Why GST Growth Slowed Across Large States in H1 FY25

GST collections have shown a noticeable slowdown in the first half (H1) of FY25, particularly across several large states. This decline, most visible in Southern states, raises questions about underlying economic trends, regional variations, and their implications for fiscal targets.

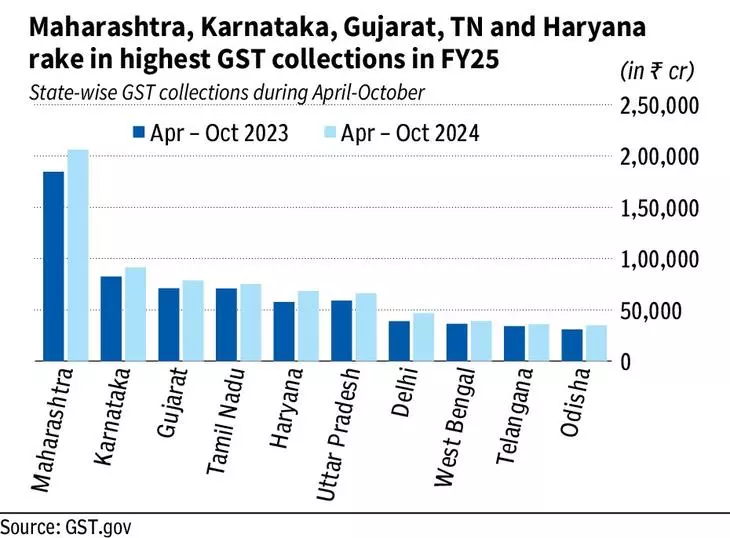

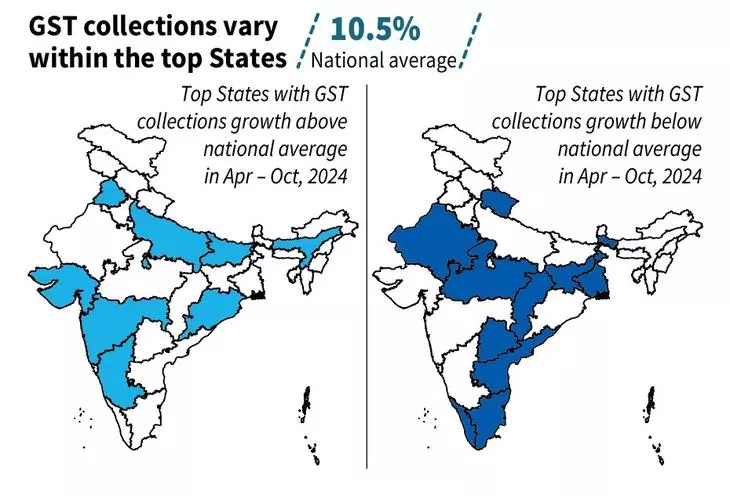

From April to October 2024, domestic GST collections rose by 10.5% year-on-year (y-o-y) to ₹9.65 lakh crore. However, this is a sharp drop from the 14.6% growth recorded in the same period last year. While some states have exceeded the national average growth, others have significantly underperformed, highlighting diverse regional dynamics.

The Divergent State Performance

From April to October 2024, domestic GST collections grew by 10.5% year-on-year (y-o-y) to reach ₹9.65 lakh crore. However, this is notably lower than the 14.6% growth recorded during the same period last year.

Some key highlights:

-

National-Level Growth:

Slower than last fiscal year, reflecting a broader consumption slowdown.

-

State-Level Variations:

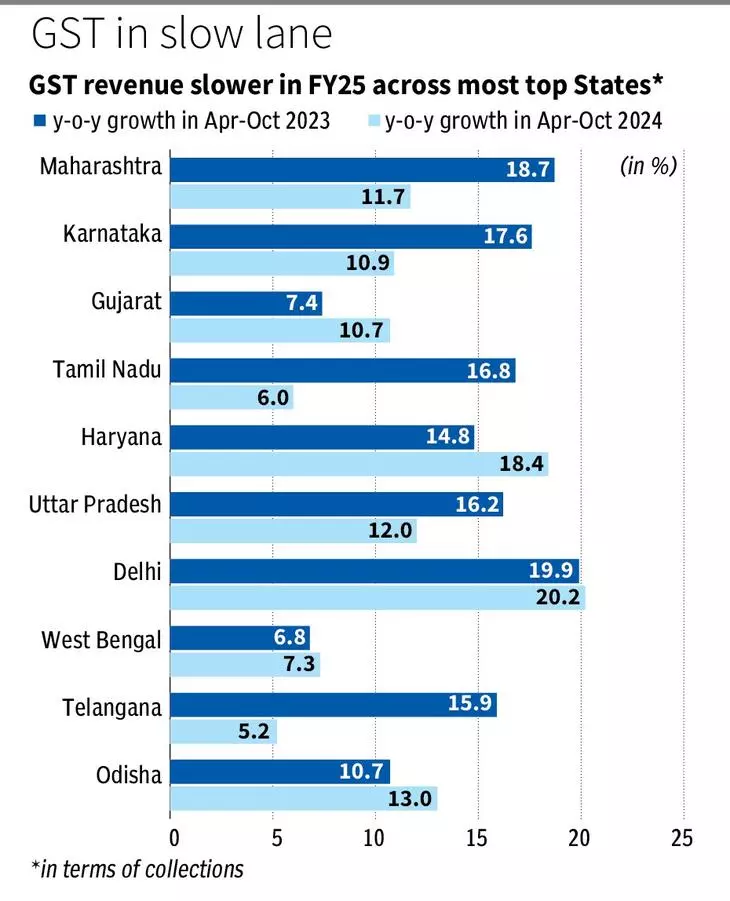

While states like Maharashtra, Uttar Pradesh, and Delhi performed better, Southern states reported subpar growth.

Top-Performing States in GST Growth:

-

Delhi: 20% growth

-

Uttar Pradesh: 12% growth

-

Maharashtra: 11.7% growth

-

Karnataka: 10.9% growth

Underperforming States in GST Growth:

-

Tamil Nadu: 6% growth (compared to 16.8% in H1 FY24)

-

Telangana: 5.2% growth (compared to 15.9% in H1 FY24)

-

Andhra Pradesh: 4% growth (compared to 8% in H1 FY24)

This regional disparity suggests that GST growth is influenced by a complex mix of consumption patterns, income levels, and local economic activities. States with higher demand for luxury goods or high-GST items such as automobiles and sin goods are naturally seeing stronger collections. In contrast, states focusing more on goods like gold or real estate, which attract lower GST rates, are lagging.

This regional disparity suggests that GST growth is influenced by a complex mix of consumption patterns, income levels, and local economic activities. States with higher demand for luxury goods or high-GST items such as automobiles and sin goods are naturally seeing stronger collections. In contrast, states focusing more on goods like gold or real estate, which attract lower GST rates, are lagging.

Key Reasons for the Decline

1. Slowing Consumption Trends

The broader economic environment has seen a dip in consumer spending, particularly on discretionary items. Products like automobiles, air conditioners, and cement, which attract high GST rates, have witnessed a slowdown in demand. This directly impacts GST collections, as these items contribute significantly to revenue.

2. Impact of Weather and Seasonal Factors

Heavy rains and floods in South India during H1 FY25 disrupted economic activities, reducing consumption in several sectors. Such disruptions, especially in regions dependent on agriculture and tourism, have adversely affected GST inflows.

3. Regional Economic Structures

States with higher disposable incomes and a consumption-driven economy tend to report better GST performance. For instance, Delhi’s high growth can be attributed to its urban consumer base and higher luxury spending. In contrast, Southern states show a preference for spending on items like gold and real estate, which either attract lower GST rates or fall outside its ambit.

4. Base Effect and High GST Rates

The strong GST growth recorded in FY24 created a high base, making it challenging to replicate similar growth this year. Furthermore, GST rates are higher for luxury items and sin goods, which do not reflect broader consumption patterns, particularly in rural areas.

Indicators of Recovery

Despite the slowdown, there are positive signs suggesting a gradual recovery:

-

Rural Demand Strengthening: Rising two-wheeler and tractor sales, coupled with higher real wages for agricultural workers, indicate improving rural consumption.

-

High-Frequency Data Trends: Indicators such as steady growth in FMCG sales and non-agricultural labor wages suggest stabilization in consumption.

Outlook for FY25

While GST collections for October 2024 reached ₹1.87 lakh crore, the second-highest monthly collection ever, overall growth rates may fall short of the budgeted 11.6% y-o-y increase for FY25. Policymakers face the dual challenge of addressing regional disparities and bolstering consumption in sectors that contribute heavily to GST revenue.

The decline in GST collections across large states underscores the need for a nuanced approach to understanding consumption patterns and economic activities. Regional factors, weather disruptions, and sectoral variations all play a role in influencing growth. While signs of recovery are visible, sustaining a consistent upward trend will require addressing structural issues and encouraging consumption in high-GST sectors.