Fake ITC Claims Continue To Surge in FY24

Fake ITC Claims Continue To Surge in FY24

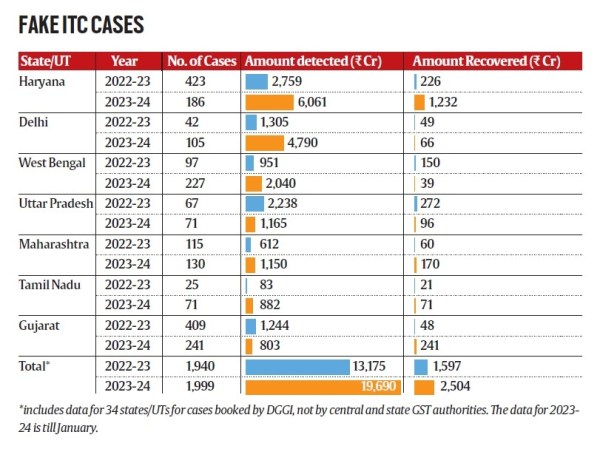

The issue of wrongful availment of input tax credit (ITC) or fake ITC claims has become a pressing concern for Goods and Services Tax (GST) authorities in India. Despite ongoing efforts to combat fraud and evasion, recent data reveals a significant surge in fake credit claims during the current financial year 2023-24, totaling a staggering amount of Rs 19,690 crore. Haryana and Delhi have emerged as the frontrunners in this illicit activity, underscoring the urgent need for stringent enforcement measures and regulatory interventions.

Rising Concerns and Regional Trends:

The detection of 1,999 cases of fake ITC claims in FY24 (till January) reflects the pervasive nature of GST evasion across various states and union territories. While Gujarat and West Bengal have recorded the highest number of cases, the monetary value of fraudulent claims in Haryana and Delhi surpasses all others, amounting to Rs 10,851 crore. This discrepancy highlights the disproportionate impact of GST fraud on certain regions, underscoring the need for targeted enforcement strategies tailored to local dynamics.

According to data reviewed by The Indian Express, the states with the highest number of fake Input Tax Credit (ITC) cases in FY24 (till January) include Gujarat, West Bengal, Haryana, Assam, Rajasthan, Maharashtra, Karnataka, and Delhi. The total amount involved in fake ITC claims during this period has surged by 49%, reaching Rs 19,690 crore, compared to Rs 13,175 crore detected in 1,940 cases in FY23.

Interestingly, while Gujarat and West Bengal have recorded the highest number of fake ITC cases among the 34 states/union territories, Haryana and Delhi have reported the highest monetary value of fraudulent claims, amounting to Rs 10,851 crore. Despite representing only 14.5% of the total number of cases, Haryana and Delhi collectively account for 55% of the total amount detected in fake ITC claims under GST in FY24.

Moreover, while the number of fake ITC cases has decreased in 10 states/union territories, including Gujarat and Haryana, it has doubled in FY24 compared to the previous year in seven states/UTs, such as Delhi (a 150% increase), West Bengal (134% increase), and Telangana (228% increase).

Evolution of Fraudulent Practices:

The modus operandi of GST fraud continues to evolve, with perpetrators employing sophisticated tactics to evade detection. Fake invoices, raised without actual supply of goods or services, remain a prevalent method for wrongfully availing ITC. Additionally, fraudulent schemes involving the circulation of invoices through shell companies or dummy entities have become increasingly common, exacerbating the challenges faced by enforcement agencies.

Sectoral Implications and Enforcement Strategies:

Various sectors, including construction, metals, tiles, marbles, insurance, and pharmaceuticals, have been identified as hotspots for fake ITC claims. Despite efforts to enhance compliance through registration reforms and analytical tools, detecting and prosecuting offenders remains a formidable task. The slow recovery rate further complicates enforcement efforts, as tracing the masterminds behind these fraudulent schemes proves to be a daunting challenge.

Government Response and Future Outlook:

Government officials acknowledge the severity of the issue and emphasize the need for concerted action to curb GST evasion. While progress has been made in tightening registration processes and disrupting fraudulent cycles, much remains to be done to effectively combat fake ITC claims. The government’s commitment to targeting masterminds and deploying advanced analytical tools underscores its determination to safeguard the integrity of the GST regime.

The surge in fake credit claims highlights the urgent need for comprehensive reforms and robust enforcement mechanisms to combat GST evasion effectively. As stakeholders collaborate to address the root causes of fraudulent practices and enhance compliance, concerted efforts must be made to strengthen regulatory oversight, streamline enforcement processes, and foster a culture of transparency and accountability within the GST ecosystem. Only through collective action can the menace of fake ITC claims be effectively addressed, ensuring the integrity and sustainability of India’s indirect tax regime.