Analyzing Gujarat’s 25% Decline in GST Registrations

In recent years, Gujarat has been grappling with significant GST evasion, largely perpetrated through fake billing scams. The state, in its fight against this menace, has implemented a pilot project making biometric identification mandatory for obtaining GST identification numbers (GSTINs). This innovative measure has yielded promising results, notably a substantial reduction in the number of applications for GST registrations.

25% Drop in GST Registrations in Gujarat

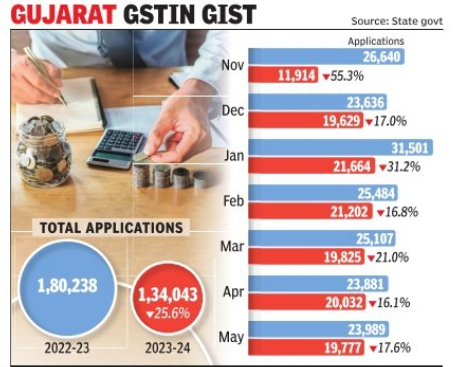

According to data from the state government, there has been a 25% drop in applications for GST registrations in the seven months since November 2023, when the new procedure was introduced. To put this in perspective, from November 2022 to May 2023, there were 1.8 lakh applications for new GSTINs in the state. However, from November 2023 to May 2024, the number of applications dropped to 1.34 lakh. This significant decline highlights the effectiveness of the biometric verification process in curbing fraudulent activities.

To bolster the security of the GST registration process, the Gujarat government established 12 GST service centres, also known as seva kendras. These centres, modelled on passport seva kendras, are strategically located in cities such as Vapi, Gandhinagar, Ahmedabad, Surat, and Vadodara. They have played a crucial role in ensuring that only genuine applicants receive GSTINs, thereby significantly reducing the chances of fraud.

Before the introduction of biometric verification, the system was rife with abuse. Scammers often obtained GSTINs using fake documents or by impersonating economically disadvantaged individuals. However, biometric verification has effectively addressed these issues by implementing stringent identity checks. Each application is now scrutinized against at least 40 criteria at these centres before a GSTIN is assigned.

The success of this initiative has not gone unnoticed. Members of the GST council and officials from states such as Maharashtra, Rajasthan, and Madhya Pradesh have visited these centres in Gujarat to study the model and potentially replicate it in their regions.

New GST Evasion Scheme Unearthed

Despite these advances, GST evasion remains a significant challenge. In the fiscal year 2023-24 alone, Gujarat witnessed fake billing amounting to Rs 22,680 crore, with taxes worth Rs 3,730 crore evaded. Since the rollout of the GST regime, there have been 6,463 reported cases of fake billing, involving bogus bills totaling Rs 89,311 crore and tax evasion of Rs 10,984 crore.

A recent crackdown by the state GST department uncovered substantial tax evasion across various eateries and ice cream parlours in Gujarat. The raid revealed that Rs 30 crore worth of ice creams, Rs 6.75 crore of bhajiyas (fritters), and Rs 4 crore of pizzas were sold without proper billing. This discovery is part of a broader investigation that has detected Rs 370 crore in tax evasion by small businesses in the business-to-consumer (B2C) segment over the past six months.

Businesses with annual turnovers exceeding Rs 40 lakh for goods and Rs 20 lakh for services are required to register for GST and pay taxes on their sales. However, many businesses were found to be hiding their actual sales to avoid paying these taxes. A senior SGST official explained that numerous businesses accepted cash payments without recording them in their account books to show lower turnover and evade taxes. Others deposited money into the accounts of different people using QR codes to conceal the transactions.

Moreover, some businesses collected GST from customers but did not remit it to the government. They also employed billing software to generate and later erase transactions, often with the assistance of software developers. The SGST department has conducted raids on various establishments, implicating over 300 individuals and taking necessary actions against the involved business owners.

While Gujarat has made significant strides in battling GST evasion through innovative measures such as biometric verification, challenges persist. The state’s proactive approach serves as a model for other regions, highlighting the importance of stringent verification processes and continuous monitoring to curb fraudulent activities and ensure compliance with tax regulations.