 18% rate with ITC.

- Impact: This reduces disputes and artificial tax structuring, requiring hospitality players to reassess their outlet categorization and ITC positions.

Transport

- Non-economy air passenger transport sees an increase in GST from 12% to 18% with ITC.

- Impact: This raises the cost of premium airfare, and airlines will need to update their fare tax calculations.

- Passenger transport by motor vehicle where fuel cost is included continues to have a 5% option with restricted ITC. The standard rate, however, increases from 12% to 18% with ITC.

- Impact: Operators now have a choice between a lower rate with no ITC versus a higher rate with full ITC, depending on their input cost structure.

- Goods Transport Agency (GTA) services see the 12% rate with ITC increase to 18% with ITC. The 5% option without ITC (under Reverse Charge Mechanism or Forward Charge Mechanism) remains unchanged.

- Impact: Contracts and invoice logic must be reset for the new 18% option, while RCM flows remain for the 5% rate.

- Rail container transport (non-Indian Railways) moves from 12% to a standard 18% with ITC, with a new concessional path of 5% without ITC.

- Impact: Freight contracts will need to reflect these two rate paths, with exporters weighing the benefit of ITC against cash flow considerations.

- Pipeline transport of crude, gas, and petroleum products moves from 12% to 18% with ITC, while the 5% option without ITC remains unchanged.

- Impact: This requires upstream and midstream companies to update their tariff models.

- Multimodal transport within India sees the 12% rate increase to 18% with ITC. A new concessional 5% rate is introduced for transport that does not include an air leg and has restricted ITC.

- Impact: Logistics companies will need to remodel pricing by corridor and require documentation to prove the “no air leg” condition.

- Renting of motor vehicle with operator for passenger transport moves from 12% to 18% with ITC, with the 5% option with limited ITC still available.

- Impact: Aggregators and fleet owners must re-evaluate which option best optimizes their profit margins.

- Renting of goods carriage with operator moves from 12% to 18% with ITC, with a concessional 5% option with limited ITC also available.

- Impact: Transporters will need to align their contracts and ERP tax codes accordingly.

- Local delivery services via e-commerce operators are now notified under section 9(5) at 18% and are explicitly excluded from the scope of GTA services.

- Impact: The tax liability shifts to the e-commerce operator when the supplier is unregistered, requiring last-mile players to adjust their invoicing.

- Third-party insurance of goods carriages sees a rate reduction from 12% to 5% with ITC.

- Impact: This will lead to lower premiums for fleet owners, and insurers must update their rate cards.

Contracts & Job Work

- Works contracts with a predominant earthwork component for the Government move from 12% to 18%.

- Impact: Engineering, Procurement, and Construction (EPC) pricing for public projects will increase, requiring a rework of Bills of Quantities (BOQs) and escalation clauses.

- Sub-contractor services for works contracts (earthwork to Government) also move from 12% to 18%.

- Impact: This ensures rate alignment for pass-through services, and sub-contract chains must update their Purchase Orders (POs).

- Offshore oil & gas works contracts increase from 12% to 18%.

- Impact: Offshore service vendors will need to reset their bids, but their ITC remains intact at 18%.

- Professional/technical services (SAC 9983) and support services (SAC 9986) for exploration and mining both increase from 12% to 18%.

- Impact: This creates a uniform 18% rate across core upstream service lines.

- Job-work for specific products sees a rate change from 12% to 5%:

- Umbrella

- Printing of Chapter 48/49 goods

- Bricks (goods taxed at 5%)

- Pharmaceutical products (Chapter 30)

- Hides/skins/leather (Chapter 41)

- Impact: This provides working-capital relief for MSME job-workers and benefits specific supply chains.

- Residual job-work (not covered elsewhere) increases from 12% to 18%.

- Impact: This prevents the misuse of the residual entry for concessional rate planning.

Miscellaneous Services

- Common Effluent Treatment Plant services and Biomedical waste treatment services by a common facility both move from 12% to 5%.

- Impact: This allows industrial estates and hospitals to reflect lower operational and maintenance charges, easing their compliance budgets.

- Admission to cinematograph films with a ticket price of ₹100 or less sees a rate drop from 12% to 5%.

- Impact: This lowers the tax burden on entry-level cinema tickets and will require multiplexes to change their pricing matrices.

- De-merit services like admission to casinos, race clubs, and sporting events (e.g., IPL), as well as licensing of bookmakers and leasing of de-merit goods, all increase from 28% to 40%.

- Impact: This imposes a higher tax burden on gaming and leisure, requiring a revision of event pricing and payouts.

- Specified actionable claims (betting, casinos, gambling, horse racing, lottery, online money gaming) are defined as “goods” and move from 28% to 40%, with valuation rules aligned to this change.

- Impact: This enforces a uniform higher tax rate on these activities, and platforms must reconfigure their base/face value and payouts.

- Individual health and life insurance (and their reinsurance) are now exempt from GST, which was previously at 18%.

- Impact: This will result in lower premiums for individuals. Insurers will need to remove output tax and reassess their ITC eligibility.

GST on Goods: What’s Changing?

The Council has proposed wide-ranging cuts and rationalisation on goods. Below are the big shifts, grouped by sector, with quick implications. Most goods changes are to apply from 22 September 2025 once notified; tobacco/pan-masala items are deferred (existing rates/cess continue for now).

FMCG & Household

- Daily-use items: GST is reduced from 12% or 18% to a new rate of 5% on items like hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, bicycles, and various kitchen and household articles.

- Impact: This is expected to lead to MRP resets and quick price reductions, requiring distributors to update price lists and barcodes.

Packaged Foods & Dairy

- Essential foods: Ultra-High Temperature (UHT) milk, pre-packaged paneer, and all Indian breads (such as chapati, roti, paratha, parotta) are now exempt from GST (NIL rate).

- Other packaged foods: Most packaged food items, including namkeens, bhujia, sauces, pasta, instant noodles, chocolates, coffee, and butter/ghee, are reduced from 12% or 18% to 5% GST.

- Impact: This will necessitate changes in pricing and pack sizes for Quick Service Restaurants (QSRs) and Fast-Moving Consumer Goods (FMCG) companies.

Electronics & Appliances

- Consumer durables: GST on air-conditioning machines, dishwashers, and all sizes of TVs is reduced from 28% to 18%.

- Impact: This is anticipated to stimulate retail demand, with brands needing to adjust their pricing.

Auto & Mobility

- Vehicles: Small cars and motorcycles with an engine capacity of 350cc or less, as well as buses, trucks, and ambulances, will see their GST rate reduced from 28% to 18%.

- Auto parts: A uniform rate of 18% GST will be applied to all auto parts, regardless of their Harmonized System of Nomenclature (HSN) code. Three-wheelers will also have their rate reduced from 28% to 18%.

- Impact: This simplifies the tax structure across the automotive value chain and lowers the total cost of ownership for two-wheeler and fleet buyers.

Construction & Materials

- Cement: The GST rate for cement is reduced from 28% to 18%.

- Impact: This provides input cost relief for the real estate and infrastructure sectors, requiring a review of escalation clauses in engineering, procurement, and construction (EPC) contracts.

Healthcare & Pharma

- Life-saving drugs: GST is removed entirely (NIL rate) on 33 life-saving drugs and medicines, and on an additional three drugs used for cancer, rare diseases, and other severe chronic conditions.

- Other medicines: The GST rate on all other drugs and medicines is reduced from 12% to 5%.

- Medical devices/equipment: The rate on various medical apparatus, devices, and supplies, including diagnostic kits, glucometers, bandages, and gauze, is reduced from 18% or 12% to 5%.

- Impact: This will lower costs for hospitals and pharmacies, and new tenders and rate contracts will need to be re-priced.

Agriculture & Farm Machinery

- Tractors and key farm machines: The GST rate is reduced from 12% to 5% on tractors and essential farm machinery such as equipment for soil preparation, harvesting, threshing, and composting.

- Impact: This lowers capital expenditure for farmers and original equipment manufacturers (OEMs) will need to update their dealer pricing.

Labour-Intensive Goods

- Handicrafts, leather, and stone: GST is reduced from 12% to 5% on labour-intensive goods like handicrafts, marble and travertine blocks, granite blocks, and intermediate leather goods.

- Impact: This enhances the price competitiveness of MSME clusters in these sectors.

Textiles & Apparel (Inverted Duty Structure Correction)

- Man-made value chain: GST on man-made fibre is reduced from 18% to 5%, and man-made yarn from 12% to 5%, to fix the inverted duty structure.

- Impact: This will lead to lower refunds and a smoother ITC flow for spinners and weavers, with subsequent adjustments in fabric and garment pricing.

Fertilisers & Chemicals

- Feedstock for fertilisers: To correct the inverted duty structure, GST on sulphuric acid, nitric acid, and ammonia is reduced from 18% to 5%.

- Impact: This provides a cost relief for fertiliser manufacturers.

Renewable Energy

- RE devices & parts: The GST rate on renewable energy devices and their parts for manufacturing or installation is reduced from 12% to 5%.

- Impact: This is expected to improve project Internal Rate of Return (IRR) and requires EPC companies to adjust their bids.

Tobacco & “Sin” Goods

- RSP-based levy: Valuation will shift from “transaction value” to Retail Sale Price (RSP) for pan masala, gutkha, cigarettes, and other tobacco products.

- Rates: The existing rates and cess on these products will remain unchanged for now until compensation cess loan obligations are fully discharged.

- Impact: This change is intended to strengthen anti-evasion measures, and manufacturers will need to ensure tighter control over MRP/RSP declarations and packaging compliance.

Conclusion: A Leap Towards a Simpler and More Citizen-Friendly GST

The 56th GST Council recommendations are welcome and arguably overdue. Moving to two principal rates and cutting taxes on widely used goods and services can simplify compliance and lower everyday costs. However, the real test now is execution: timely notifications, clear FAQs, uniform adoption by states and field formations, and smooth IT system changes will determine whether this reform feels simple in practice or merely on paper.

Equally important is pass-through. The intent is for benefits to reach the end consumer through revised MRPs, updated hospital billing, and transparent pricing in services. That will demand close attention from businesses (reworking contracts, price lists, ERPs) and vigilant oversight from authorities to prevent transition distortions or selective pass-through.

The next few months will be a period of heavy lifting for all stakeholders, including industry, trade, insurers, hospitals, and administrators, as rates on services and most goods take effect on 22 September 2025. If implemented cleanly, the package should be net-positive for the ordinary citizen and supportive of growth. In that sense, the timing is right provided we match policy intent with disciplined, on-ground execution.

Press Release – Recommendations of the 56th GST Council Meeting

Frequently Asked Questions – GST Reforms 2.0