India Logs All-Time High GST E-Way Bill Volume

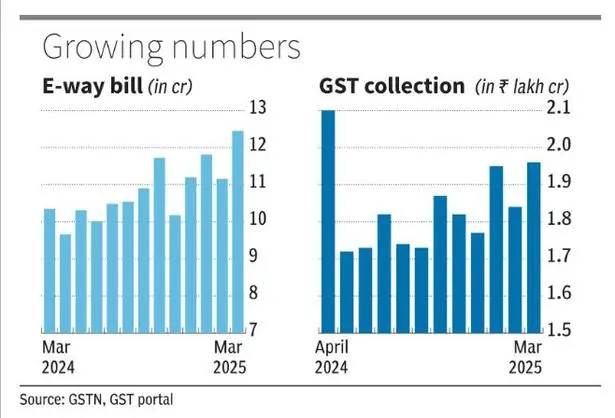

India’s logistics and tax compliance ecosystem reached a new milestone as GST E-Way Bill generation surged past 12 crore in March 2025, marking the highest monthly figure since the system was introduced in 2018. This record-setting figure closes FY25 on a strong note, pointing to increased formalization, stronger compliance mechanisms, and year-end economic activity.

The GST E-Way Bill, a digital document required for the movement of goods worth more than ₹50,000, has become a critical tool not only for tracking logistics but also for gauging the economic pulse. The March numbers show a 20% year-on-year increase—underscoring both improved compliance and intensified business activity as companies rushed to meet fiscal targets.

Behind the Numbers: What’s Fueling the Surge in GST E-Way Bill Generation?

Several key factors are driving this unprecedented rise in e-way bill volumes:

1. Enhanced Compliance Culture

Stronger enforcement against GST fraud, increased digital literacy among businesses, and a maturing GST system have all contributed to greater voluntary compliance. With the risk of evasion becoming costlier, more businesses, even at the MSME level, are opting to stay within the formal framework.

2. Financial Year-End Transactions

March traditionally sees a significant spike in business activity. Companies often clear backlogs, move inventory, and push sales to meet yearly financial goals. This seasonal surge has been amplified in FY25 by improved supply chains and restocking ahead of the new fiscal.

3. System Improvements and Automation

Recent upgrades in the GST E-Way Bill portal—including auto-filled Part-B details, real-time tracking, and integration with vehicle data—have made compliance easier and faster. These improvements have contributed to a more seamless experience, encouraging more accurate and timely reporting.

Implications for GST Revenue Collection

The GST E-Way Bill is not just a logistics tool—it’s a predictive indicator of revenue. Historically, high e-way bill generation in March has foreshadowed record GST collections in April. The pattern has held firm:

-

₹1.87 lakh crore in April 2023

-

₹2.10 lakh crore in April 2024

With e-way bill numbers now crossing 12 crore, analysts anticipate another record-setting GST revenue figure when April 2025 data is released on May 1. While a direct correlation is complex—since services, which form a large part of GST, don’t require e-way bills—the trend signals healthy economic activity.

However, experts caution that sustained growth depends on underlying consumption trends. If the current spike is primarily inventory clearance rather than end-consumer demand, the revenue momentum might not hold beyond Q1 FY26.

Recent Changes in GST E-Way Bill System

The government has introduced multiple reforms in FY25 to tighten compliance and reduce evasion through the e-way bill mechanism:

-

Geotagging of high-value consignments to track actual goods movement

-

AI-driven anomaly detection, flagging suspicious billing patterns

-

Increased scrutiny for mismatched invoices, especially in intra-state transactions

-

Mandatory linkage with e-invoicing systems for larger businesses

These measures have improved data accuracy, boosted taxpayer confidence, and strengthened the case for integrating GST E-Way Bill data into policy planning and economic forecasting.

What This Means for India’s Economic Outlook

The March 2025 surge in GST E-Way Bill generation marks a turning point in the country’s logistics and taxation landscape. It reflects a maturing tax ecosystem, increased business accountability, and readiness for digital compliance.

As India moves into FY26, maintaining this momentum will be key. If paired with rising consumption and robust manufacturing output, this record E-Way Bill milestone could lay the groundwork for sustained GST revenue growth—and, by extension, a stronger, more formalized Indian economy.