Rs 11,613 Crore Lost to Tax Evasion via Bogus Billing in Gujarat

In recent years, Gujarat has faced a significant challenge in the form of tax evasion through bogus billing. Despite efforts to improve the ease of doing business and streamline the tax filing process, the state has witnessed a substantial loss of revenue due to fraudulent activities. This article delves into the alarming trend of tax evasion in Gujarat, highlighting the measures taken and the ongoing challenges.

The Scale of the Problem

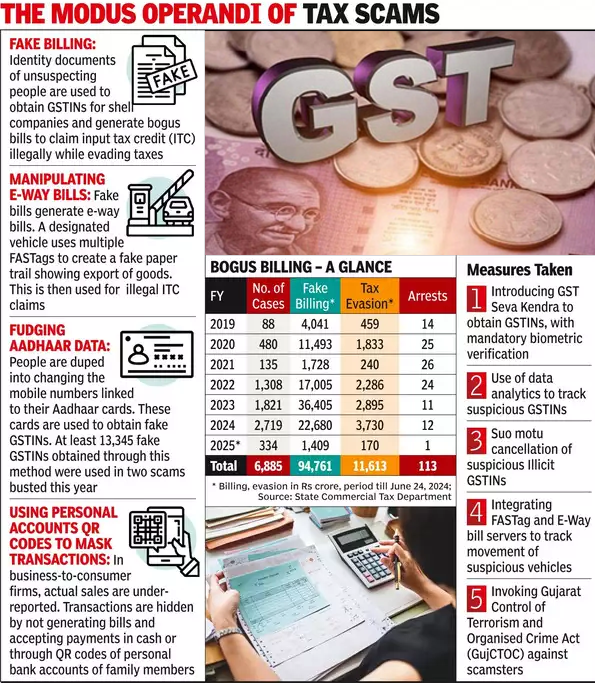

Since the rollout of the Goods and Services Tax (GST) nearly seven years ago, Gujarat has experienced a staggering Rs 94,761 crore in bogus billing turnover. This has resulted in an estimated Rs 11,613 crore in evaded taxes. Data from the state commercial tax department, covering the fiscal years 2017-18 to 2024-25, underscores the magnitude of this issue.

In response to these fraudulent activities, SGST officials have arrested 113 individuals, including key masterminds behind major tax evasion scams. Despite these arrests and numerous rule changes, fake billing scams persist, leading to substantial losses for the exchequer.

The commercial tax department has managed to recover only about 5% of the evaded amount, roughly Rs 550 crore. In the fiscal year 2024 alone, 2,729 cases of bogus billing were recorded. These cases involved fake GST registrations aimed at dodging taxes, with the number of such cases surging by 50% compared to the previous year.

Trends in Bogus Billing and Tax Evasion

SGST officials reported that Rs 22,680 crore in fake billing transactions were made during the year to evade Rs 3,730 crore in taxes. While the bogus billing turnover decreased by 37% compared to the previous year, tax evasion increased by 30% within just one year. This indicates that while fewer fake transactions were recorded, they were more effective in evading higher amounts of taxes.

GST-Gujarat-Evasion

Measures to Curb Fake Billing

In a statewide drive, both state and central GST departments are cracking down on scammers to curb fake billing. Gujarat has also implemented a pilot project requiring biometric verification for new GSTINs, addressing the critical issue of no physical verification at the time of issuance. This mandatory biometric verification has led to a sharp decline in new registration applications in the state.

National Implementation of SGST Proposals

Several changes proposed by the SGST department in Gujarat have now been acknowledged at the national level and are being implemented in other states facing similar issues. This recognition highlights the effectiveness of Gujarat’s measures in tackling tax evasion and serves as a model for other states.

The battle against tax evasion through bogus billing in Gujarat is far from over. Despite significant efforts and some successes, the state continues to face formidable challenges. The ongoing drive to implement stricter verification processes and crack down on fraudulent activities is crucial in safeguarding the state’s revenue and ensuring a fair and transparent tax system.