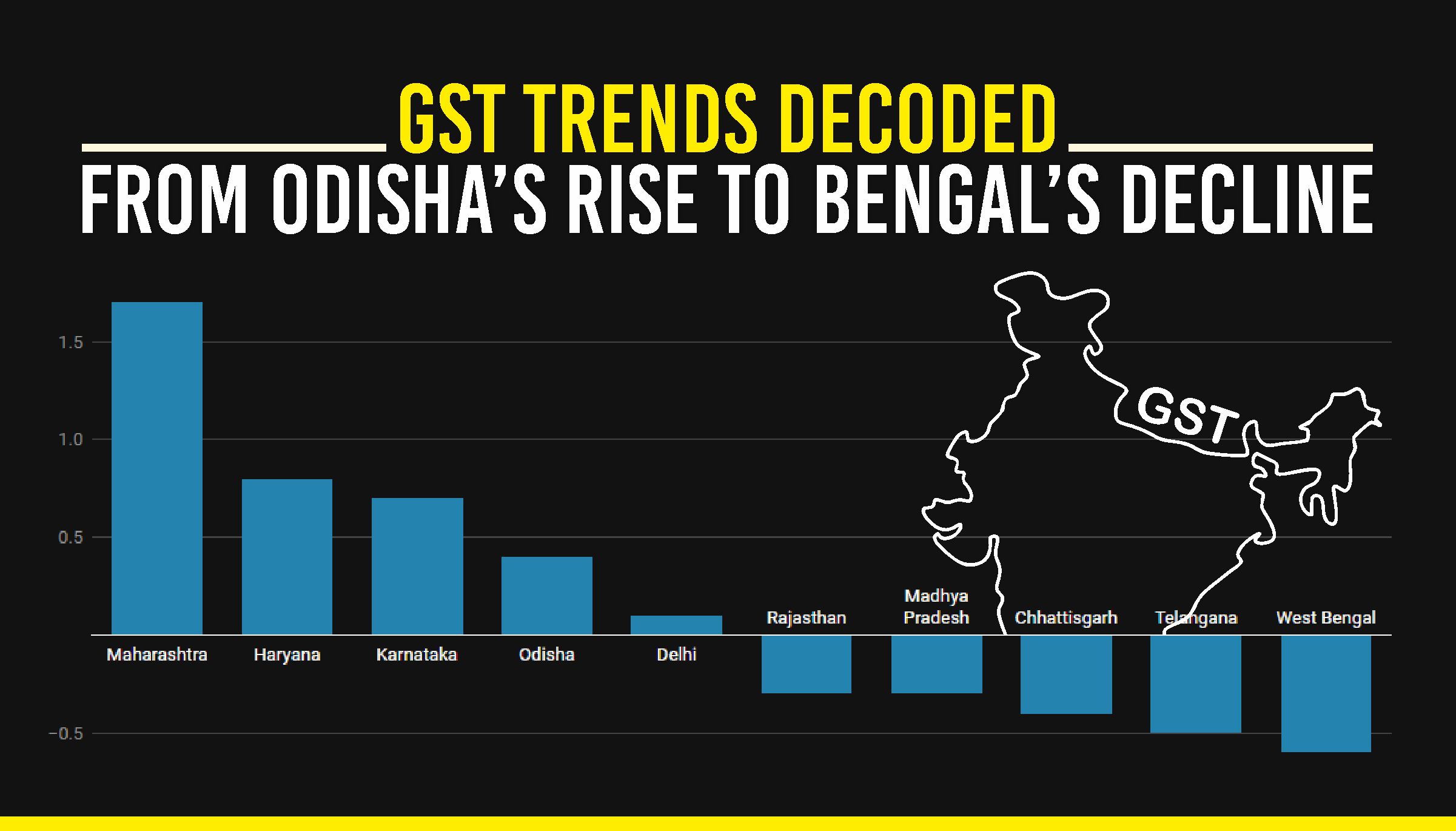

From Odisha’s Rise to Bengal’s Decline: GST Trends Decoded

The Goods and Services Tax (GST) regime, implemented in India in July 2017, is a landmark reform in indirect taxation. Over the years, state-wise contributions to the national GST pool have exhibited notable trends. While industrial states have shown robust growth, others have struggled to maintain their share. This article delves into the recent data, focusing on states like West Bengal and Telangana, which have seen a significant decline in their share of national GST collections.

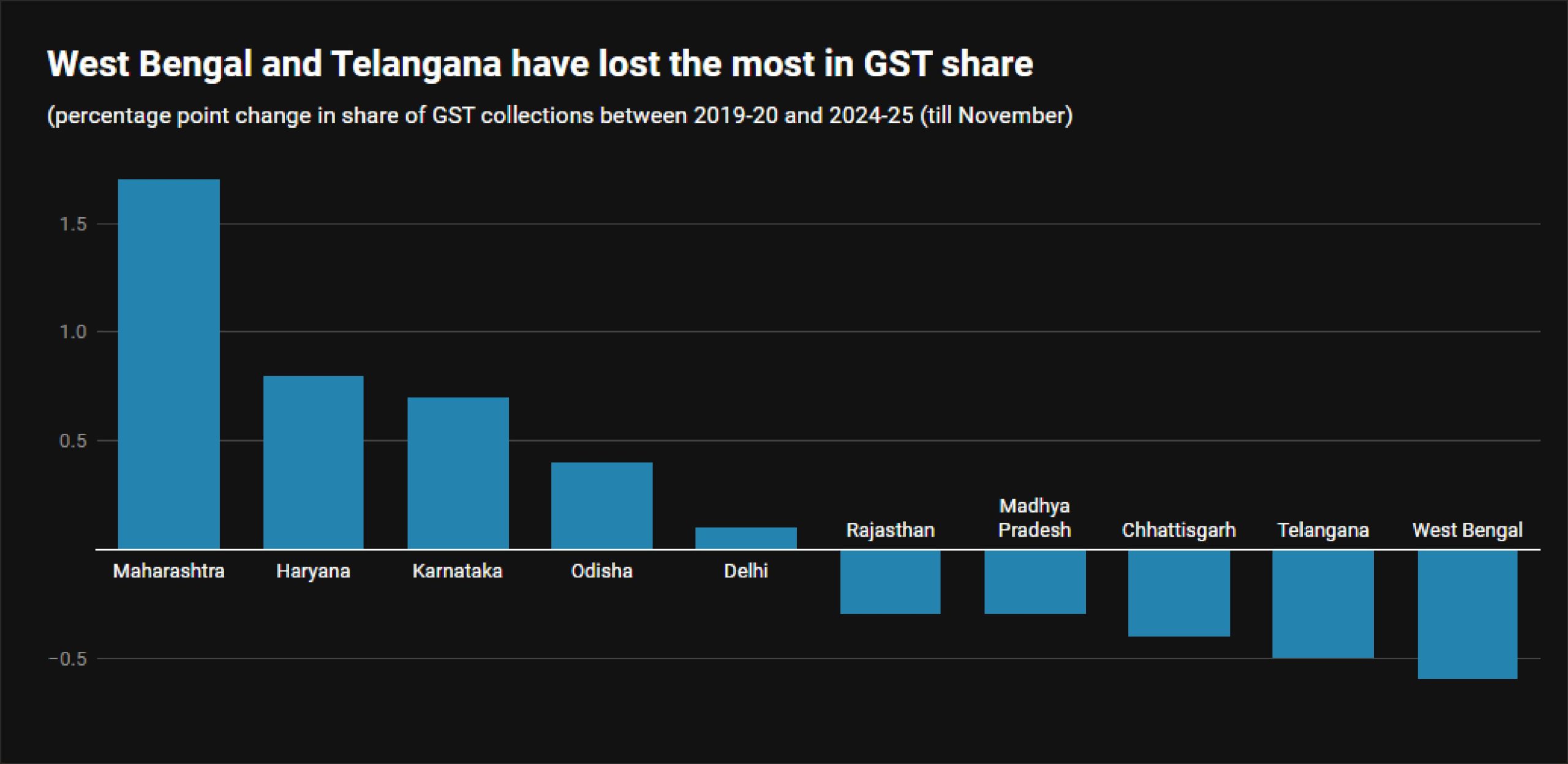

West Bengal and Telangana’s Decline in GST Share

West Bengal’s contribution to the national GST pool has declined from 4.6% in 2019-20 to 4% in 2024-25 (till November). Telangana, another major state, witnessed a drop from 4.2% to 3.7% over the same period. This decline highlights a pressing concern about these states’ ability to harness their economic potential and adapt to the evolving GST framework.

Comparative Data: Declines Across Other States

-

Chhattisgarh: Lost 0.4 percentage points.

-

Rajasthan, Madhya Pradesh, Jharkhand: Each recorded a 0.3 percentage point decline.

These states collectively represent a concerning trend of underperformance in GST collections, signaling underlying structural or economic challenges.

GST Share Analysis Statewise

The Rise of Industrial States: Maharashtra, Haryana, and Karnataka

In contrast to the declining shares of some states, industrialized regions have consolidated their dominance in GST contributions:

-

Maharashtra: Increased its share from 19% in 2019-20 to 21.7% in 2024-25, reaffirming its position as an economic powerhouse.

-

Haryana: Grew its share from 6.3% to 7.1%, showcasing robust industrial and commercial activity.

-

Karnataka: Witnessed an increase from 8.8% to 9.5%, driven by its thriving technology and manufacturing sectors.

These states have leveraged their industrial bases and economic dynamism to outperform others in GST revenue generation.

Odisha Emerges as a Key Performer

Among the less industrialized states, Odisha stands out as a success story:

-

Share Growth: Increased its share from 3.1% in 2019-20 to 3.6% in 2024-25, narrowing the gap with Telangana.

-

Per Capita Revenue Growth: Achieved a remarkable 93.5% increase in per capita GST revenue over five years, highlighting its rapid economic progress.

This growth highlights Odisha’s efforts to enhance its economic activities and improve tax compliance, positioning it as a rising player in the GST framework.

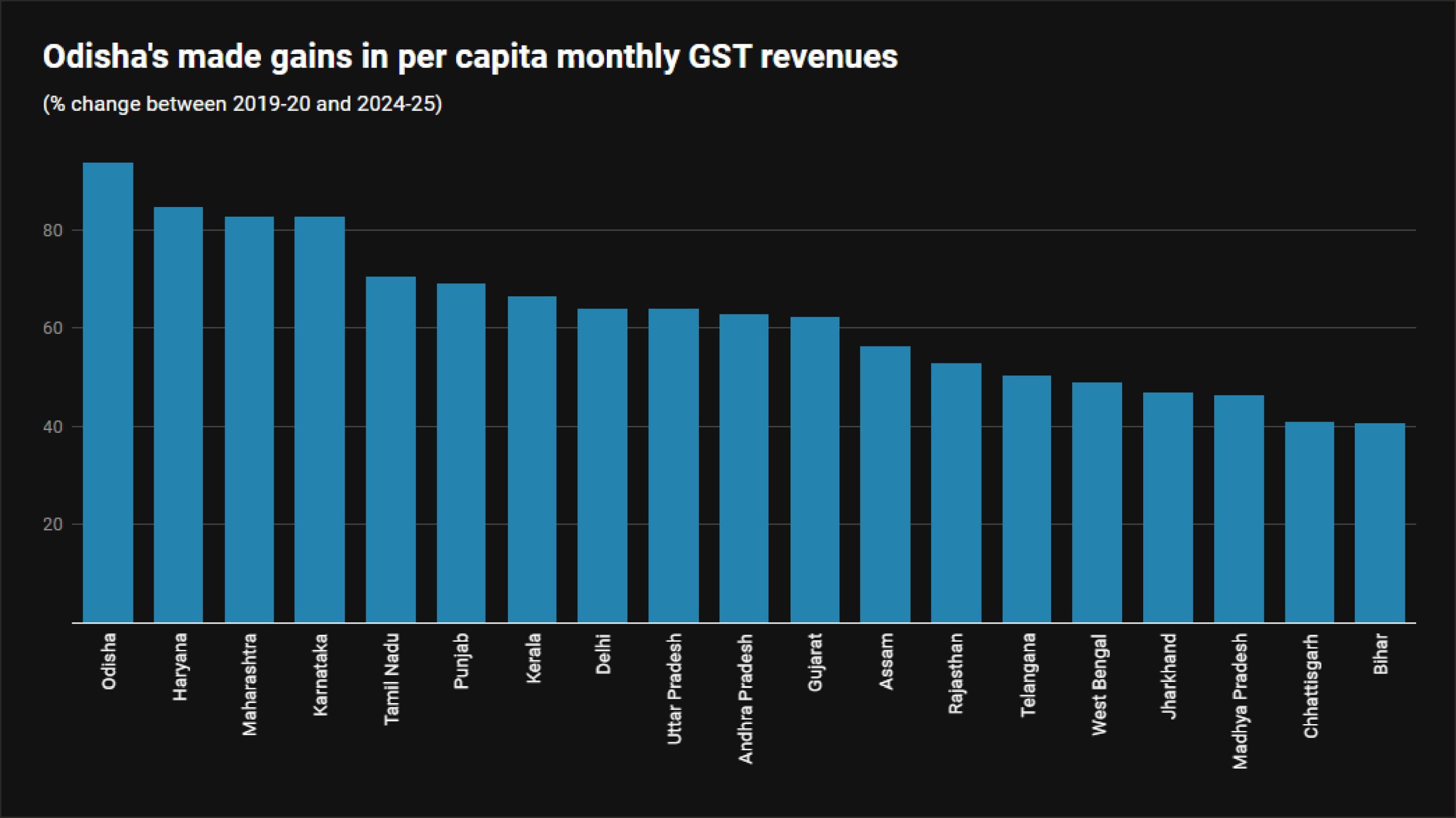

Odisha GST Gains

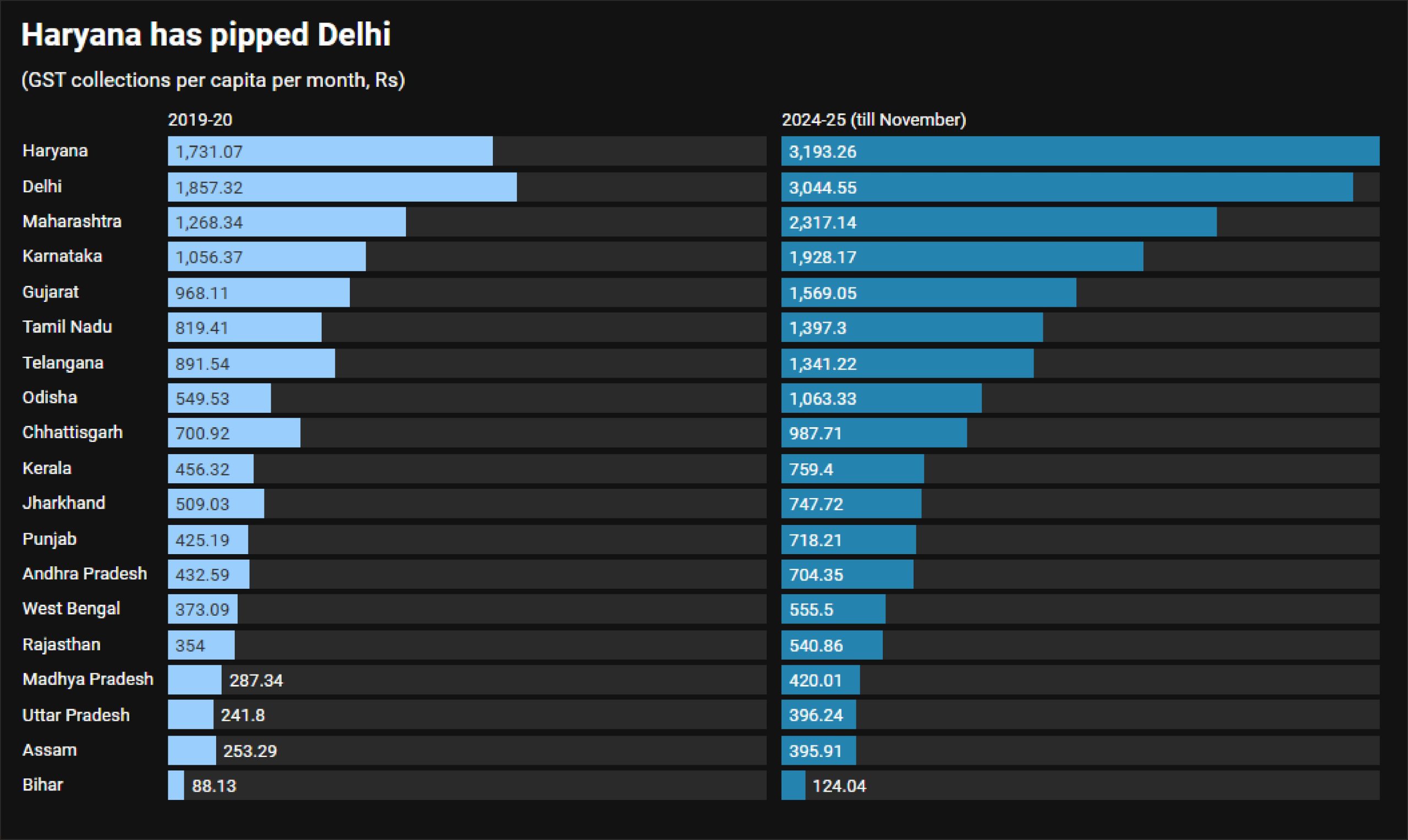

Per Capita GST Revenues: A Mixed Bag

India’s per capita monthly domestic GST revenue has grown by 56.6% over five years, but the growth is uneven:

-

Haryana: Leads the chart with a per capita monthly revenue of ₹3,200, up from ₹1,731 (84.5% increase).

-

Maharashtra: Despite its large base, recorded an 82.7% growth.

-

West Bengal: Grew by only 48.9%, lagging behind the national average.

-

Chhattisgarh and Bihar: Showed the slowest growth at around 40%.

The disparities in per capita revenue growth reflect varying levels of economic activity, tax compliance, and industrial development across states.

GST Share Per Capita

Analysis: What Explains the Trends?

Factors Behind Declining Shares

-

Economic Structure: States like West Bengal and Telangana rely heavily on traditional sectors, which may not align well with GST’s compliance requirements.

-

Tax Base Erosion: Informal economies and lower compliance rates could have contributed to the decline.

-

Policy and Infrastructure Gaps: Inefficient tax collection mechanisms and lack of investment in digitization may have hampered growth.

Success Drivers for Industrial States

-

Diverse Economic Base: States like Maharashtra, Haryana, and Karnataka benefit from diversified industrial and service sectors.

-

High Tax Compliance: Strong enforcement and technological adoption have boosted their GST revenues.

-

Policy Support: Pro-business policies and better infrastructure attract investment and spur economic activity.

Implications for Policymakers

The disparities in GST performance have several implications:

-

-

Targeted Interventions: States with declining shares need focused support to diversify their economies and improve tax compliance.

-

Capacity Building: Enhancing administrative efficiency and adopting advanced technologies can help lagging states improve their GST collections.

-

Policy Reforms: Revisiting the GST framework to address structural inequities and incentivize high-performing states could ensure more balanced growth.

-

A Tale of Two Trends

The GST collection data reveals a tale of two Indias—one represented by industrial states that are thriving, and the other by states struggling to keep pace. Addressing these disparities requires coordinated efforts by both state and central governments to create a more equitable and efficient tax regime. Only then can India realize the full potential of its GST framework, fostering inclusive growth across all regions.