GST e-filing | Filing Returns under the Quarterly Return Monthly Payment Scheme under GST with respect to the changes on the GST Portal.

A new scheme – Quarterly Return Monthly Payment (QRMP) Scheme – is being introduced by The Central Board of Indirect Taxes and Customs. As per the scheme, which will be effective from January 1st, 2021, Registered Person (herein after referred as RP), with an aggregate annual Turnover of upto 5 Cr rupees in the preceding financial year, will be eligible for QRPM Scheme and will have to make monthly payment of taxes and Quarterly submission of Returns. However, if and when aggregate annual Turnover exceeds the 5 Cr turnover limit, registered person will cease to be eligible for the same.

People who can benefit from the scheme:

Quarterly Returns can be filed and tax can be paid on a monthly basis by the following Registered Persons:

- An RP who is required to file Form GSTR 3B and having Aggregate Annual Turnover of up to Rs 5 Cr. in the previous financial year.

- If Aggregate Annual Turnover crosses Rs 5 Cr. during any Quarter. RP will become ineligible for the Scheme from the next quarter.

- Any person obtaining a new registration or opting out of the Composition Scheme can also opt for this Scheme.

- This said Scheme is applicable GSTIN wise. Therefore, few GSTINs for that PAN can opt for the Scheme and the remaining GSTINs can remain out of the Scheme.

Changes on the GST Portal:

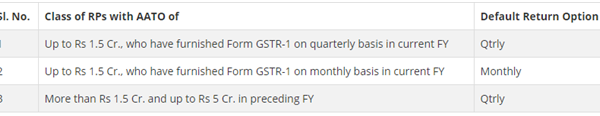

For the quarter starting from January 2021 and ending March 2021, all RP’s who’s aggregate annual turnover for the FY 2019-20 is up to Rs 5 Cr. and have furnished the return in Form GSTR-3B for the month of October 2020 by 30th 2020, will be migrated by default in the GST system as follows:

When can a person opt in and Opt out for the scheme:

- A RP can opt in for any quarter from first day of second month of preceding quarter to the last day of the first month of the quarter.

- Option for QRMP Scheme, once exercised, will continue till RP revises the option or his Aggregate Annual Turnover exceeds Rs 5 Cr.

- RPs migrated by default can choose to remain out of the scheme by exercising their option from 5th, 2020 till 31st Jan., 2021.

- The RPs opting for the scheme can avail the facility of Invoice Furnishing Facility (IFF), so that the outward supplies to registered persons are reflected in their Form GSTR 2A & 2B.

- The facility for opting out of the Scheme for a quarter will be available from first day of second month of preceding quarter to the last day of the first month of the quarter.

Payment of tax under the scheme:

- RPs need to pay the due taxes in each of the two months (by 25th of next month) in the Quarter, by selecting “Monthly payment for the true taxpayer” as a reason for generating Challan in Form GST PMT-06.

- RPs can either use Fixed Sum Method (pre-filled challan) or Self-Assessment Method (actual tax due), for a monthly payment of tax for the two months, after adjusting ITC.

- No deposit is required for the month if there is a nil tax liability.

- Tax deposited for the two months can be used for adjusting liability for the Quarter in Form GSTR-3B and can’t be used for any other purpose till the filing of return for the Quarter.

- Late fee is applicable for delay in furnishing of return/details of outward supply as per the provision of Section 47 of the CGST Act.

- As per the Scheme, the requirement to furnish the return under the proviso to subsection (1) of Section 39 of the CGST Act is quarterly.

- Accordingly, a late fee would be applicable for delay in furnishing the quarterly return or details of outward supply.

- It is clarified that no late fee is applicable for delay in payment of tax in the first two months of the quarter.

Filing of Returns under the scheme:

- RPs opting for the QRPM Scheme would be required to furnish Form GSTR-3B, for each quarter, on or before 22nd or 24th day of the month succeeding such quarter for Class A States and Class B States respectively.

- RPs opting for the Scheme would be required to furnish the details of outward supply in Form GSTR-1 on quarterly basis.

- Invoice furnishing facility (‘IFF’) has been introduced in respect of reporting the invoice for details of supply made to registered persons for the first two months of the quarter.

- The supplier can upload these invoices on monthly basis. the taxpayer can upload maximum of Rs 50 Lakhs invoices in each of the two months of quarter

- The IFF facility is optional. The details of invoices furnished under this facility in the first two months are not required to be furnished again in Form GSTR-1.