Introduction:

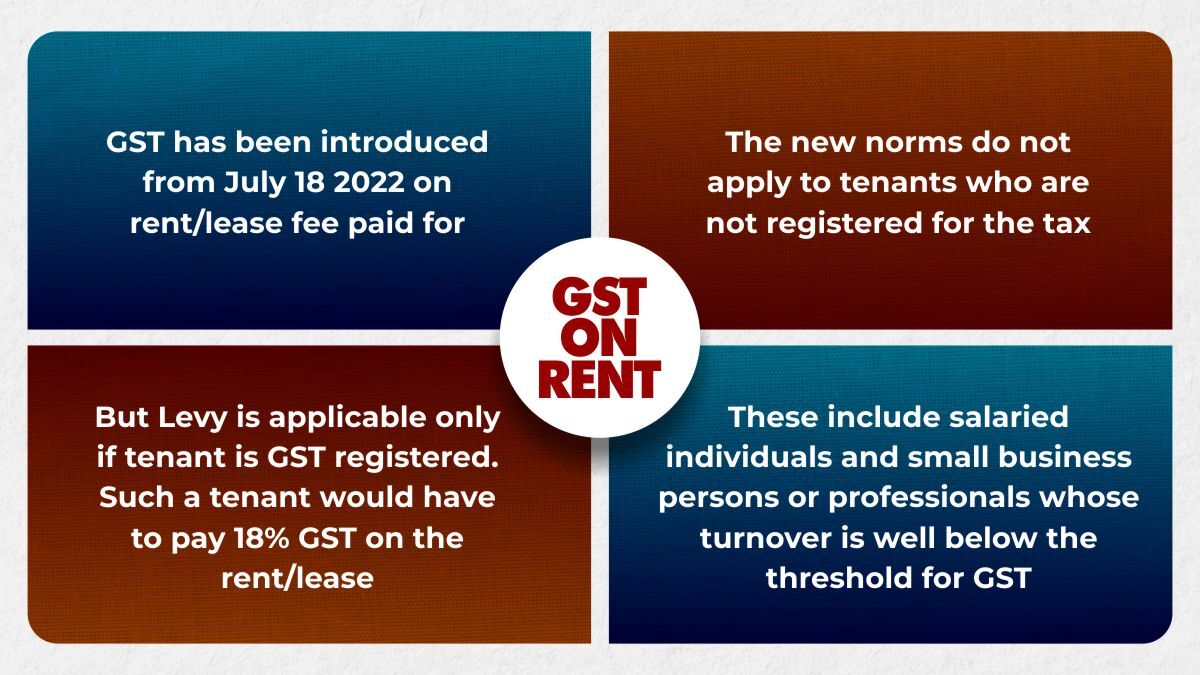

The Goods and Services Tax (GST) regime has brought significant changes to India’s taxation system, affecting various sectors including real estate. One of the areas where GST has an impact is on rental income, distinguishing between residential and commercial properties. Understanding the implications of GST on rent for residential and commercial premises is crucial for landlords, tenants, and real estate investors alike.

Residential Premises:

Under the Goods and Services Tax (GST) regime, the levy of GST on rental income from residential premises is exempted. This exemption is provided under Notification No. 12/2017-Central Tax (Rate) dated June 28, 2017, as amended from time to time.

It is pertinent to note that the exemption from GST on rent for residential premises is applicable solely to the rental income derived from the leasing or letting out of residential properties meant for residential purposes. Any additional services provided along with the residential property, such as maintenance, security, or other amenities, are treated as separate supplies and may attract GST if their value exceeds the prescribed threshold limits.

Furthermore, this exemption does not extend to commercial properties or premises leased out for commercial or business purposes. Rent received from commercial properties, including office spaces, retail outlets, warehouses, or industrial units, falls within the purview of GST and is subject to taxation at the applicable rates.

Landlords or lessors of residential premises are advised to maintain proper documentation and records of rental agreements, receipts, and any ancillary services provided to ensure compliance with GST regulations. While residential rental income is exempt from GST, any failure to adhere to the prescribed guidelines may attract penalties or other legal consequences as per the provisions of the GST law.

It is pertinent to note that if a residential premises is rented for commercial or business use, the same would be taxable under GST, for example if a director rents his residential premises to his company for use as a company office, same would be taxable in the hands of the director @ 18%.

So, In Simple Language, if you’re renting out your apartment, house, or any other residential space for residential use, you are not required to charge GST on the rent collected from your tenants.

However, it’s essential to note that if you’re providing additional services along with the residential property, such as maintenance, security, or clubhouse facilities, GST might be applicable on those services. These services would be treated as separate from the rental income and would attract GST as per the prevailing rates.

Commercial Premises:

Under the provisions of the Goods and Services Tax (GST) regime, rental income derived from commercial premises is subject to GST as per the applicable rates prescribed under the Central Goods and Services Tax Act, 2017, and related notifications issued thereunder.

As per Schedule II of the CGST Act, 2017, the renting or leasing of commercial properties for commercial or business purposes constitutes a supply of services. Therefore, any consideration received by a lessor for leasing out commercial premises, including office spaces, retail outlets, warehouses, industrial units, or any other commercial property, is subject to GST.

The GST rate applicable on rental income from commercial premises is currently prescribed at 18% (as of the current writing), as per Notification No. 11/2017-Central Tax (Rate) dated June 28, 2017, as amended.

It is essential for lessors of commercial properties to fulfill their GST compliance obligations, which include obtaining GST registration if their aggregate turnover exceeds the threshold limits specified under the GST law. Additionally, lessors must issue tax invoices or bill of supply, as applicable, containing the requisite details prescribed under the GST rules.

Tenants leasing commercial spaces must factor in the GST component while evaluating their rental expenses and budgeting for operational costs. The inclusion of GST in rental payments increases the overall cost of occupancy for tenants and impacts their financial planning and budget allocation.

Non-compliance with GST regulations regarding rental income from commercial premises may attract penalties, interest, or other legal consequences under the provisions of the GST law.

Input Tax Credit (ITC):

Moreover, lessors leasing out commercial premises are eligible to claim Input Tax Credit (ITC) on the GST paid on various goods and services procured for the maintenance, property insurance, repair, renovation (revenue exp in nature), or improvement on account of movable furniture or fixture in the commercial property.

It also pertinent to note that ITC of construction of said property shall not be available as of now, however said issue is pending in Supreme Court in the case of Safari Retreats. Proper documentation and maintenance of records are imperative to substantiate the claim of ITC and ensure compliance with GST regulations.

Impact on Tenants:

For tenants, especially businesses leasing commercial spaces, the implementation of GST on rental income has financial implications. The inclusion of GST in rental expenses increases the overall cost of occupancy, affecting the operational expenses of businesses.

Tenants need to factor in the GST component while budgeting for rental expenses and negotiating lease agreements. Understanding the tax implications helps tenants make informed decisions regarding their choice of premises and lease terms.

Compliance and Documentation:

Both landlords and tenants must comply with GST regulations on rental income to avoid legal issues. Landlords must register for GST if their aggregate turnover exceeds the threshold limit. Proper documentation of rental agreements, invoices, and GST returns is crucial for transparency, smooth transactions, and simplifying tax benefits or deductions.

Conclusion:

The differentiation between GST on rent for residential and commercial premises underscores the complexity of India’s taxation system, particularly in the real estate sector. While residential rental income is exempt from GST, commercial rental income attracts a significant tax burden at the rate of 18%.

Understanding the nuances of GST on rental income is essential for landlords, tenants, and real estate professionals to make informed decisions and ensure compliance with the law. By staying updated with the latest GST regulations and seeking professional advice, when necessary, stakeholders can navigate the intricacies of GST on rent effectively.