Supreme Court Dismisses Plea for Tighter GST Norms

The Supreme Court of India recently dismissed a Public Interest Litigation (PIL) demanding significantly stricter checks on the Goods and Services Tax (GST) registration process. This decision, though procedural, thrusts the critical trade-off between Ease of Doing Business (EoDB) and robust anti-fraud measures directly back to the government.

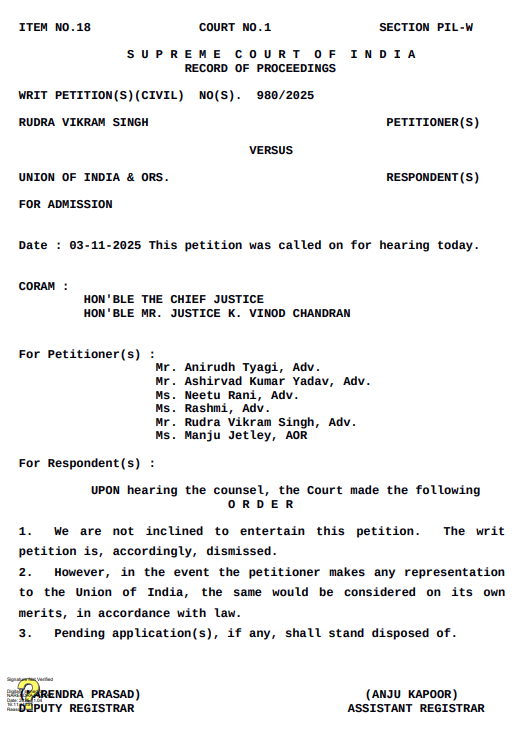

The News: SC Takes a Step Back on GST Vetting

The Apex Court, specifically a bench including Chief Justice of India and Justice K. Vinod Chandran, chose not to intervene in the petition filed by lawyer Rudra Vikram Singh. The PIL sought directions for multi-layer verification, including mandatory live facial verification and stronger linkage with Aadhaar authentication logs, to prevent widespread identity fraud.

The petitioner argued that unscrupulous elements exploit stolen or forged Aadhaar and PAN details to create shell companies, issue bogus invoices, and wrongfully claim Input Tax Credit (ITC). This practice damages the national exchequer and compromises the integrity of the entire GST regime.

However, the Supreme Court dismissed the writ petition, advising the applicant to instead make a representation to the Union Government. This essentially signals that the Court views this issue as a matter of executive policy and legislative design, not one requiring immediate judicial diktat. This decision, while not a judgment on the merits of the proposal, reinforces the government’s responsibility to fine-tune the existing framework.

The Context: The High-Stakes Dilemma

The challenge lies at the heart of the GST’s design philosophy. When the new indirect tax regime was launched, its core promise was a seamless, simplified, and fast registration process to enhance India’s EoDB ranking. The process is largely online, PAN-based, and requires minimal document submission, often granting registration within days or even automatically in some cases.

This speed significantly helps genuine micro, small, and medium enterprises (MSMEs) and startups enter the formal economy quickly. However, this same speed and streamlined verification become the vulnerability point for fraudsters. The ease with which forged documents or the identities of unsuspecting citizens can be submitted allows criminal syndicates to register numerous bogus firms rapidly.

These phantom entities quickly generate and pass on fake invoices, enabling genuine, but corrupt, businesses down the chain to fraudulently avail ITC. This creates a chain reaction of tax evasion, with the loss of revenue to the government often running into thousands of crores.

The SC’s Stance: Policy, Not Judicial Intervention

The Supreme Court’s reluctance to entertain the PIL demonstrates an appreciation for the separation of powers and the complexity of policy-making. Directly mandating new, stricter verification protocols could inadvertently disrupt the momentum of the ‘ease of business’ agenda.

Introducing mandatory, complex verification like live facial recognition for every applicant would add layers of friction, time, and potential technical glitches. This friction disproportionately impacts honest, small-scale entrepreneurs in remote areas with limited access to advanced technology, effectively slowing down the formalization of the economy, the very objective GST aims to achieve. The Court, by suggesting a representation to the government, correctly places the onus on the executive to craft a balanced, workable, and scalable solution.

SC – GST Registration

Instances and Efforts: The On-Ground Reality

The need for action is undeniable. Instances of large-scale GST fraud using identity theft regularly make headlines:

Forged Credentials: Fraud syndicates routinely use forged Aadhaar and PAN details, often of employees or unrelated individuals, along with fake rent agreements, to register dozens of shell companies.

The ITC Scam: The primary goal remains the fraudulent claim of ITC, often involving circular trading where firms pass invoices back and forth without any actual supply of goods or services. Recent investigations, such as the major busts in Noida and across different states, expose networks that claimed tens of crores in fraudulent refunds.

High Court Intervention: In stark contrast to the SC’s non-interference, various High Courts, like the Bombay High Court, have actively had to intervene. They have directed the deletion of GST registrations obtained through identity impersonation, criticizing the systemic failure that allowed such frauds to occur and creating legal nightmares for innocent individuals whose identity was stolen.

In response, the Central Board of Indirect Taxes and Customs (CBIC) and the GST Network (GSTN) have already implemented several anti-fraud measures:

Risk-Based Vetting: Authorities have moved to a risk-based registration system. They utilize AI and data analytics (e.g., Project Anveshan) to flag suspicious applications based on address, document patterns, and linkages with other risky entities.

Enhanced Verification: For applicants flagged as high-risk, a mandatory Aadhaar-based biometric authentication is being rolled out pan-India. Additionally, the government has mandated physical verification of business premises for certain applicants before granting registration.

Multi-Factor Authentication (MFA): The introduction of MFA for the GST portal login is a basic yet crucial digital security step to prevent unauthorized access and control of genuine GSTINs.

Conclusion: Striking the Balance is the Key

The Supreme Court’s order is not a setback for anti-fraud efforts; it is a policy directive. It highlights that the government, through the GST Council and CBIC, must develop a sophisticated, two-pronged strategy.

We cannot sacrifice EoDB at the altar of anti-fraud, nor can we allow fraud to compromise the tax system’s integrity.

The future of GST registration must lie in intelligent, targeted intervention:

Streamline for the Honest: The standard registration process for low-risk, genuine applicants must remain quick and frictionless. The recent announcement for auto-approval within three days for new, compliant applicants is a step in this direction.

Rigor for the Risky: Technology must handle the heavy lifting. AI and data analytics should instantly flag applications showing suspicious patterns (e.g., shared addresses, multiple registrations on one ID, high-risk HSN codes). These high-risk cases must then automatically trigger the multi-layer, human-verified checks like biometric authentication, physical site verification, or deep data linkage.

By adopting this smart, risk-based approach, the government can uphold the twin objectives: facilitating legitimate trade with speed, while simultaneously erecting impenetrable digital walls against fraud. The challenge is immense, but an intelligent application of technology is the only viable path to a truly robust and easy-to-use GST system.