Customs, GST Reforms to Boost India’s Growth: GTRI

The Global Trade Research Initiative (GTRI), a leading economic think tank, has emphasized the necessity of comprehensive reforms in customs duties, the Goods and Services Tax (GST), and overall commerce policies to drive India’s growth. According to GTRI, India stands on the brink of a transformative era, and these strategic reforms are crucial for sustainable development and inclusive growth.

Simplifying the Customs Duty Structure

The current customs duty structure in India, which affects $680 billion worth of imports, has remained unchanged for over two decades. This outdated system comprises over 27 different duty rates and more than 100 specific or mixed duty slabs. Notably, 85% of customs duty revenue is generated from less than 10% of tariff lines, while 60% of tariff lines contribute less than 3% of revenue.

GTRI proposes reducing the average import tariff from 18.1% to below 10% through simplification. This adjustment could be made without affecting important products, thereby addressing global criticisms such as those from former US President Donald Trump, who labeled India as the “tariff king.” Simplifying the customs duty structure will enhance transparency, reduce bureaucratic complexity, and foster a more competitive business environment.

GST Reforms for the MSME Sector

GTRI suggests increasing the GST exemption limit for firms’ annual turnover from ₹40 lakh to ₹1.5 crore. This reform is expected to be transformative for India’s Micro, Small, and Medium Enterprises (MSME) sector, which constitutes over 80% of GST registrations but contributes less than 7% of tax revenue.

Raising the exemption limit would reduce the number of GST taxpayers from 1.4 crore to less than 23 lakh, significantly easing the administrative burden. It would enable the implementation of invoice-matching for 100% compliance, eliminating fake invoices and tax theft. Although there might be a short-term loss of 7% in tax revenue, increased compliance and tax collection are expected to offset this loss.

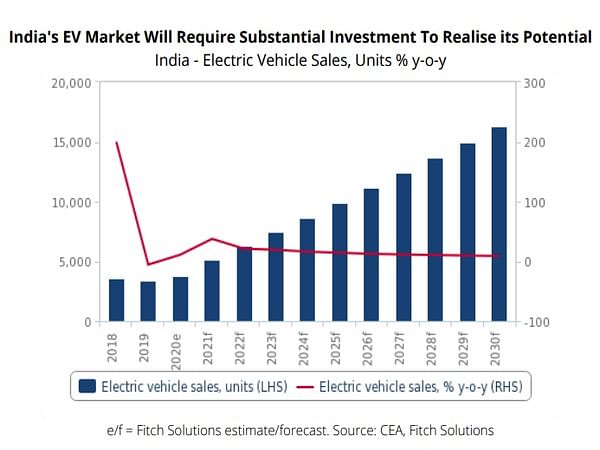

Strategic Approach to Electric Vehicles (EVs)

GTRI advises against incentivizing low value-added electric vehicles (EVs) due to their heavy reliance on Chinese batteries and parts, which account for 60-90% of their cost. With the US and EU imposing restrictions on Chinese EVs, China is redirecting its focus to Southeast Asian markets, including India.

GTRI warns that within a few years, Chinese firms might dominate the Indian EV market through independent ventures or joint ventures with Indian companies. To safeguard and develop the domestic auto industry, it is crucial for India to avoid incentivizing low value-added EVs and instead focus on enhancing local manufacturing capabilities.

Strengthening the Pharmaceutical Sector

India imports 70% of its Active Pharmaceutical Ingredients (APIs) and over 80% of its biosimilars from China, posing a significant risk to both the pharmaceutical industry and national security. GTRI recommends developing domestic capacity to produce inputs and intermediates for both chemical and fermentation-based APIs.

Boosting E-commerce Exports

GTRI highlights the potential of India’s e-commerce sector, which includes over 20 lakh firms producing high-quality products. However, less than one lakh of these firms currently engage in exports. Simplifying rules related to e-commerce exports, including those from the Reserve Bank of India (RBI), banking, customs, GST, and the Directorate General of Foreign Trade (DGFT), will encourage more firms to enter the export market.

By streamlining regulations, India can boost the export of handicrafts, jewelry, ethnic wear, decorative paintings, Ayurveda products, and more. This will not only enhance the country’s export revenues but also support the growth of small and medium-sized enterprises.

Reducing Reliance on Chinese Imports

India’s dependence on Chinese imports has increased tenfold in the past two decades, with China being the top supplier for major industrial product categories. As Chinese firms expand their operations in India, imports are expected to rise further. GTRI calls for a strategic approach to reduce reliance on Chinese imports. This includes developing alternative supply chains, promoting local manufacturing, and implementing policies to encourage the use of domestically produced goods.

The Global Trade Research Initiative’s comprehensive reform agenda aims to simplify customs duties, reform GST, and strategically manage commerce policies to drive India’s growth. These reforms are essential for building a robust, resilient, and globally competitive economy, ensuring sustainable development and inclusive growth for India.